Assumption Agreement Loan Form

What is the assumption agreement loan

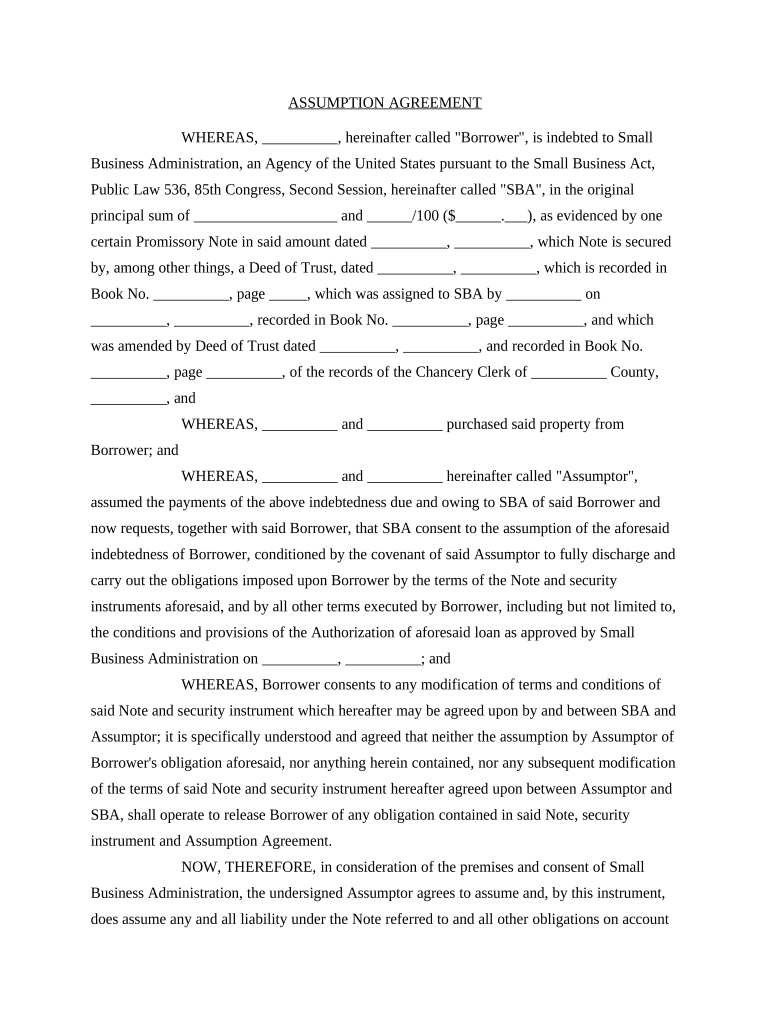

An assumption agreement loan is a legal document that allows a borrower to transfer their loan obligations to another party. This agreement typically involves a buyer assuming the existing mortgage of a seller, which can be beneficial if the terms of the original loan are favorable. The new borrower takes over the payments and responsibilities, thereby relieving the original borrower of their obligations. This type of agreement is often used in real estate transactions, particularly when the interest rates on existing loans are lower than current market rates.

Key elements of the assumption agreement loan

Several critical components make up an assumption agreement loan. These include:

- Identification of parties: Clearly stating the original borrower, the new borrower, and the lender.

- Loan details: Including the loan amount, interest rate, and payment schedule.

- Terms of assumption: Outlining the conditions under which the new borrower assumes the loan.

- Liabilities: Specifying who is responsible for any outstanding payments or fees.

- Signatures: Requiring signatures from all parties involved to validate the agreement.

Steps to complete the assumption agreement loan

Completing an assumption agreement loan involves several steps to ensure that the process is legally binding and clear. Here are the general steps:

- Review the original loan documents to understand the terms and conditions.

- Obtain consent from the lender, as many loans require lender approval for assumptions.

- Draft the assumption agreement, including all key elements.

- Have all parties review and agree to the terms outlined in the document.

- Sign the agreement in the presence of a notary, if required.

- Submit the signed document to the lender for their records.

Legal use of the assumption agreement loan

The legal validity of an assumption agreement loan depends on compliance with state and federal laws. It is essential to ensure that the agreement meets the requirements set forth by the lender and adheres to relevant regulations. This includes ensuring that the document is properly executed with all necessary signatures and that it is filed according to state laws. Additionally, understanding the implications of assuming a loan, such as liability for any defaults, is crucial for all parties involved.

How to use the assumption agreement loan

Using an assumption agreement loan can be advantageous in various scenarios, particularly in real estate transactions. To effectively use this loan type:

- Evaluate the existing loan terms to determine if they are beneficial for the new borrower.

- Communicate with the lender to understand their policies regarding loan assumptions.

- Prepare the necessary documentation, including the assumption agreement and any additional forms required by the lender.

- Ensure that all parties involved understand their rights and responsibilities under the agreement.

Required documents

To complete an assumption agreement loan, specific documents are typically required. These may include:

- The original loan agreement.

- The assumption agreement itself, detailing the terms of the transfer.

- Proof of identity for all parties involved.

- Any additional forms requested by the lender, such as a credit application or financial disclosure.

Quick guide on how to complete assumption agreement loan

Effortlessly prepare Assumption Agreement Loan on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily access the proper form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Assumption Agreement Loan on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Assumption Agreement Loan with ease

- Find Assumption Agreement Loan and click on Get Form to initiate the process.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the provided information and click on the Done button to save your modifications.

- Choose how you'd like to share your form—via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Assumption Agreement Loan to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assumption agreement loan?

An assumption agreement loan allows a buyer to take over the mortgage of the seller, effectively assuming the existing debt. This type of loan can benefit both parties by streamlining the transaction process. It’s crucial to understand the terms and conditions of the assumption agreement loan to avoid any legal complications.

-

What are the benefits of using airSlate SignNow for an assumption agreement loan?

Using airSlate SignNow simplifies the process of creating, sending, and eSigning an assumption agreement loan. Our platform offers a user-friendly interface that allows for quick document preparation and management. Additionally, it ensures your documents are secure, making it easier for both buyers and sellers to transact confidently.

-

Are there any fees associated with using airSlate SignNow for assumption agreement loans?

AirSlate SignNow offers competitive pricing models tailored for businesses, including options for free and premium plans. The specific fees depend on the features you choose, but each plan is designed to provide value and cost-effectiveness for handling assumption agreement loans. Always review our pricing page for the most accurate and up-to-date information.

-

How does airSlate SignNow ensure the security of my assumption agreement loan documents?

At airSlate SignNow, we prioritize the security of your data. Our platform utilizes advanced encryption protocols and secure cloud storage to protect your assumption agreement loan documents from unauthorized access. Additionally, we comply with all relevant regulations to ensure your information remains confidential and secure.

-

Can I integrate airSlate SignNow with other tools for managing assumption agreement loans?

Yes, airSlate SignNow offers seamless integrations with various tools and applications that can help manage assumption agreement loans more effectively. This includes CRM systems, document management tools, and more. Integrating these services maximizes productivity and streamlines your workflow.

-

Is it easy to track the status of documents related to assumption agreement loans using airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking features that keep you updated on the status of your assumption agreement loan documents. You'll receive notifications when documents are viewed, signed, or completed, ensuring that you can follow up promptly and maintain communication with all parties involved.

-

How can I get started with airSlate SignNow for my assumption agreement loan needs?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website and choose a plan that suits your needs. Once you're registered, you can begin creating and sending documents for your assumption agreement loan within minutes.

Get more for Assumption Agreement Loan

- Ringwood town wide yard sale ringwood nj form

- Tax account information changecorrection form rev 1705 formspublications

- Bvacant landb purchase agreement jim miner form

- Form dhec 2015 2019

- Form 410 california 2016 2019

- Event recap form grand valley state university gvsu

- Cr 132 notice of appeal misdemeanor judicial council forms alpine courts ca

- Get 365831866 form

Find out other Assumption Agreement Loan

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement