Demand Bond Form

What is the Demand Bond Form

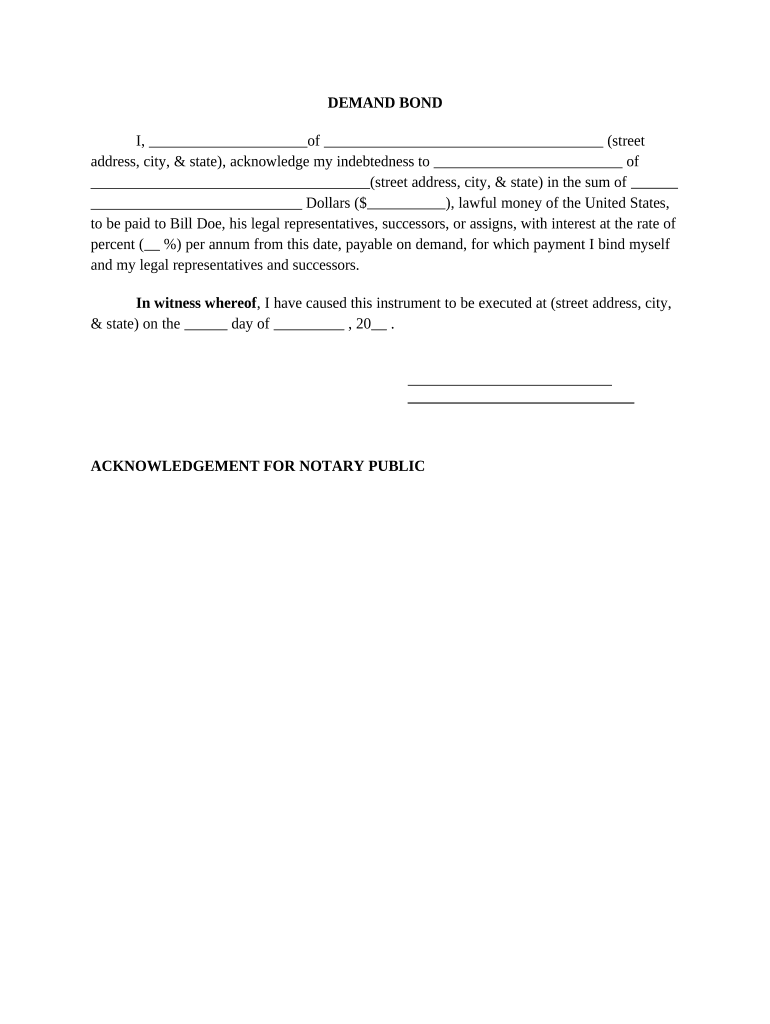

The demand bond form is a legal document that guarantees payment or performance under specific conditions. It serves as a promise from the issuer to fulfill obligations, often used in various business transactions. This form is essential in ensuring that parties meet their commitments, providing security and trust in contractual agreements.

How to use the Demand Bond Form

Using the demand bond form involves several straightforward steps. First, identify the parties involved in the agreement and clearly outline the obligations. Next, fill out the form with accurate information, including the amount of the bond and the conditions for its activation. Once completed, ensure that all parties sign the document to validate it. Finally, retain copies for your records and distribute them as necessary to involved parties.

Steps to complete the Demand Bond Form

Completing the demand bond form requires careful attention to detail. Follow these steps for accuracy:

- Gather necessary information about all parties involved.

- Clearly define the obligations and conditions of the bond.

- Fill out the form with the required details, ensuring clarity and precision.

- Obtain signatures from all relevant parties to formalize the agreement.

- Store the completed form securely for future reference.

Legal use of the Demand Bond Form

The legal use of the demand bond form is governed by specific regulations that vary by state. To ensure compliance, it is crucial to understand the legal framework surrounding the form. This includes adherence to local laws regarding bonding requirements and obligations. Utilizing a reliable digital signature platform can further enhance the legal validity of the document, ensuring that all signatures are authenticated and compliant with eSignature laws.

Key elements of the Demand Bond Form

Several key elements must be included in the demand bond form to ensure its effectiveness and legality. These elements include:

- The names and addresses of all parties involved.

- The specific obligations guaranteed by the bond.

- The amount of the bond and any conditions for its execution.

- Signatures of all parties, indicating their agreement to the terms.

- Date of execution to establish the timeline of the agreement.

State-specific rules for the Demand Bond Form

Each state in the U.S. may have unique requirements regarding the demand bond form. It is essential to research and understand these state-specific rules to ensure compliance. This may include variations in the language used, specific clauses that must be included, or additional documentation required alongside the bond. Consulting with a legal professional familiar with local regulations can provide valuable guidance.

Quick guide on how to complete demand bond form

Effortlessly Complete Demand Bond Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Demand Bond Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Demand Bond Form with Ease

- Acquire Demand Bond Form and click Obtain Form to begin.

- Utilize the tools available to fill out your document.

- Highlight pertinent sections of the documents or black out sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Complete button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Demand Bond Form and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is bond demand and how does it relate to airSlate SignNow?

Bond demand refers to the market's desire for bonds, which can influence financing options for businesses. airSlate SignNow offers a solution that can streamline document processes for businesses, helping them manage contracts related to bond demand more efficiently.

-

How does airSlate SignNow support the electronic signing of bond demand documents?

airSlate SignNow provides a secure platform for electronic signatures, making it easy for businesses to sign and send bond demand documents. This ensures compliance while also speeding up the process, which is crucial in meeting financial deadlines.

-

Can airSlate SignNow accommodate high-volume bond demand transactions?

Yes, airSlate SignNow is designed to handle high-volume transactions seamlessly. Its features allow businesses to manage multiple documents at once, making it ideal for companies dealing with signNow bond demand.

-

What pricing options does airSlate SignNow offer for businesses focusing on bond demand?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. Whether you are a small startup or a large enterprise handling bond demand, you can find a plan that suits your budget.

-

Are there specific features of airSlate SignNow that benefit bond demand processes?

Absolutely! airSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking, all of which can enhance the efficiency of managing bond demand documents. These tools help streamline processes and minimize errors.

-

How does airSlate SignNow integrate with other tools for managing bond demand?

airSlate SignNow offers integrations with popular applications such as CRM and accounting software. These integrations allow businesses to link their bond demand documentation with existing systems for improved efficiency and data management.

-

Is airSlate SignNow secure for handling sensitive bond demand documents?

Yes, airSlate SignNow employs advanced security measures to protect sensitive documents, including those related to bond demand. With encryption and compliance with regulations, your documents are kept safe and secure during the signing process.

Get more for Demand Bond Form

- Condominium registration application version 1 dpor virginia form

- Isutrecht bapplication formb primary years programme international

- Sign order form ibexshowcom

- Consent for treatment andor admission form

- Ao to fill serche warrant 2013 2019 form

- Australian guide to healthy eating form

- Form mrc s for serving employees rsintranet nic

- Form 2118

Find out other Demand Bond Form

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will