Living Trust for Husband and Wife with No Children Texas Form

What is the Living Trust For Husband And Wife With No Children Texas

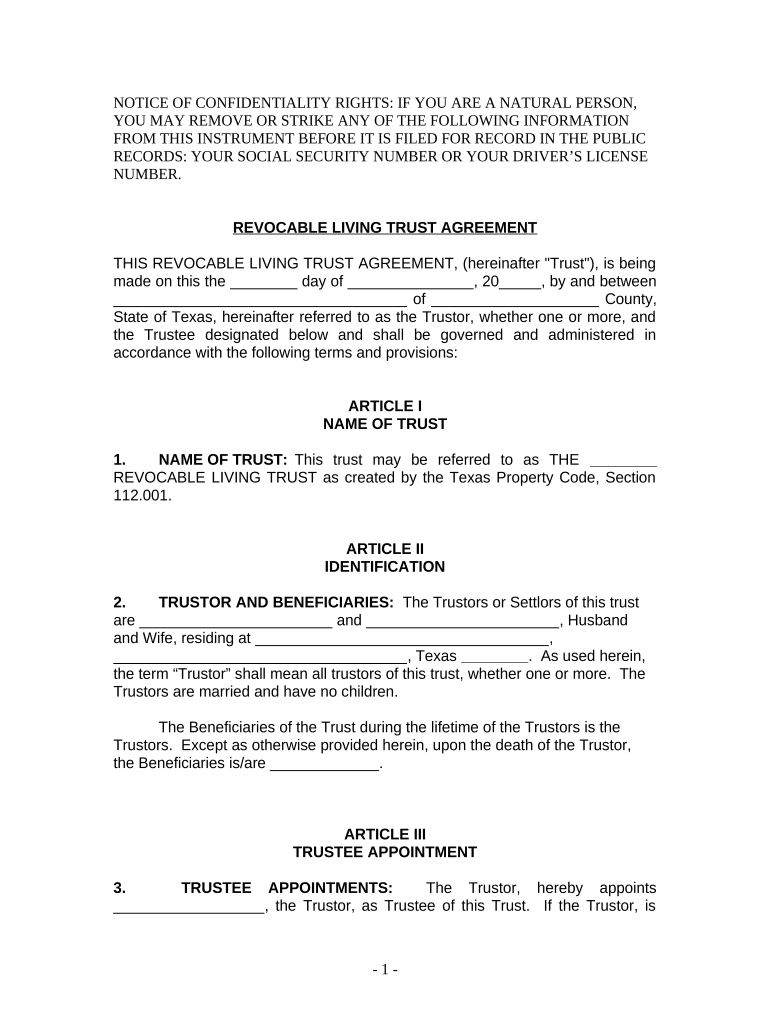

A living trust for husband and wife with no children in Texas is a legal document that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust can help avoid probate, streamline the transfer of property, and provide privacy regarding asset distribution. It is particularly beneficial for couples without children, as it allows them to specify beneficiaries, which could include relatives, friends, or charitable organizations.

Steps to Complete the Living Trust For Husband And Wife With No Children Texas

Completing a living trust involves several key steps:

- Identify Assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Choose a Trustee: Decide who will manage the trust. This can be one or both spouses, or a third party.

- Draft the Trust Document: Create the trust document, detailing how assets will be managed and distributed. This may require legal assistance to ensure compliance with Texas laws.

- Fund the Trust: Transfer ownership of the identified assets into the trust. This may involve changing titles and account names.

- Review and Update: Regularly review the trust to ensure it reflects your current wishes and financial situation.

Legal Use of the Living Trust For Husband And Wife With No Children Texas

The legal use of a living trust in Texas allows couples to maintain control over their assets while providing clear instructions for distribution upon death. It is recognized under Texas law, making it a valid estate planning tool. The trust can specify how assets are to be managed, who will receive them, and under what conditions. This flexibility is particularly useful for couples without children, as they can designate alternate beneficiaries and provide for specific needs.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Texas

Texas has specific rules governing living trusts, including the requirement that the trust document be in writing and signed by the grantors. Additionally, Texas law allows for the creation of revocable trusts, meaning that the couple can alter or dissolve the trust during their lifetime. It is important to ensure that the trust complies with state laws to avoid complications in the future.

Key Elements of the Living Trust For Husband And Wife With No Children Texas

Key elements of a living trust include:

- Grantors: The individuals who create the trust, typically both spouses.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or organizations designated to receive the trust assets after the grantors pass away.

- Terms of Distribution: Specific instructions on how and when the assets will be distributed to beneficiaries.

How to Obtain the Living Trust For Husband And Wife With No Children Texas

Obtaining a living trust typically involves consulting with an estate planning attorney who can help draft the trust document according to Texas laws. Alternatively, couples can use online legal services that provide templates for creating a living trust. It is crucial to ensure that the chosen method complies with legal requirements to ensure the trust's validity.

Quick guide on how to complete living trust for husband and wife with no children texas

Complete Living Trust For Husband And Wife With No Children Texas effortlessly on any device

Online document management has become increasingly popular with companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Living Trust For Husband And Wife With No Children Texas on any device using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The easiest way to modify and eSign Living Trust For Husband And Wife With No Children Texas with ease

- Find Living Trust For Husband And Wife With No Children Texas and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign Living Trust For Husband And Wife With No Children Texas and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Texas?

A Living Trust For Husband And Wife With No Children in Texas is a legal arrangement that allows couples to manage their assets during their lifetime and direct the distribution of those assets after death. This type of trust can simplify the estate planning process, eliminate probate, and ensure that your wishes are honored without the complications that can arise when children are involved.

-

How does a Living Trust differ from a Will in Texas?

Unlike a Will, which only takes effect after death and must go through probate, a Living Trust For Husband And Wife With No Children in Texas is effective as soon as it is created. This means your assets can bypass the lengthy probate process, offering quicker access to your beneficiaries while maintaining privacy.

-

What are the benefits of creating a Living Trust For Husband And Wife With No Children in Texas?

Creating a Living Trust For Husband And Wife With No Children in Texas provides several advantages, including asset management during your lifetime, privacy regarding your estate, and a streamlined process upon your passing. Additionally, it can help minimize estate taxes and ensure that your assets are distributed according to your wishes without court intervention.

-

Are there any costs associated with setting up a Living Trust For Husband And Wife With No Children in Texas?

Yes, there are costs involved in setting up a Living Trust For Husband And Wife With No Children in Texas, which can vary depending on the complexity of your assets and whether you hire an attorney. However, many find that the long-term savings on probate fees and taxes justify the initial investment. Using a service like airSlate SignNow can also help reduce costs with an easy-to-use platform for document management.

-

Can I make changes to my Living Trust For Husband And Wife With No Children in Texas?

Yes, one of the main advantages of a Living Trust For Husband And Wife With No Children in Texas is that it is revocable. This means you can modify the terms, add or remove assets, and change beneficiaries as your circumstances change, ensuring that your estate plan stays up-to-date with your wishes.

-

How does airSlate SignNow help with creating a Living Trust For Husband And Wife With No Children in Texas?

airSlate SignNow provides an accessible platform for electronically signing and managing documents related to your Living Trust For Husband And Wife With No Children in Texas. It simplifies the process by allowing you to easily collaborate with attorneys or financial advisors and securely store important documents, ensuring that your estate planning is efficient and organized.

-

Is a Living Trust For Husband And Wife With No Children in Texas necessary if we have no assets?

Even if you believe you have minimal assets, a Living Trust For Husband And Wife With No Children in Texas can be beneficial. It can help manage any assets you may acquire in the future and can also provide peace of mind knowing that your wishes are clearly stated and legally established, regardless of your current financial situation.

Get more for Living Trust For Husband And Wife With No Children Texas

Find out other Living Trust For Husband And Wife With No Children Texas

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors