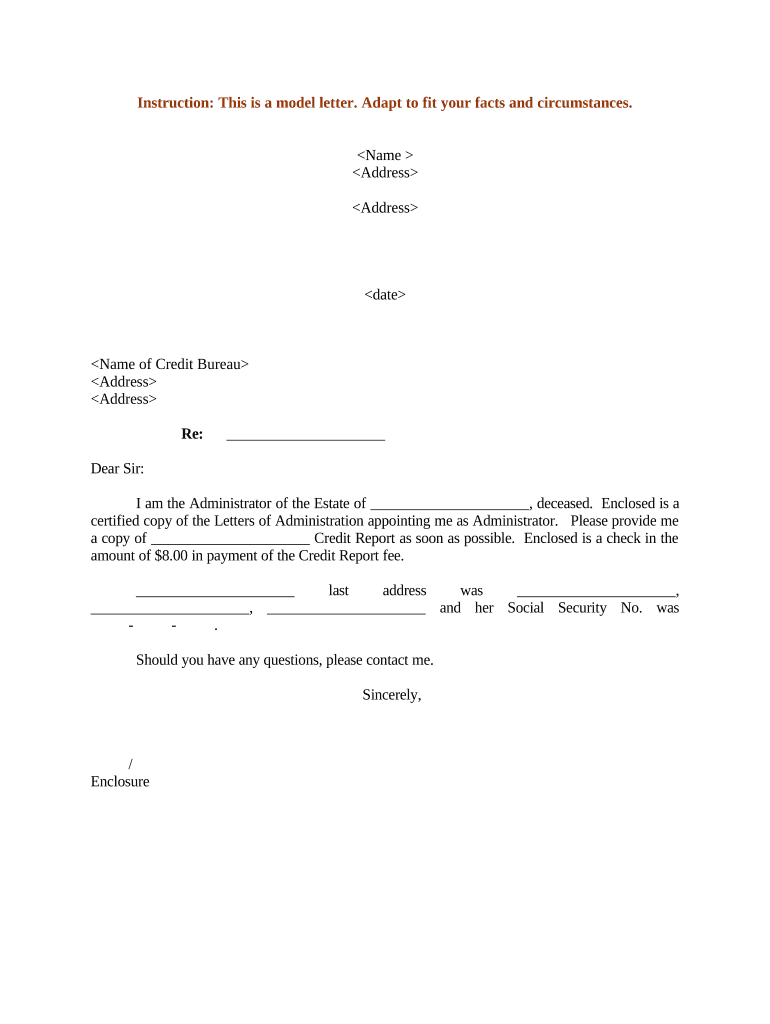

Letter Estate Administrator Form

What is the letter estate administrator?

The letter estate administrator is a formal document that grants an individual the authority to manage and distribute the assets of a deceased person's estate. This letter is essential for the appointed administrator to act on behalf of the estate and is often required by financial institutions, government agencies, and other entities involved in the estate settlement process. The letter serves as proof of the administrator's legal authority, ensuring that they can perform necessary actions such as accessing bank accounts, paying debts, and distributing assets according to the deceased's wishes or state laws.

Steps to complete the letter estate administrator

Completing the letter estate administrator involves several key steps to ensure that it meets legal requirements. First, the appointed administrator must gather necessary information, including the deceased's full name, date of death, and details about the estate. Next, the administrator should fill out the letter accurately, including their own personal information and the relationship to the deceased. Once completed, the letter must be signed and notarized to validate its authenticity. Finally, the administrator may need to file the letter with the probate court, depending on state regulations, to officially establish their authority.

Legal use of the letter estate administrator

The legal use of the letter estate administrator is crucial for ensuring that the estate is managed in compliance with state laws. This document allows the administrator to act on behalf of the estate, which includes settling debts, filing tax returns, and distributing assets to beneficiaries. It is important for the administrator to understand their responsibilities and the legal implications of their actions. Failure to adhere to legal requirements can result in penalties or personal liability, making it essential to follow proper procedures and maintain accurate records throughout the estate administration process.

Required documents for the letter estate administrator

To obtain a letter estate administrator, certain documents are typically required. These may include a certified copy of the death certificate, a petition for probate, and any relevant wills or trust documents. Additionally, the administrator may need to provide identification and proof of their relationship to the deceased. It is advisable to check with the local probate court for specific requirements, as they can vary by state. Having all necessary documentation prepared can help streamline the process and avoid delays in estate administration.

Examples of using the letter estate administrator

There are various scenarios in which the letter estate administrator is utilized. For instance, if a family member passes away and leaves behind a home, the appointed administrator will need the letter to sell the property or transfer ownership to heirs. Similarly, when dealing with financial accounts, banks will require the letter to allow the administrator access to the deceased's funds for settling debts or distributing assets. Understanding these practical applications can help the administrator navigate the responsibilities effectively and ensure compliance with legal obligations.

State-specific rules for the letter estate administrator

Each state has its own rules and regulations governing the use of the letter estate administrator. These rules may dictate the format of the letter, the required documentation, and the process for obtaining it. Some states may have specific forms that must be completed, while others may allow for more flexibility. It is important for administrators to familiarize themselves with their state's probate laws to ensure compliance and avoid potential legal issues. Consulting with a legal professional can also provide valuable guidance tailored to the specific jurisdiction.

Quick guide on how to complete letter estate administrator

Prepare Letter Estate Administrator effortlessly on any device

Web-based document management has become widely accepted by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Manage Letter Estate Administrator on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Letter Estate Administrator without hassle

- Find Letter Estate Administrator and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Letter Estate Administrator to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample credit form?

A sample credit form is a template that businesses can use to request credit information from potential clients or customers. This form helps streamline the credit application process and ensures that all necessary information is collected consistently. By using a sample credit form, companies can maintain professionalism and improve efficiency in their credit assessments.

-

How can I create a sample credit form using airSlate SignNow?

Creating a sample credit form with airSlate SignNow is easy and intuitive. You can use our drag-and-drop editor to customize your form, adding fields for personal information, credit history, and any other specifics you need. Once designed, you can instantly send the form for eSignature, making the process quick and efficient.

-

What are the benefits of using a sample credit form?

Using a sample credit form offers several benefits, including improved data accuracy, faster processing times, and enhanced organization. It allows you to collect all relevant credit-related information in a structured manner, reducing the chance of incomplete submissions. Moreover, it can help your business make informed credit decisions more efficiently.

-

Is there a cost associated with using the sample credit form on airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Creating and using a sample credit form is included in our plans, ensuring you have access to a cost-effective solution for document signing and management. You can choose a plan that best fits your budget and requirements.

-

Can I integrate the sample credit form with other software?

Yes, airSlate SignNow allows for seamless integration with multiple software applications, enhancing the functionality of your sample credit form. You can connect it to CRM systems, workflow automation tools, and other applications to streamline data collection and management. This integration ensures a smooth flow of information across your business processes.

-

What features does airSlate SignNow provide for sample credit forms?

airSlate SignNow provides features such as customizable templates, eSignature capability, form analytics, and secure storage. These features ensure that your sample credit form is not only easy to use but also complies with legal requirements. Additionally, you can track the status of sent forms for better management.

-

How secure is my sample credit form data with airSlate SignNow?

airSlate SignNow takes data security seriously and employs advanced encryption methods to protect your sample credit form information. We follow industry standards to ensure that all documents are stored securely, and access is limited to authorized users only. This commitment to security helps safeguard sensitive credit information.

Get more for Letter Estate Administrator

Find out other Letter Estate Administrator

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors