Payoff Letter Form

What is the loan payoff letter?

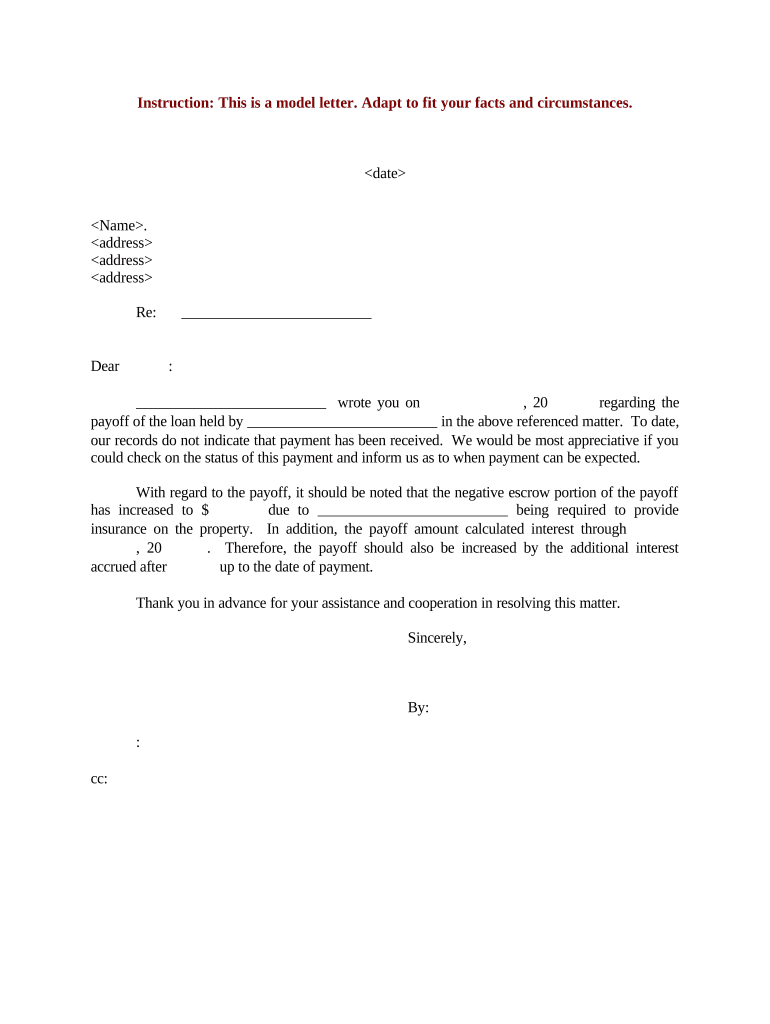

A loan payoff letter is an official document provided by a lender that states the total amount needed to pay off a loan. This letter is essential for borrowers who wish to settle their debt in full. It details the remaining balance, including any interest, fees, and other charges that may apply. Understanding the contents of a loan payoff letter is crucial for ensuring that the borrower pays the correct amount and fulfills their obligations.

How to obtain the loan payoff letter

To obtain a loan payoff letter, borrowers typically need to contact their lender directly. This can often be done through customer service channels, online account access, or by visiting a local branch. When requesting the letter, it is helpful to have the following information ready:

- Loan account number

- Personal identification information

- Specific request for a payoff statement

Some lenders may require a formal written request, while others may provide the information over the phone or online. It is advisable to ask about the processing time, as it can vary by institution.

Steps to complete the loan payoff letter

Completing a loan payoff letter involves several key steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather all relevant loan information, including the account number and outstanding balance.

- Request the loan payoff letter from your lender and review the details provided.

- Verify the total amount due, including any applicable fees or interest.

- Prepare your payment method, ensuring it meets the lender's requirements.

- Submit your payment along with any necessary documentation to finalize the loan payoff.

Following these steps can help ensure a smooth loan payoff process.

Key elements of the loan payoff letter

A loan payoff letter typically includes several critical components that are essential for the borrower. These elements often consist of:

- The total amount due to pay off the loan

- The date through which the payoff amount is valid

- Any additional fees or charges that may apply

- Instructions for making the payment

- Contact information for the lender

Understanding these elements can help borrowers ensure they are fully informed about their loan payoff obligations.

Legal use of the loan payoff letter

The loan payoff letter serves a significant legal purpose. It acts as proof that the borrower has fulfilled their financial obligations to the lender once the payment is made. This document can be crucial in resolving any disputes regarding the loan balance and can be used in legal proceedings if necessary. It is essential to keep a copy of the payoff letter for personal records, as it may be required for future financial transactions or inquiries.

Examples of using the loan payoff letter

There are various scenarios where a loan payoff letter may be utilized. For instance:

- When selling a property, the payoff letter can confirm the remaining mortgage balance to potential buyers.

- In refinancing situations, lenders may require a payoff letter to assess the current loan status.

- Borrowers may need it for personal records or when applying for new credit to demonstrate they have paid off existing debts.

These examples illustrate the practical applications of a loan payoff letter in managing personal finances.

Quick guide on how to complete payoff letter

Easily Prepare Payoff Letter on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents promptly and efficiently. Manage Payoff Letter on any device with the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

How to Modify and Electrically Sign Payoff Letter Effortlessly

- Locate Payoff Letter and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Payoff Letter to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are loan payoff letter examples?

Loan payoff letter examples are templates that illustrate how to request a payoff statement from a lender. They typically include key information such as account details, loan balances, and specific verbiage for clear communication. Using these examples helps ensure that your request is accurate and comprehensive.

-

How can airSlate SignNow help in creating loan payoff letter examples?

airSlate SignNow offers customizable document templates that can be used to create loan payoff letter examples quickly and efficiently. The intuitive platform allows users to add their information and make modifications easily. This streamlines the process of sending and signing loan payoff letters securely.

-

Are there any costs associated with using airSlate SignNow for loan payoff letters?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Depending on the plan you choose, you can access a variety of features, including the ability to create and send loan payoff letter examples. The pricing is designed to be cost-effective, especially for businesses managing multiple documents.

-

What are the key features of airSlate SignNow related to loan payoff letters?

Key features of airSlate SignNow include document templates, eSignature capabilities, and secure cloud storage. These features make it easy to create and manage loan payoff letter examples with just a few clicks. Additionally, you can track the status of your documents to ensure timely responses from lenders.

-

How do I integrate airSlate SignNow with my existing systems for loan payoff letters?

Integrating airSlate SignNow with your existing systems is straightforward due to its robust API capabilities. This allows you to streamline the creation and sending of loan payoff letter examples directly from your CRM or other platforms. Detailed documentation is available to assist with the integration process.

-

What benefits does airSlate SignNow provide for managing loan payoff letters?

Using airSlate SignNow for managing loan payoff letters simplifies the entire workflow. You benefit from reduced paperwork, faster turnaround times, and increased accuracy through templates and automated features. This means you can focus more on your business rather than administrative tasks.

-

Can I customize loan payoff letter examples in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize loan payoff letter examples according to your needs. You can modify text, add your branding, and include specific details relevant to your situation, ensuring that each letter accurately reflects your request and helps facilitate a smooth communication process.

Get more for Payoff Letter

- That execution of same is done freely and voluntarily form

- Form fl 988lt

- Probate attorneys of san diego handbook for probate executors form

- Fort bend county texas fort bend county tx health ampamp human form

- Patient registration washington township medical foundation form

- Form al 864lt

- Nc do 11apdf form

- Personally came and appeared before me the undersigned authority in and for the said form

Find out other Payoff Letter

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed