Quitclaim Deed from Individual to LLC Texas Form

What is the Quitclaim Deed From Individual To LLC Texas

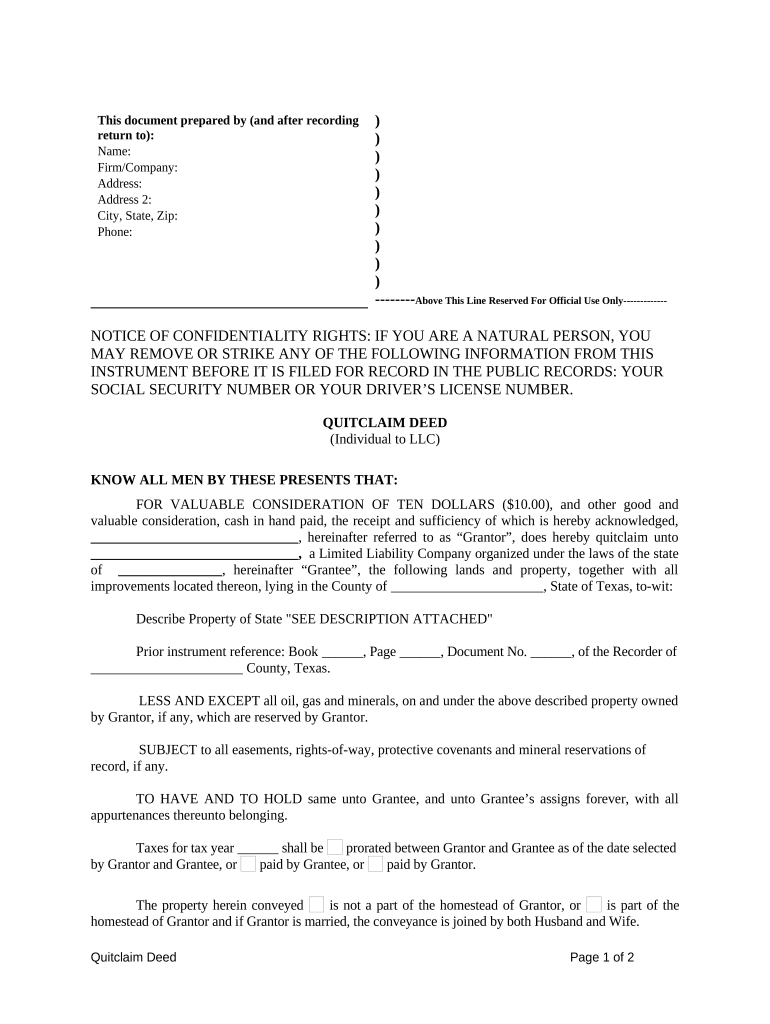

A quitclaim deed from an individual to an LLC in Texas is a legal document that allows an individual to transfer their interest in a property to a limited liability company (LLC). This type of deed does not guarantee that the individual holds clear title to the property; rather, it conveys whatever interest the individual may have. This form is commonly used in real estate transactions where ownership is being transferred to a business entity for various reasons, such as asset protection or business structuring.

Steps to Complete the Quitclaim Deed From Individual To LLC Texas

Completing a quitclaim deed involves several key steps to ensure its validity and compliance with Texas law:

- Gather necessary information, including the legal description of the property, the names of the individual and the LLC, and any relevant identification numbers.

- Obtain the quitclaim deed form, which can be sourced from legal document providers or state resources.

- Fill out the form accurately, ensuring all required fields are completed, including the property description and the parties involved.

- Sign the document in the presence of a notary public, as notarization is required for the deed to be legally binding.

- File the completed deed with the county clerk's office in the county where the property is located to officially record the transfer.

Legal Use of the Quitclaim Deed From Individual To LLC Texas

The quitclaim deed from individual to LLC in Texas is legally recognized as a valid means of transferring property ownership. However, it is essential to understand that this type of deed does not provide any warranties regarding the title. Therefore, it is advisable for individuals to conduct due diligence before accepting a quitclaim deed. This may include checking for existing liens or encumbrances on the property, as these will also transfer to the LLC.

Key Elements of the Quitclaim Deed From Individual To LLC Texas

Several key elements must be included in a quitclaim deed to ensure its effectiveness:

- Grantor and Grantee Information: Clearly state the full names and addresses of both the individual (grantor) and the LLC (grantee).

- Property Description: Provide a detailed legal description of the property being transferred, including lot numbers and boundaries.

- Consideration: Mention any consideration exchanged for the property, although a quitclaim deed can be executed with or without monetary exchange.

- Notarization: The document must be signed in front of a notary public to validate the transfer.

State-Specific Rules for the Quitclaim Deed From Individual To LLC Texas

In Texas, specific rules govern the use of quitclaim deeds. It is important to comply with state regulations, which include:

- The deed must be executed by the grantor and notarized.

- The deed should be filed with the county clerk's office to be effective against third parties.

- Texas law does not require a quitclaim deed to be accompanied by a title insurance policy, but it is advisable to obtain one for added protection.

Examples of Using the Quitclaim Deed From Individual To LLC Texas

There are various scenarios in which an individual might use a quitclaim deed to transfer property to an LLC:

- An individual may transfer their personal residence to an LLC for asset protection purposes.

- A property investor might transfer multiple rental properties into an LLC to streamline management and liability.

- Business owners may transfer commercial property to their LLC to separate personal and business liabilities.

Quick guide on how to complete quitclaim deed from individual to llc texas

Finalize Quitclaim Deed From Individual To LLC Texas effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as it allows you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Quitclaim Deed From Individual To LLC Texas on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign Quitclaim Deed From Individual To LLC Texas without effort

- Obtain Quitclaim Deed From Individual To LLC Texas and then click Access Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Complete button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your selection. Modify and eSign Quitclaim Deed From Individual To LLC Texas and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Individual To LLC in Texas?

A Quitclaim Deed From Individual To LLC in Texas is a legal document used to transfer ownership of property from an individual to a limited liability company (LLC). This type of deed does not provide any warranties on the property, meaning the buyer receives whatever interest the seller has. It is commonly used for simplifying ownership changes in a business context.

-

How do I complete a Quitclaim Deed From Individual To LLC in Texas?

To complete a Quitclaim Deed From Individual To LLC in Texas, you need to fill out a specific form that includes details about the property, the parties involved, and signNowd signatures. It's important to ensure that the deed meets Texas state requirements. Utilizing an online service can streamline the process and ensure accuracy.

-

What are the benefits of creating a Quitclaim Deed From Individual To LLC in Texas?

Creating a Quitclaim Deed From Individual To LLC in Texas offers several benefits, including ease of transfer and reduced legal complexities. It allows for simple ownership changes without the need for title insurance or an extensive sales closing. This is particularly advantageous for business owners needing to streamline their property management.

-

Are there any costs associated with a Quitclaim Deed From Individual To LLC in Texas?

Yes, there are typically costs associated with a Quitclaim Deed From Individual To LLC in Texas. These can include filing fees with the county clerk’s office and potential legal fees if you choose to consult an attorney. Using a digital platform like airSlate SignNow can help minimize costs with its affordable eSigning solutions.

-

Can I use airSlate SignNow to create a Quitclaim Deed From Individual To LLC in Texas?

Absolutely! airSlate SignNow provides easy-to-use templates and tools that allow you to create a Quitclaim Deed From Individual To LLC in Texas efficiently. The platform simplifies document preparation and eSigning, ensuring a smooth process from start to finish.

-

Is a Quitclaim Deed From Individual To LLC in Texas taxable?

Whether a Quitclaim Deed From Individual To LLC in Texas is taxable depends on various factors, including the state and local tax laws applicable to the property. Generally, the transfer may not incur a tax if no money exchanges hands. However, it's always best to consult a tax professional for precise advice based on your specific situation.

-

What integrations does airSlate SignNow offer for handling quitclaim deeds?

airSlate SignNow offers various integrations with popular business tools that help manage workflows involving Quitclaim Deeds From Individual To LLC in Texas. You can seamlessly integrate with platforms like Google Drive, Dropbox, and CRM systems to store and access your documents efficiently. This ensures that your document management process is streamlined and effective.

Get more for Quitclaim Deed From Individual To LLC Texas

- Scanned document ctgov form

- Form florida marriage 2015

- State and zip form

- Form st 14 commonwealth of virginia liquidationcom

- Expiration date march 31 2022 form

- Work search activity log getkansasbenefitsgov form

- Cmp form 1190 notification number

- Plantation police department applicant background information form plantation 388020012

Find out other Quitclaim Deed From Individual To LLC Texas

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple