SPCC1 Claim for Single Person Child Carer Credit Revenue 2017

What is the SPCC1 Claim For Single Person Child Carer Credit Revenue

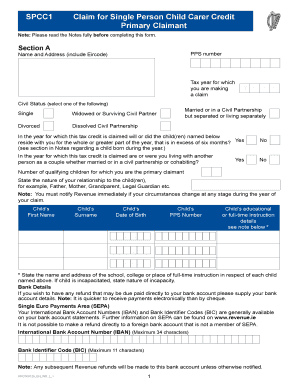

The SPCC1 Claim For Single Person Child Carer Credit Revenue is a tax form designed for individuals who are the sole caregivers for a child. This form allows eligible taxpayers to claim a credit that can reduce their tax liability. The credit aims to provide financial relief to single parents or guardians who bear the primary responsibility for raising a child. Understanding this form is crucial for ensuring that you receive the appropriate benefits available to you under tax law.

Eligibility Criteria

To qualify for the SPCC1 Claim For Single Person Child Carer Credit Revenue, certain eligibility criteria must be met. Generally, the claimant must be a single individual who provides primary care for a dependent child. The child must be under a specific age, typically under the age of 17, and must reside with the claimant for more than half the year. Additionally, the claimant's income must fall within designated thresholds to qualify for the credit. It is important to review the specific requirements to ensure compliance and maximize benefits.

Steps to Complete the SPCC1 Claim For Single Person Child Carer Credit Revenue

Completing the SPCC1 Claim For Single Person Child Carer Credit Revenue involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income and information regarding the dependent child. Next, fill out the form accurately, providing all required information such as your name, Social Security number, and details about your child. After completing the form, review it for any errors before submission. Finally, submit the form through the appropriate method, ensuring that you keep copies for your records.

Required Documents

When filing the SPCC1 Claim For Single Person Child Carer Credit Revenue, specific documents are necessary to support your claim. These typically include:

- Proof of income, such as W-2 forms or tax returns

- Social Security numbers for both the claimant and the dependent child

- Documentation showing the child's residency, such as school records or medical documents

Having these documents ready can streamline the filing process and help avoid delays in processing your claim.

Form Submission Methods

The SPCC1 Claim For Single Person Child Carer Credit Revenue can be submitted through various methods, including online, by mail, or in-person. For online submissions, ensure you are using a secure platform that complies with eSignature laws. If submitting by mail, send the completed form to the designated address provided by the IRS. In-person submissions may be possible at local IRS offices, where assistance can also be sought if needed. Each method has its benefits, so choose the one that best suits your situation.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the SPCC1 Claim For Single Person Child Carer Credit Revenue. Typically, the deadline aligns with the standard tax filing date, which is usually April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates or changes to deadlines to ensure timely submission of your claim.

Quick guide on how to complete spcc1 claim for single person child carer credit revenue

Effortlessly Prepare SPCC1 Claim For Single Person Child Carer Credit Revenue on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without any holdups. Handle SPCC1 Claim For Single Person Child Carer Credit Revenue on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign SPCC1 Claim For Single Person Child Carer Credit Revenue Effortlessly

- Find SPCC1 Claim For Single Person Child Carer Credit Revenue and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow designed for that purpose.

- Generate your eSignature with the Sign tool, which takes only a few seconds and has the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, and mistakes that require reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you select. Edit and eSign SPCC1 Claim For Single Person Child Carer Credit Revenue to ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct spcc1 claim for single person child carer credit revenue

Create this form in 5 minutes!

How to create an eSignature for the spcc1 claim for single person child carer credit revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SPCC1 Claim For Single Person Child Carer Credit Revenue?

The SPCC1 Claim For Single Person Child Carer Credit Revenue is a specific tax credit designed to support single parents caring for children. This claim aims to alleviate some financial burden by providing eligible individuals with substantial credits against their tax liabilities, enabling better financial stability.

-

Who is eligible to apply for the SPCC1 Claim For Single Person Child Carer Credit Revenue?

To be eligible for the SPCC1 Claim For Single Person Child Carer Credit Revenue, applicants must be single parents or guardians with dependent children. Additional eligibility criteria, such as income thresholds and age of the child, may also apply, so it's essential to review the specific requirements carefully.

-

How do I file the SPCC1 Claim For Single Person Child Carer Credit Revenue?

Filing the SPCC1 Claim For Single Person Child Carer Credit Revenue can be done via the tax authority's online portal or through a professional tax preparer. It's important to gather all necessary documentation that supports your claim, including identification, proof of caring for the child, and other financial records.

-

What are the benefits of the SPCC1 Claim For Single Person Child Carer Credit Revenue?

The primary benefit of the SPCC1 Claim For Single Person Child Carer Credit Revenue is the financial support provided to single parents, helping alleviate the costs associated with raising children. This credit boosts disposable income and improves overall financial stability, making it easier to manage day-to-day expenses.

-

What documents do I need for the SPCC1 Claim For Single Person Child Carer Credit Revenue?

To process the SPCC1 Claim For Single Person Child Carer Credit Revenue, you will need identification documents such as a birth certificate for your child, proof of your income, and any related care expenses. Keeping all relevant paperwork organized will streamline the claim process.

-

How long does it take to process the SPCC1 Claim For Single Person Child Carer Credit Revenue?

The processing time for the SPCC1 Claim For Single Person Child Carer Credit Revenue can vary based on the method of submission and the volume of claims received by the tax authority. Generally, it can take several weeks to a few months, so it’s wise to file as early as possible.

-

Can the SPCC1 Claim For Single Person Child Carer Credit Revenue be integrated with other tax credits?

Yes, the SPCC1 Claim For Single Person Child Carer Credit Revenue can often be combined with other tax credits, depending on your financial situation. Make sure to consult a tax professional to understand how these credits interrelate and can maximize your benefits.

Get more for SPCC1 Claim For Single Person Child Carer Credit Revenue

Find out other SPCC1 Claim For Single Person Child Carer Credit Revenue

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple