Quitclaim Deed from Corporation to Corporation Texas Form

What is the Quitclaim Deed From Corporation To Corporation Texas

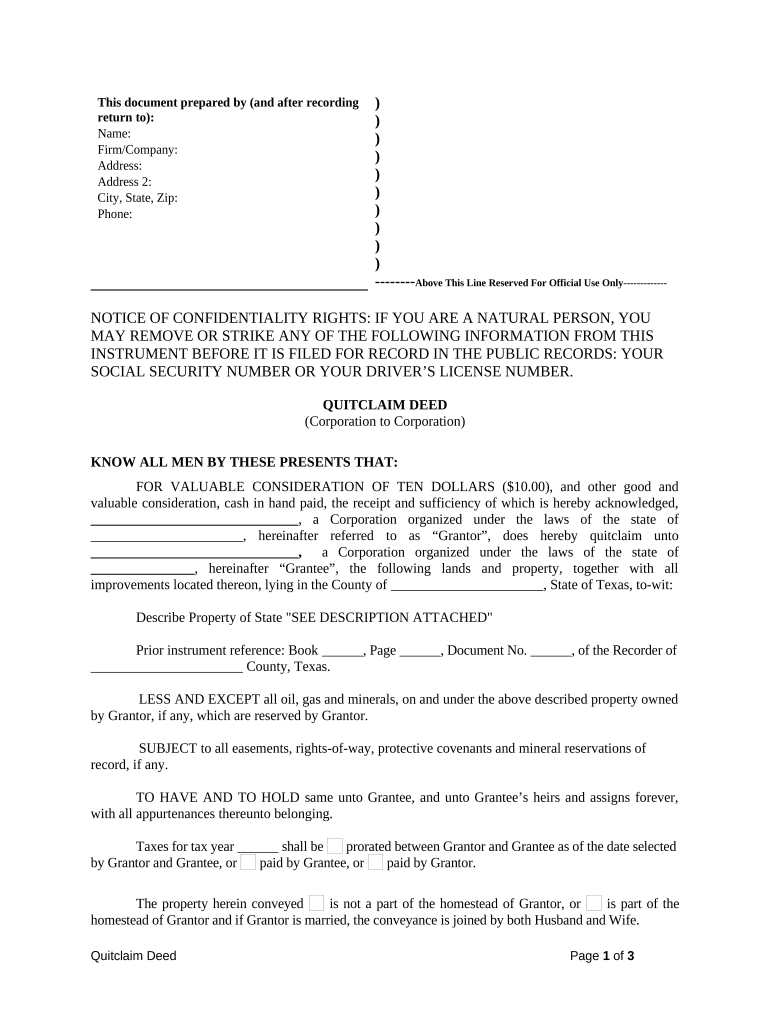

A quitclaim deed from corporation to corporation in Texas is a legal document that facilitates the transfer of property ownership between two corporate entities. Unlike a warranty deed, a quitclaim deed does not guarantee that the title is free of claims or encumbrances; it merely transfers whatever interest the transferring corporation has in the property. This type of deed is often used in business transactions where corporations wish to transfer property without the complexities of a traditional sale.

How to use the Quitclaim Deed From Corporation To Corporation Texas

To use a quitclaim deed from corporation to corporation in Texas, the transferring corporation must complete the deed form, ensuring that all required information is accurately filled out. This includes the names of both corporations, the legal description of the property, and the signatures of authorized representatives. Once completed, the deed should be filed with the county clerk's office where the property is located to make the transfer official. Utilizing electronic signature solutions can streamline this process, ensuring that all parties can sign the document securely and efficiently.

Steps to complete the Quitclaim Deed From Corporation To Corporation Texas

Completing a quitclaim deed from corporation to corporation in Texas involves several key steps:

- Gather necessary information, including the names and addresses of both corporations and the legal description of the property.

- Obtain the quitclaim deed form, which can be found through legal resources or online document services.

- Fill out the form, ensuring all details are accurate and complete.

- Have the form signed by authorized representatives of both corporations, ideally using a secure electronic signature platform.

- Submit the completed deed to the county clerk's office for recording.

Key elements of the Quitclaim Deed From Corporation To Corporation Texas

Several key elements must be included in a quitclaim deed from corporation to corporation in Texas to ensure its validity:

- The full legal names of both corporations involved in the transaction.

- A clear legal description of the property being transferred, including any relevant parcel numbers.

- The date of the transaction.

- Signatures of authorized officers from both corporations, along with their titles.

- A notary public's acknowledgment to verify the identities of the signers.

State-specific rules for the Quitclaim Deed From Corporation To Corporation Texas

In Texas, specific rules govern the use of quitclaim deeds. The state requires that all deeds be in writing and signed by the grantor. Additionally, the deed must be acknowledged by a notary public to be recorded. Texas does not impose a requirement for the use of a quitclaim deed over a warranty deed; however, it is essential to understand that a quitclaim deed offers less protection regarding title issues. Corporations should also ensure compliance with any local regulations that may apply to property transfers.

Legal use of the Quitclaim Deed From Corporation To Corporation Texas

The legal use of a quitclaim deed from corporation to corporation in Texas is primarily for transferring property interests without warranties. This can be useful in various scenarios, such as internal corporate restructuring, mergers, or when one corporation acquires another. However, it is crucial for corporations to conduct due diligence before using a quitclaim deed, as it does not provide any guarantees about the property title, which could expose the receiving corporation to potential claims or liabilities.

Quick guide on how to complete quitclaim deed from corporation to corporation texas

Accomplish Quitclaim Deed From Corporation To Corporation Texas seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle Quitclaim Deed From Corporation To Corporation Texas on any platform using airSlate SignNow Android or iOS applications and simplify any document-based procedure today.

The easiest way to edit and eSign Quitclaim Deed From Corporation To Corporation Texas effortlessly

- Obtain Quitclaim Deed From Corporation To Corporation Texas and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign Quitclaim Deed From Corporation To Corporation Texas and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Corporation in Texas?

A Quitclaim Deed From Corporation To Corporation in Texas is a legal document that transfers ownership of real estate from one corporation to another without guaranteeing title. This type of deed is often used in business transactions where the parties know each other and want a quick transfer of assets. Understanding this process can help corporations facilitate property transfers efficiently.

-

How can I create a Quitclaim Deed From Corporation To Corporation in Texas?

To create a Quitclaim Deed From Corporation To Corporation in Texas, you can use airSlate SignNow's user-friendly template. Simply fill in the required information, such as corporate details and property descriptions, and sign electronically. This service simplifies the legal process, ensuring compliance with Texas laws.

-

Are there any costs associated with filing a Quitclaim Deed From Corporation To Corporation in Texas?

Yes, there may be costs associated with filing a Quitclaim Deed From Corporation To Corporation in Texas, such as filing fees with the local county clerk's office. Additionally, using airSlate SignNow offers a cost-effective solution, minimizing expenses related to paperwork and legal consultations. Assess your needs to understand the total costs involved.

-

What are the benefits of using airSlate SignNow for Quitclaim Deeds?

Using airSlate SignNow for your Quitclaim Deed From Corporation To Corporation in Texas streamlines the eSigning and document management process. The platform enhances security, provides templates, and facilitates collaboration between corporations. These features not only save time but also ensure that your transactions are legally compliant.

-

Is the Quitclaim Deed From Corporation To Corporation in Texas customizable?

Yes, the Quitclaim Deed From Corporation To Corporation template available on airSlate SignNow is customizable to meet your specific needs. You can easily modify the fields to reflect the exact details of the corporations involved and the property being transferred. This flexibility ensures that the deed accurately represents your transaction.

-

Can I integrate airSlate SignNow with other software for my Quitclaim Deed processes?

Absolutely! airSlate SignNow supports various integrations with popular software platforms, allowing you to streamline your Quitclaim Deed From Corporation To Corporation process. This can help improve efficiency and ensure that all related documents and data are synchronized across your business systems. Make the most out of your corporate transactions by utilizing these integrations.

-

How long does it take to process a Quitclaim Deed From Corporation To Corporation in Texas?

Processing a Quitclaim Deed From Corporation To Corporation in Texas can take anywhere from a few hours to several days, depending on various factors. With airSlate SignNow, you can expedite the eSigning process, which signNowly reduces delay times. Ensure that all parties sign promptly for a swift transfer of ownership.

Get more for Quitclaim Deed From Corporation To Corporation Texas

- Ds 1810 us department of state form

- Attention us department of state form

- Magnetic resonance imaging mri prescreening questionnaire form

- Dd form 2527 2004

- Dd 2527 fillable 2008 form

- Doe f 4701 contract security classification specification cscspdf form

- Eoir form 33 portland department of justice justice

- Eoir28 2014 form

Find out other Quitclaim Deed From Corporation To Corporation Texas

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation