Tn Interest Form

What is the tn interest?

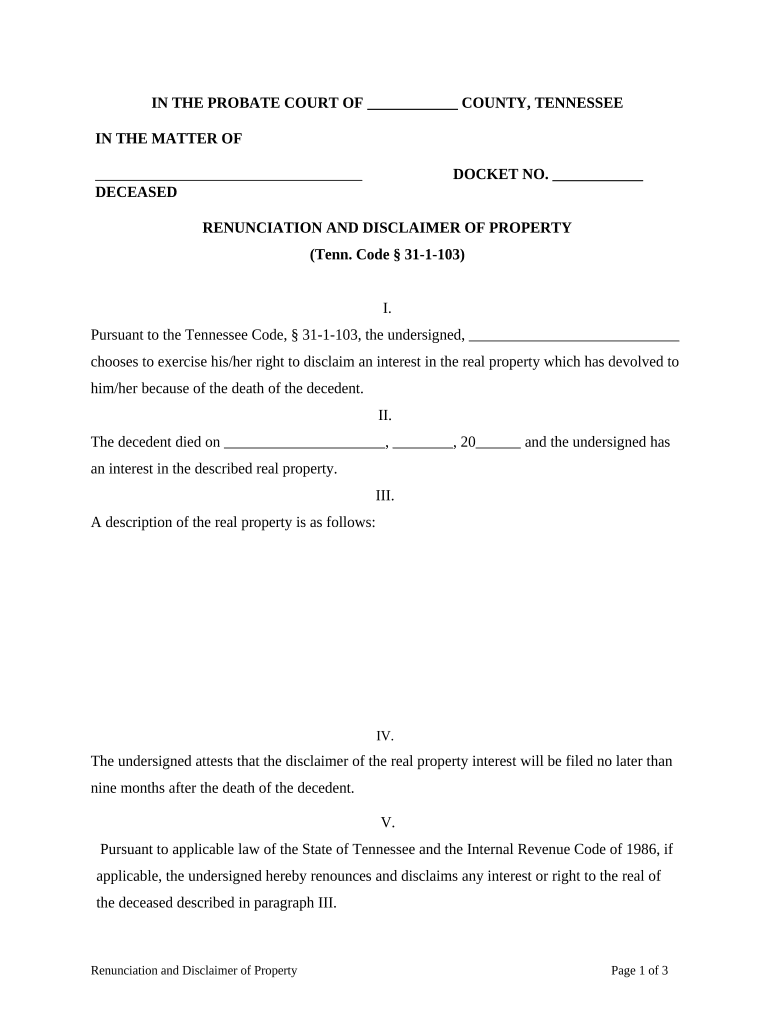

The tn interest form is a specific document used in Tennessee for various legal and financial purposes. It serves as a declaration or acknowledgment of interest in a property or asset. This form is essential for individuals and businesses who need to formalize their stake in a particular interest, ensuring that their claims are recognized under Tennessee law. Understanding the nuances of this form is crucial for compliance and legal clarity.

How to use the tn interest

Using the tn interest form involves several key steps. First, gather all necessary information about the property or asset in question. This includes details such as the location, ownership history, and any relevant financial information. Next, accurately fill out the form, ensuring that all required fields are completed. After completing the form, it must be signed by all relevant parties to validate the claims made. Finally, submit the form to the appropriate authority, whether that be a local government office or a financial institution, depending on the context of the interest being declared.

Steps to complete the tn interest

Completing the tn interest form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation related to the interest being declared.

- Fill out the form with accurate information, ensuring clarity in each section.

- Review the form for any errors or omissions before signing.

- Obtain signatures from all parties involved to ensure the form is legally binding.

- Submit the completed form to the relevant authority as required.

Legal use of the tn interest

The tn interest form holds legal significance in Tennessee, as it is used to establish and formalize claims to property or financial interests. For the form to be legally binding, it must comply with state laws regarding signatures and documentation. This includes adherence to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which govern the validity of electronic signatures. Proper use of the tn interest form ensures that interests are protected and recognized by the law.

Key elements of the tn interest

Several key elements must be included in the tn interest form to ensure its validity:

- Identification of parties: Clearly state the names and contact information of all individuals or entities involved.

- Description of the interest: Provide a detailed description of the property or asset in question.

- Signatures: All relevant parties must sign the form to validate the claims made.

- Date of signing: Include the date when the form is signed to establish a timeline of the agreement.

Examples of using the tn interest

There are various scenarios in which the tn interest form may be utilized. For instance, a business may use this form to declare its interest in a commercial property it intends to purchase. Similarly, individuals may need to complete the form to assert their rights to an inheritance or a shared asset. Each of these examples highlights the importance of the tn interest form in protecting legal and financial interests in Tennessee.

Quick guide on how to complete tn interest

Prepare Tn Interest effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without any delays. Handle Tn Interest on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The most efficient method to modify and eSign Tn Interest with ease

- Obtain Tn Interest and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional handwritten signature.

- Review the information and click on the Done button to secure your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Tn Interest to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is tn interest in the context of airSlate SignNow?

The term 'tn interest' refers to the financial implications and benefits businesses may experience when utilizing airSlate SignNow for document signing. By streamlining the eSigning process, businesses can reduce operational costs, improve efficiency, and ultimately enhance their bottom line.

-

How does airSlate SignNow ensure security in eSignatures?

AirSlate SignNow takes security seriously, utilizing advanced encryption protocols to protect 'tn interest' and sensitive data throughout the signing process. Our platform complies with international standards, ensuring that your documents and eSignatures are secure and legally binding.

-

What pricing options are available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you're a small startup or a large enterprise, you can find a plan that aligns with your budget while maximizing your 'tn interest' through cost-effective solutions for electronic signatures.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications and tools. This ensures that you can leverage your existing workflows and maximize 'tn interest' by enhancing productivity and collaboration within your organization.

-

What features does airSlate SignNow offer to enhance user experience?

AirSlate SignNow includes a user-friendly interface, customizable templates, and advanced features such as tracking and reminders. These features not only simplify the document signing process but also contribute signNowly to your 'tn interest' by saving time and resources.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows businesses to explore our features and assess their potential 'tn interest' before committing to a subscription. This trial helps you understand how our platform can benefit your organization and streamline your eSigning process.

-

How can airSlate SignNow help in improving workflow efficiency?

By using airSlate SignNow, businesses can signNowly enhance workflow efficiency by reducing the time spent on paper-based processes. The quick turnaround of eSignatures ultimately boosts productivity and improves 'tn interest' as it allows teams to focus more on core business activities.

Get more for Tn Interest

- Card children s ministry program registration form fbcswan

- 3 d cell project rubric edwardsville high school ecusd7 form

- Kansas immunization program usd230 form

- Improving outcomes for australians with lung cancer form

- Face to name transition sheet form

- Amelia park arb application rev 01182016 ameliapark form

- Radi101 credit card authorization form sxswcom

- I 290b online form 2017 2019

Find out other Tn Interest

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy