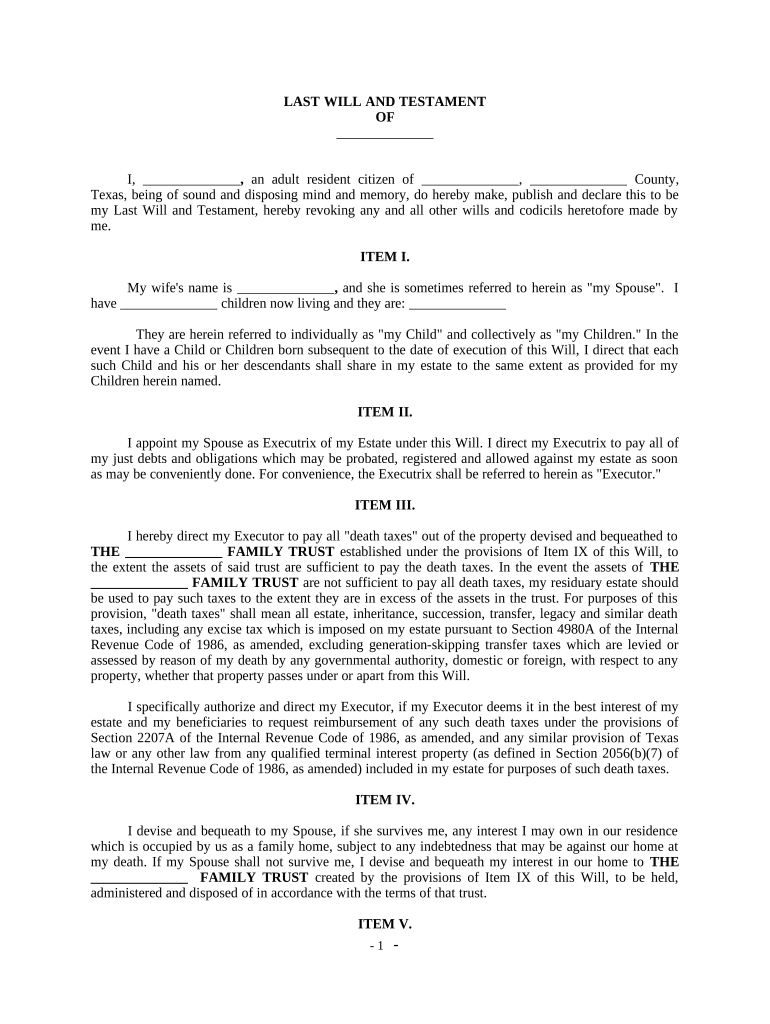

Complex Will with Credit Shelter Marital Trust for Large Estates Texas Form

What is the Complex Will With Credit Shelter Marital Trust For Large Estates Texas

The Complex Will With Credit Shelter Marital Trust for Large Estates in Texas is a legal document designed to manage the distribution of assets for individuals with significant wealth. This type of will incorporates a marital trust and a credit shelter trust, allowing for the strategic allocation of estate assets. The marital trust provides for a surviving spouse, while the credit shelter trust helps minimize estate taxes by utilizing the estate tax exemption available to the deceased spouse. This dual structure ensures that a larger portion of the estate is preserved for heirs, effectively reducing tax liabilities.

How to Use the Complex Will With Credit Shelter Marital Trust For Large Estates Texas

Using the Complex Will With Credit Shelter Marital Trust involves several steps. Initially, it is essential to consult with an estate planning attorney who specializes in Texas law to ensure compliance with state regulations. The attorney will help draft the will, incorporating specific provisions for both the marital and credit shelter trusts. Once the document is prepared, it should be signed in accordance with Texas law, which typically requires witnesses. After execution, it is advisable to store the will in a secure location and inform relevant parties, such as the executor and family members, of its existence.

Key Elements of the Complex Will With Credit Shelter Marital Trust For Large Estates Texas

Several key elements define the Complex Will With Credit Shelter Marital Trust. These include:

- Marital Trust: This trust is designed to provide for the surviving spouse, allowing them to access income and principal as needed.

- Credit Shelter Trust: This trust helps to shield a portion of the estate from taxation, utilizing the estate tax exemption of the deceased spouse.

- Asset Distribution: Clear instructions on how assets are to be divided among beneficiaries, ensuring that the wishes of the deceased are honored.

- Executor Designation: Identification of an executor responsible for managing the estate and ensuring that the terms of the will are executed properly.

Steps to Complete the Complex Will With Credit Shelter Marital Trust For Large Estates Texas

Completing the Complex Will With Credit Shelter Marital Trust involves a series of important steps:

- Consult with an estate planning attorney to discuss specific needs and goals.

- Gather necessary financial information, including assets, liabilities, and potential beneficiaries.

- Draft the will, incorporating both the marital and credit shelter trust provisions.

- Review the document with the attorney to ensure clarity and compliance with Texas law.

- Sign the will in the presence of witnesses, as required by Texas law.

- Store the signed document in a secure location, such as a safe or with an attorney.

Legal Use of the Complex Will With Credit Shelter Marital Trust For Large Estates Texas

The legal use of the Complex Will With Credit Shelter Marital Trust is governed by Texas estate laws. This document must adhere to the formalities required for wills in Texas, which include proper execution, witnessing, and notarization if applicable. Additionally, the provisions within the will must comply with state tax laws to ensure that the intended tax benefits are realized. It is crucial to regularly review and update the will to reflect any changes in personal circumstances or tax laws.

State-Specific Rules for the Complex Will With Credit Shelter Marital Trust For Large Estates Texas

Texas has specific rules governing the execution and validity of wills, including those that incorporate a Complex Will With Credit Shelter Marital Trust. Key state-specific rules include:

- Wills must be signed by the testator and witnessed by at least two individuals who are not beneficiaries.

- Texas recognizes holographic wills, which are handwritten and do not require witnesses, provided they meet certain criteria.

- The will must be filed with the probate court to initiate the probate process after the testator's death.

Quick guide on how to complete complex will with credit shelter marital trust for large estates texas

Complete Complex Will With Credit Shelter Marital Trust For Large Estates Texas effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can easily find the right form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Complex Will With Credit Shelter Marital Trust For Large Estates Texas on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Texas with ease

- Find Complex Will With Credit Shelter Marital Trust For Large Estates Texas and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to retain your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Texas and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas?

A Complex Will With Credit Shelter Marital Trust For Large Estates in Texas is a legal document that ensures the optimal distribution of assets while minimizing estate taxes. This type of will can provide signNow financial advantages for couples with substantial assets, helping them secure their family's future. Utilizing such a will can be particularly beneficial in managing large estates and protecting beneficiaries.

-

How much does it cost to create a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas?

The cost for creating a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas varies depending on the complexity of the estate and the attorney fees involved. On average, clients can expect to invest a few hundred to several thousand dollars for comprehensive legal services. It's essential to consult with an experienced attorney to get an accurate estimate tailored to your specific needs.

-

What are the primary benefits of a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas?

The primary benefits of a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas include tax savings, asset protection, and ensuring that your wishes are honored after your death. This type of will helps maximize the inheritance for heirs by strategically placing assets in trust. Additionally, it provides peace of mind knowing that your estate will be managed efficiently according to your preferences.

-

What features should I look for in a service to create a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas?

When selecting a service to create a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas, look for features such as robust customization options, expert legal guidance, and user-friendly document management tools. Integration capabilities with eSignature solutions can streamline the signing process. Additionally, ensure the service is cost-effective and offers continuous support throughout the estate planning process.

-

Can I update my Complex Will With Credit Shelter Marital Trust For Large Estates in Texas later on?

Yes, you can update your Complex Will With Credit Shelter Marital Trust For Large Estates in Texas whenever necessary. Life changes, such as marriage, divorce, or the birth of a child, may prompt revisions to best reflect your current wishes. It's advisable to review your will regularly and make updates as needed to ensure it aligns with your evolving estate planning goals.

-

How does a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas differ from a traditional will?

A Complex Will With Credit Shelter Marital Trust For Large Estates in Texas incorporates sophisticated trust arrangements that aid in reducing inheritance taxes and protecting assets, unlike a traditional will which typically distributes assets directly to heirs. This complexity allows for better management and protection of large estates. Additionally, trust provisions can ensure that beneficiaries receive their inheritance in a more controlled manner.

-

Is it necessary to hire an attorney for a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas?

While it is possible to create a Complex Will With Credit Shelter Marital Trust For Large Estates in Texas without an attorney, hiring one is highly recommended. Attorneys bring expertise in navigating the complexities of estate law, ensuring your will adheres to Texas laws and regulations. Their guidance can help you avoid potential pitfalls and ensure that your estate is properly structured for your family's benefit.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates Texas

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates Texas

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament