Tennessee Chapter 13 Form

What is the Tennessee Chapter 13?

The Tennessee Chapter 13 is a legal process that allows individuals with a regular income to restructure their debts. This form is part of the U.S. Bankruptcy Code and is designed to help debtors create a repayment plan to pay back all or part of their debts over a specified period, typically three to five years. Unlike Chapter 7 bankruptcy, which involves liquidating assets, Chapter 13 enables individuals to keep their property while making manageable payments to creditors.

Key elements of the Tennessee Chapter 13

Understanding the key elements of the Tennessee Chapter 13 is crucial for effective navigation through the process. Important components include:

- Repayment Plan: The debtor proposes a plan to repay creditors, which must be approved by the court.

- Eligibility: To qualify, individuals must have a regular income and unsecured debts below a certain limit.

- Automatic Stay: Filing for Chapter 13 provides an automatic stay, halting most collection actions against the debtor.

- Discharge: Upon successful completion of the repayment plan, remaining eligible debts may be discharged.

Steps to complete the Tennessee Chapter 13

Completing the Tennessee Chapter 13 involves several key steps:

- Gather Financial Information: Collect details about income, expenses, debts, and assets.

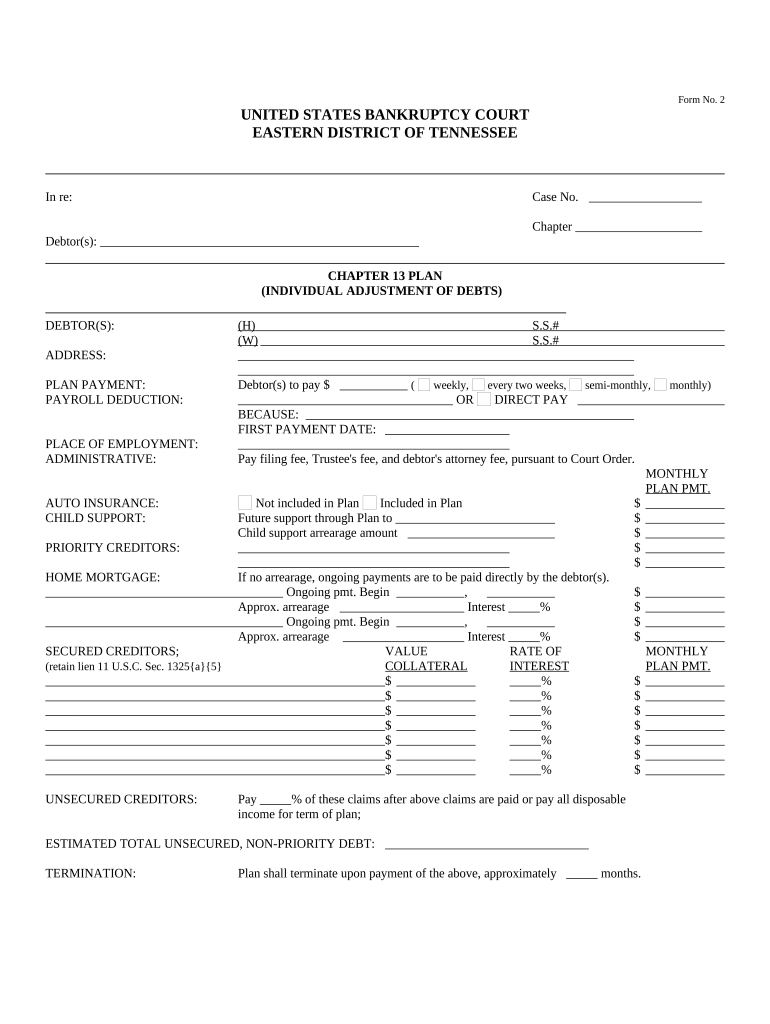

- Complete Required Forms: Fill out the necessary bankruptcy forms, including the Chapter 13 plan template.

- File with the Court: Submit the completed forms to the appropriate bankruptcy court in Tennessee.

- Attend the Meeting of Creditors: Participate in a hearing where creditors can question the repayment plan.

- Make Payments: Begin making payments according to the approved plan, typically through a trustee.

Legal use of the Tennessee Chapter 13

The legal use of the Tennessee Chapter 13 is governed by federal bankruptcy laws, which ensure that the process is fair and transparent. It is essential for individuals to understand their rights and obligations under this chapter. Legal representation is often recommended to navigate the complexities of bankruptcy law and to ensure compliance with all requirements.

Required Documents

When filing for the Tennessee Chapter 13, specific documents are required to support the application. These typically include:

- Proof of Income: Recent pay stubs or tax returns to demonstrate income.

- List of Debts: A comprehensive list of all debts, including amounts owed and creditor information.

- Asset Documentation: Information about personal property and assets.

- Monthly Expenses: A detailed account of monthly living expenses to establish the repayment plan.

Eligibility Criteria

To qualify for the Tennessee Chapter 13, individuals must meet specific eligibility criteria, including:

- Regular Income: The debtor must have a reliable source of income to fund the repayment plan.

- Debt Limits: Unsecured debts must be below a certain threshold, which is adjusted periodically.

- Previous Bankruptcy Filings: Individuals who have filed for bankruptcy previously must meet certain time restrictions before filing again.

Quick guide on how to complete tennessee chapter 13

Effortlessly Prepare Tennessee Chapter 13 on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed forms, enabling you to access the necessary documents and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Handle Tennessee Chapter 13 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Tennessee Chapter 13 with Ease

- Find Tennessee Chapter 13 and click on Get Form to begin.

- Make use of the tools at your disposal to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Select your preferred method for delivering your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Tennessee Chapter 13 to ensure effective communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tennessee Chapter 13 bankruptcy?

A Tennessee Chapter 13 bankruptcy is a legal process that allows individuals with a regular income to create a repayment plan to pay back all or part of their debts over a period of three to five years. This form of bankruptcy can help you keep your assets while managing your debt. Understanding Tennessee Chapter 13 is crucial for those looking to regain financial stability.

-

How much does it cost to file for a Tennessee Chapter 13 bankruptcy?

The cost to file a Tennessee Chapter 13 bankruptcy typically includes court fees, attorney fees, and any additional costs related to the repayment plan. Average attorney fees in Tennessee can vary, but it's important to discuss total costs upfront for clarity. Ultimately, investing in a Tennessee Chapter 13 bankruptcy can be a practical way to secure your financial future.

-

What are the key features of a Tennessee Chapter 13 plan?

A Tennessee Chapter 13 plan allows debtors to propose a repayment schedule to pay off debts over three to five years while retaining their assets, such as their home or car. It provides the benefit of stopping foreclosure proceedings and collection actions during the repayment process. This plan enables individuals to take control of their financial obligations within Tennessee's legal framework.

-

What are the benefits of filing a Tennessee Chapter 13 bankruptcy?

The primary benefits of filing a Tennessee Chapter 13 bankruptcy include the ability to keep your property, the structured repayment plan, and the opportunity to eliminate unsecured debts. Additionally, it stops foreclosure on your home and can provide financial relief from creditor harassment. It’s an effective approach to regaining your financial footing in Tennessee.

-

How long does the Tennessee Chapter 13 process take?

The Tennessee Chapter 13 process typically lasts between three to five years, depending on the terms of the repayment plan approved by the court. During this period, you’ll make regular payments to a bankruptcy trustee who will distribute funds to creditors. Understanding the duration is essential for planning your financial future.

-

Can I modify my Tennessee Chapter 13 repayment plan?

Yes, you can modify your Tennessee Chapter 13 repayment plan if you're facing financial difficulties or signNow life changes. Modifications can be made through the court to accommodate new circumstances, ensuring the plan remains feasible. Keeping open communication with your attorney about your financial situation is crucial for successful adjustments.

-

What types of debts can be discharged in a Tennessee Chapter 13 bankruptcy?

In a Tennessee Chapter 13 bankruptcy, unsecured debts such as credit card bills, medical bills, and personal loans can potentially be discharged after the completion of the repayment plan. However, certain debts like child support and student loans generally cannot be discharged. It’s vital to understand which debts can be addressed through this process.

Get more for Tennessee Chapter 13

Find out other Tennessee Chapter 13

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors