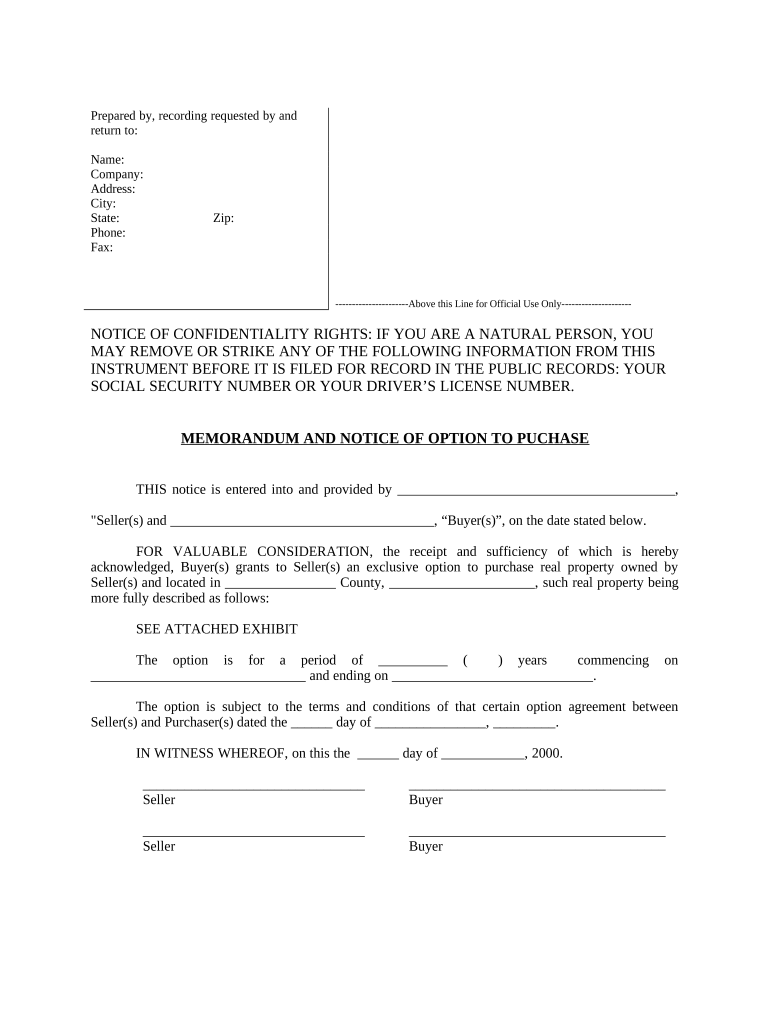

Texas Option Form

What is the Texas Option

The Texas Option refers to a specific provision that allows individuals in Texas to make certain choices regarding their tax filings or legal obligations. This option is particularly relevant for taxpayers seeking to navigate their tax responsibilities effectively. Understanding the Texas Option is crucial for ensuring compliance with state regulations while maximizing potential benefits.

How to use the Texas Option

Utilizing the Texas Option involves a series of steps to ensure proper execution. Taxpayers must first determine their eligibility and understand the implications of choosing this option. Once eligibility is confirmed, individuals should gather the necessary documentation and complete the required forms accurately. It is advisable to consult with a tax professional to ensure that all aspects of the Texas Option are correctly addressed.

Steps to complete the Texas Option

Completing the Texas Option involves several key steps:

- Review eligibility criteria to ensure compliance.

- Gather all required documents, including previous tax returns and supporting financial records.

- Fill out the necessary forms accurately, paying attention to detail.

- Submit the completed forms through the appropriate channels, whether online or via mail.

- Keep a copy of all submitted documents for your records.

Legal use of the Texas Option

The legal use of the Texas Option is governed by state tax laws and regulations. It is essential for taxpayers to understand the legal framework surrounding this option to avoid potential penalties. Compliance with all legal requirements ensures that the Texas Option is recognized as valid by state authorities, providing peace of mind during the filing process.

Eligibility Criteria

To qualify for the Texas Option, individuals must meet specific eligibility criteria set forth by the state. These criteria may include factors such as income level, residency status, and prior tax history. It is important for taxpayers to review these requirements carefully to determine if they can take advantage of the Texas Option.

Required Documents

When applying for the Texas Option, certain documents are necessary to support the application. Commonly required documents include:

- Previous tax returns for the last few years.

- Proof of residency in Texas.

- Financial statements or records that substantiate income claims.

- Any additional forms specified by the Texas tax authority.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the Texas Option can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to adhere to all guidelines to avoid these consequences and ensure that their tax obligations are met in a timely manner.

Quick guide on how to complete texas option

Effortlessly Manage Texas Option on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly and without issues. Manage Texas Option on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and eSign Texas Option Effortlessly

- Obtain Texas Option and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Texas Option and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Texas option in airSlate SignNow?

The Texas option in airSlate SignNow refers to a feature that allows users to easily manage and eSign documents relevant to Texas businesses. This includes compliance with Texas state regulations and laws, making it ideal for local enterprises.

-

How much does the Texas option cost?

The Texas option is part of airSlate SignNow's flexible pricing plans, which start at affordable monthly rates. By choosing the Texas option, businesses can optimize their document management processes without a signNow financial investment.

-

What features come with the Texas option?

The Texas option includes comprehensive document security, templates tailored for Texas legal requirements, and real-time tracking of document status. These features ensure you can manage your documents efficiently while remaining compliant with local laws.

-

Can airSlate SignNow integrate with other tools while using the Texas option?

Yes, airSlate SignNow supports numerous integrations with popular tools like Salesforce, Google Drive, and Dropbox, even when using the Texas option. This allows Texas businesses to streamline their workflows and enhance productivity seamlessly.

-

What are the benefits of using the Texas option?

Using the Texas option empowers businesses to sign documents swiftly while ensuring compliance with state regulations. You'll benefit from increased efficiency, reduced turnaround times, and enhanced security, all tailored to the needs of Texas organizations.

-

Is the Texas option suitable for small businesses?

Absolutely! The Texas option is designed to cater to businesses of all sizes, including small enterprises. With its cost-effective solutions, small businesses can easily implement eSigning and document management processes that meet Texas-specific needs.

-

How does the Texas option enhance document security?

The Texas option prioritizes document security through features such as encryption, secure access, and audit trails. This ensures that all your Texas-related documents are safeguarded against unauthorized access and maintain their integrity throughout the signing process.

Get more for Texas Option

- It 201 tax form 2017

- Form or 40 n oregon individual income tax return oregongov

- Pr 482 form 2014

- Reviewer hacienda pr form

- California form 3809 2017

- 2018 form 592 f foreign partner or member annual return 2018 form 592 f foreign partner or member annual return

- Virginia form 2017 2019

- 2017 form 3538 franchise tax board

Find out other Texas Option

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document