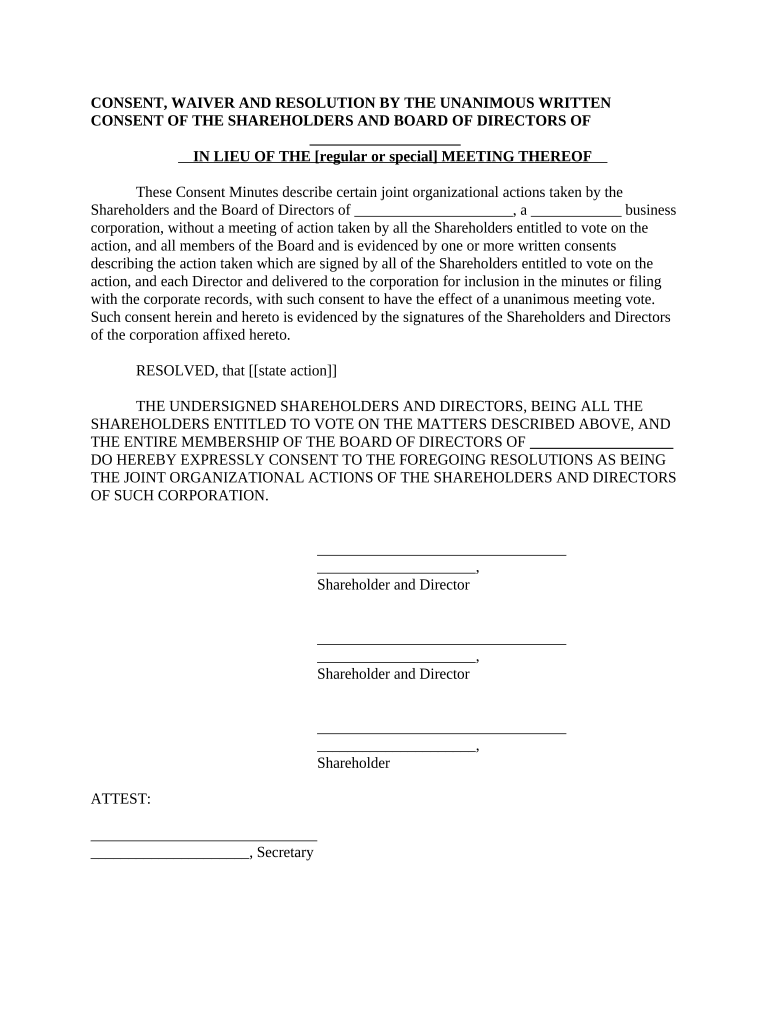

Corporation Form

What is the Corporation Form

The corporation form is a legal document used to establish a corporation as a recognized entity within the United States. This form outlines the fundamental details of the corporation, including its name, purpose, and structure. By filing this document, businesses can enjoy limited liability protection, allowing owners to separate personal assets from business liabilities. The corporation form is essential for compliance with state laws and regulations, ensuring that the business operates within the legal framework.

How to use the Corporation Form

Using the corporation form involves several steps to ensure proper completion and submission. First, gather all necessary information about the corporation, including its name, registered agent, and business address. Next, fill out the form accurately, ensuring that all details are correct and complete. Once the form is filled out, it must be signed by the incorporators. After signing, submit the form to the appropriate state agency, typically the Secretary of State, along with any required fees. Utilizing digital solutions can streamline this process, making it easier to complete and submit the form electronically.

Steps to complete the Corporation Form

Completing the corporation form requires careful attention to detail. Follow these steps for a smooth process:

- Research the specific requirements for your state, as regulations may vary.

- Choose a unique name for your corporation that complies with state naming rules.

- Designate a registered agent who will receive legal documents on behalf of the corporation.

- Provide the corporation's principal office address and any additional information required.

- Review the form for accuracy and completeness before submission.

Legal use of the Corporation Form

The legal use of the corporation form is critical for establishing a corporation in compliance with state laws. This form must be filed with the appropriate state agency to gain legal recognition. It serves as a public record of the corporation's existence and its adherence to regulatory requirements. Properly completing and filing the corporation form protects the owners from personal liability and ensures that the corporation can conduct business legally.

Required Documents

When filing the corporation form, certain documents are typically required to support the application. These may include:

- Articles of Incorporation, which detail the corporation's structure and purpose.

- Bylaws, which outline the rules for operating the corporation.

- Identification documents for the incorporators and registered agent.

- Payment for any filing fees associated with the submission.

Who Issues the Form

The corporation form is issued by the Secretary of State or a similar regulatory body in each state. This agency oversees the incorporation process and maintains records of all registered corporations. Each state has its own specific form, and it is essential to obtain the correct version based on the state where the corporation will be established. Understanding the issuing authority can help ensure compliance with local regulations.

Quick guide on how to complete corporation form 497328457

Effortlessly prepare Corporation Form on any device

The management of online documents has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can locate the suitable form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Handle Corporation Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

How to modify and electronically sign Corporation Form effortlessly

- Locate Corporation Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searches, or errors requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Corporation Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a corporation form and why is it important?

A corporation form is a legal document used to establish a corporation. It outlines essential details such as the corporation's name, registered agent, and purpose. This form is crucial as it helps businesses comply with state laws and maintain good standing.

-

How can airSlate SignNow assist in filling out a corporation form?

airSlate SignNow provides a user-friendly platform for electronically signing and completing your corporation form. With our digital tools, you can quickly gather information, ensure accuracy, and securely send the document. This streamlines the incorporation process and saves valuable time.

-

What are the costs associated with using airSlate SignNow for a corporation form?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. Our solutions are cost-effective, making it easy to manage your corporation form and other document needs without breaking the bank. Check our website for detailed pricing information.

-

Does airSlate SignNow provide any templates for a corporation form?

Yes, airSlate SignNow offers customizable templates for a corporation form. This feature allows you to start with a professional layout tailored for your needs, making it easier to fill in required details. Our templates help ensure you include all necessary information for smooth processing.

-

Can I integrate airSlate SignNow with other business tools for corporation form management?

Absolutely! airSlate SignNow seamlessly integrates with various business tools to streamline your corporation form management. Whether it's CRM systems, cloud storage solutions, or productivity apps, our integrations enhance collaboration and efficiency.

-

What benefits does airSlate SignNow offer for businesses filing a corporation form?

Using airSlate SignNow to file your corporation form offers numerous benefits, including faster document turnaround and enhanced security. Our platform allows for easy tracking of document status and real-time updates, ensuring that your incorporation process is efficient and transparent.

-

Is airSlate SignNow legally compliant for submitting a corporation form?

Yes, airSlate SignNow is designed to meet legal requirements for electronic signatures and document submissions, making it a trustworthy option for handling your corporation form. Our platform adheres to industry standards and regulations, ensuring your documents remain legally binding.

Get more for Corporation Form

- Correction form 2019

- State of tennessee alcoholic beverage commission davy crockett tower 500 james robertson parkway 3rd floor nashville tn 37243 form

- Ab 0017 tngov tn form

- Workers compensation exemption form michigan 2013 2019

- Cincinatti 2015 2019 form

- Arizona association of realtors pre qualification form fillable 2018 2019

- Louisiana residential agreement to buy or sell 2015 2017 2018 form

- Listing agreement standard form new orleans 2013 undersigned client 2016 2019

Find out other Corporation Form

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure