Tx Failure Form

What is the Tx Failure

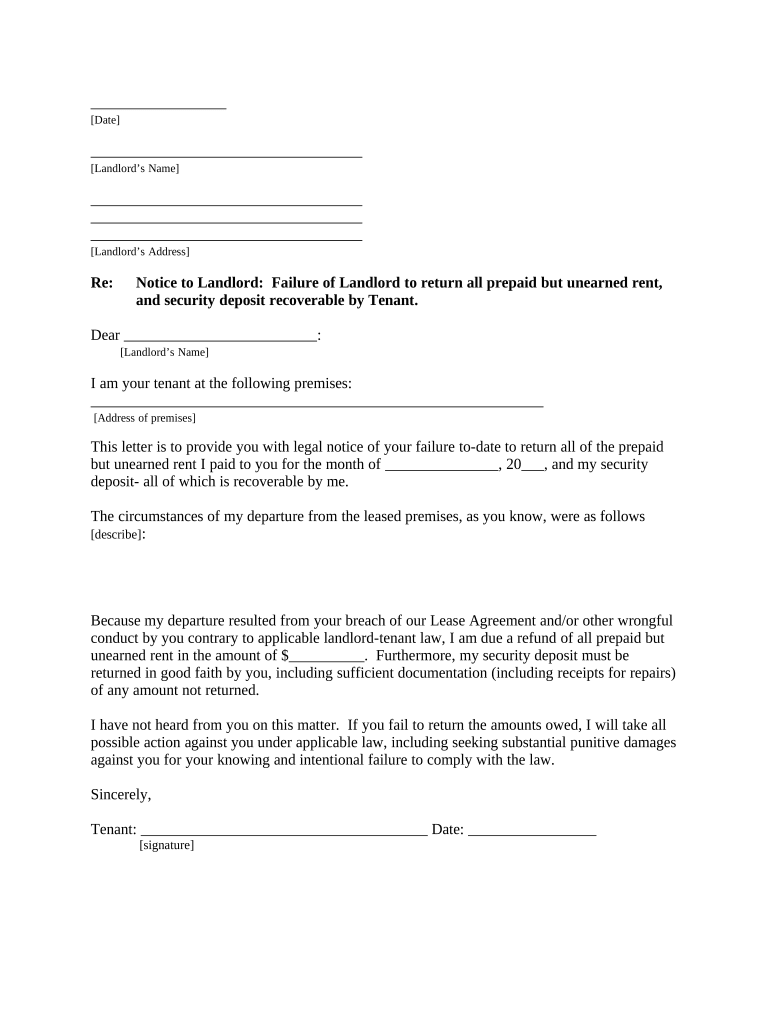

The Tx Failure form is a critical document used in various tax-related scenarios, particularly when a taxpayer encounters issues with their tax filings. This form serves to report discrepancies or failures in tax submissions, ensuring that taxpayers can rectify their situations with the IRS. Understanding the purpose of the Tx Failure is essential for maintaining compliance and avoiding penalties.

Steps to complete the Tx Failure

Completing the Tx Failure form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your tax situation, including previous filings and any correspondence from the IRS. Next, accurately fill out the form, providing detailed information about the discrepancies or failures you are reporting. It is crucial to double-check all entries for accuracy before submission. Finally, submit the completed form through the appropriate channels, whether online or by mail, and keep a copy for your records.

Legal use of the Tx Failure

The Tx Failure form must be used in accordance with IRS regulations to ensure its legal standing. This includes adhering to guidelines regarding submission deadlines and required documentation. When properly completed and submitted, the form serves as a legal instrument to address and resolve tax issues, protecting the taxpayer’s rights and interests. Compliance with all relevant laws and regulations is essential for the form to be considered valid.

IRS Guidelines

The IRS provides specific guidelines for the use of the Tx Failure form, outlining the circumstances under which it should be filed. These guidelines include detailed instructions on the information required, the filing process, and any associated deadlines. Familiarizing yourself with these guidelines is crucial for ensuring that your submission is accepted and processed without delays.

Required Documents

When completing the Tx Failure form, certain documents are required to support your claims. These may include copies of previous tax returns, correspondence from the IRS regarding your tax status, and any relevant financial statements. Having these documents readily available will facilitate a smoother filing process and help substantiate your case.

Penalties for Non-Compliance

Failing to properly file the Tx Failure form can result in significant penalties from the IRS. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the implications of non-compliance and to take timely action to rectify any issues to avoid these consequences.

Eligibility Criteria

Eligibility to file the Tx Failure form typically depends on specific circumstances related to your tax situation. This may include factors such as the type of tax issue you are facing, your filing history, and whether you have received any notices from the IRS. Understanding the eligibility criteria can help determine if this form is appropriate for your needs.

Quick guide on how to complete tx failure

Effortlessly Prepare Tx Failure on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tx Failure on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Tx Failure Effortlessly

- Locate Tx Failure and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Tx Failure to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is tx failure in electronic signatures?

Tx failure refers to instances when a transaction, like an electronic signature, does not complete successfully. This can occur due to technical issues or connectivity problems. Understanding tx failure is crucial for businesses to ensure efficient document processing.

-

How does airSlate SignNow handle tx failure issues?

airSlate SignNow actively monitors transactions to minimize tx failure instances. In the event of a tx failure, the platform provides real-time notifications, allowing users to quickly address the issue. This proactive approach enhances the reliability of your document workflows.

-

Are there any costs associated with fixing tx failure in airSlate SignNow?

There are no additional fees for addressing tx failure issues in airSlate SignNow. The platform offers comprehensive support to help resolve any transaction failures without incurring extra costs. Leveraging our features can help streamline your document processes efficiently.

-

What features help prevent tx failure in airSlate SignNow?

airSlate SignNow includes features such as auto-save, robust error handling, and user notifications to reduce the chances of tx failure. Additionally, our seamless integrations with third-party applications help ensure reliable transactions. These features foster a smoother signing experience.

-

Can integrations cause tx failure issues?

Integrations can sometimes lead to tx failure if they are not configured correctly. However, airSlate SignNow's user-friendly interface simplifies integration processes, minimizing potential errors. Properly set up integrations help facilitate successful document transactions.

-

What benefits does airSlate SignNow provide in relation to tx failure?

By using airSlate SignNow, businesses can reduce the likelihood of tx failure considerably. The platform enhances the signing process with efficient workflows, ensuring a better customer experience. Overall, it streamlines document management, saving time and resources.

-

How quickly can I resolve a tx failure issue with airSlate SignNow?

Resolving a tx failure issue with airSlate SignNow can be very quick, often within minutes. Our support team provides swift assistance to troubleshoot and resolve issues that may arise. Timely resolutions ensure that your document processes remain uninterrupted.

Get more for Tx Failure

- Tobacco tax form 032019

- Affidavit for free certified copy of birth certificate 8 15docx form

- Book 1 exhibit f attachment 1 form ocip s1docx

- Non residential lease for real estate lc1 part one of form

- In the circuit court of the state of oregon for the county of declaration form

- C 102workingpdf page 2preflight form

- Form uce 1010 sc dew scgov

- Form 12 910b 2015 2019

Find out other Tx Failure

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile