Unmarried File Form

What is the unmarried file?

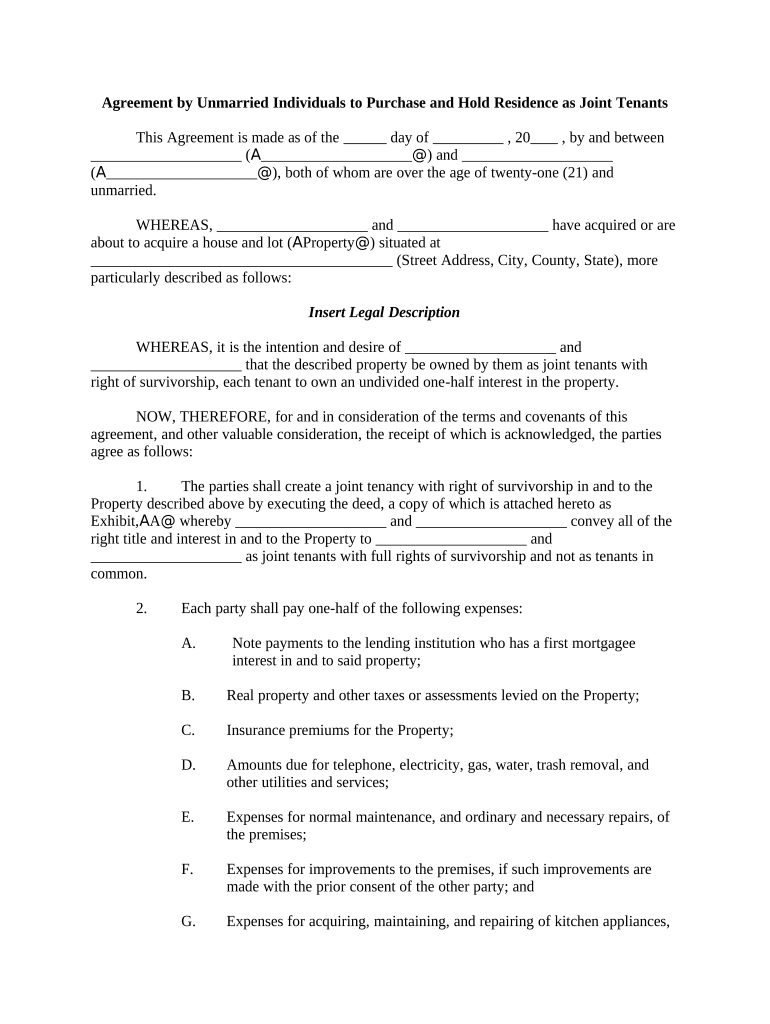

The unmarried file is a specific form used primarily in legal and tax contexts to declare an individual's unmarried status. This form is essential for various applications, including tax filings, legal documentation, and eligibility for certain benefits. Understanding the purpose and implications of this form is crucial for individuals who may need to assert their unmarried status for legal or financial reasons.

How to use the unmarried file

Using the unmarried file involves completing the form accurately and submitting it to the appropriate authority. Depending on the context, this may include tax agencies, legal entities, or other organizations requiring proof of marital status. It is important to follow the instructions provided with the form to ensure that all necessary information is included, which may include personal identification details and any relevant supporting documentation.

Steps to complete the unmarried file

Completing the unmarried file requires careful attention to detail. Here are the general steps to follow:

- Gather necessary personal information, such as your full name, address, and Social Security number.

- Review the form for specific instructions regarding any additional documentation required.

- Fill out the form completely, ensuring all sections are addressed.

- Sign and date the form where indicated.

- Submit the completed form according to the specified method, whether online, by mail, or in person.

Legal use of the unmarried file

The unmarried file serves a legal purpose by providing a formal declaration of an individual's unmarried status. This declaration can be critical in various legal situations, such as divorce proceedings, estate planning, or when applying for certain benefits. Ensuring that the form is filled out correctly and submitted to the right entity is essential for it to be considered valid and enforceable.

Key elements of the unmarried file

Key elements of the unmarried file typically include:

- Personal identification information, including name and address.

- Affirmation of unmarried status, often requiring a signature.

- Any applicable dates, such as the date of separation or other relevant timelines.

- Supporting documentation, if required, to validate the claim.

State-specific rules for the unmarried file

Each state may have unique regulations regarding the unmarried file. It is important to be aware of these rules, as they can affect the validity and acceptance of the form. Some states may require additional documentation or have specific submission processes. Checking with local authorities or legal resources can provide clarity on state-specific requirements.

Quick guide on how to complete unmarried file

Complete Unmarried File seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to acquire the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Unmarried File on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Unmarried File effortlessly

- Find Unmarried File and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Unmarried File and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the unmarried file and how does it work with airSlate SignNow?

The unmarried file refers to tax filing for individuals who are not married. With airSlate SignNow, you can easily sign and send all necessary documents related to your unmarried file, ensuring a smooth and efficient process. Our platform streamlines the document preparation and signing, making it ideal for individual tax filers.

-

How can airSlate SignNow help me manage my unmarried file documentation?

airSlate SignNow provides secure, easy-to-use features for managing your unmarried file documentation. You can upload, sign, and store important documents all in one place, eliminating the hassle of physical paperwork. This enhances your organization and saves time during tax season.

-

What are the pricing options for airSlate SignNow for individuals managing an unmarried file?

airSlate SignNow offers competitive pricing tailored to individual needs, including those managing an unmarried file. Our pricing plans are designed to be cost-effective, giving you access to all essential features at an affordable rate. You can select a plan that fits your budget and volume of documents.

-

Can airSlate SignNow integrate with other tools I use for my unmarried file?

Yes, airSlate SignNow easily integrates with various accounting and financial software that can assist with your unmarried file. This allows for seamless data transfer and document management, improving efficiency and reducing errors. You can use our integrations to simplify your document workflow.

-

What features does airSlate SignNow offer for editing my unmarried file documents?

airSlate SignNow offers a range of features for editing your unmarried file documents, such as adding text, dates, and signatures. You can also annotate documents and make real-time changes with ease. This flexibility ensures that your documents are accurate and ready for submission.

-

Is it secure to store my unmarried file documents with airSlate SignNow?

Absolutely. airSlate SignNow prioritizes the security of your unmarried file documents, using advanced encryption and secure cloud storage. You can trust that your sensitive information will remain confidential and safely protected against unauthorized access.

-

How does airSlate SignNow improve efficiency in managing my unmarried file?

airSlate SignNow improves efficiency by allowing you to sign and send documents online, signNowly reducing the time spent on paperwork for your unmarried file. Automatic notifications and reminders ensure you stay on track with deadlines. This leads to quicker processing and enhanced productivity.

Get more for Unmarried File

- Sworn affidavit b bbee qualifying small enterprise dti gov form

- 17000140 alabama department of revenue form

- Separator sheet 2014 form 432153451

- Child administration instructions eastconn eastconn form

- Gift basket order form whole foods market

- Ecers 3 materials checklist form

- Caring canine doctor dog therapy dog health screening form dgp toronto

- Homelessness prevention application lawrencedouglas county housing authority is this the right application for me ldcha form

Find out other Unmarried File

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer