Transfer Stock Agreement Template Form

What is the Transfer Stock Agreement Template

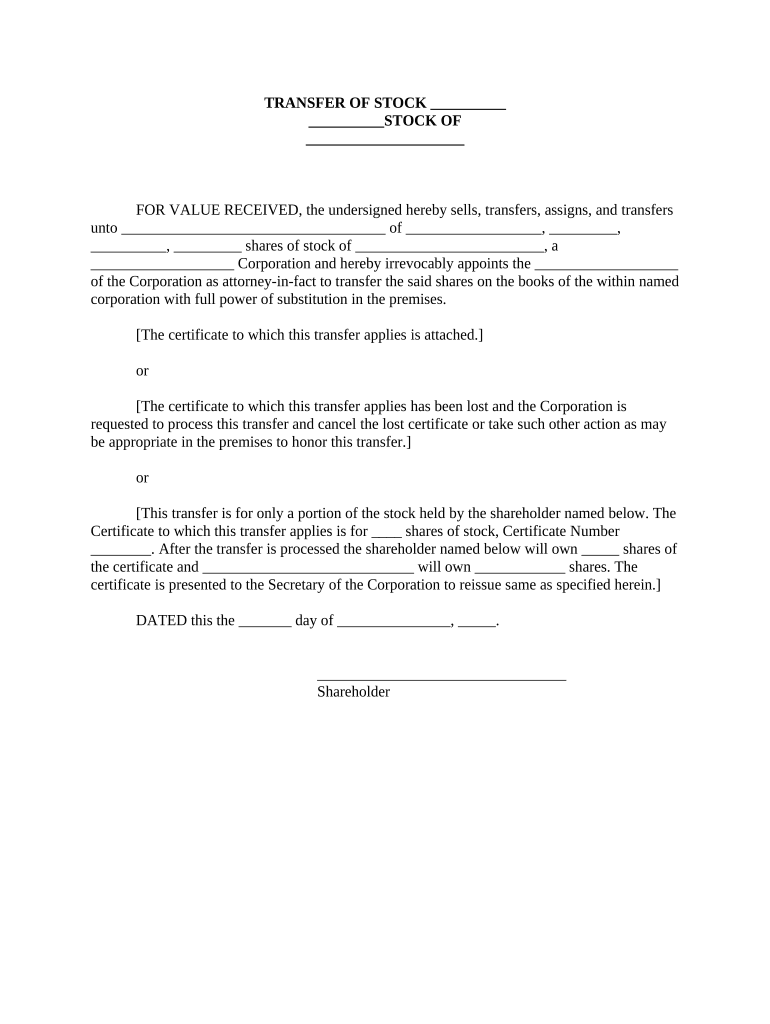

The transfer stock agreement template is a legal document used to facilitate the transfer of ownership of stock shares from one party to another. This template outlines the terms and conditions under which the transfer occurs, ensuring that both the seller and buyer understand their rights and obligations. It typically includes essential details such as the names of the parties involved, the number of shares being transferred, and any payment terms associated with the transaction. By using a standardized template, parties can ensure compliance with legal requirements and reduce the risk of misunderstandings during the transfer process.

How to Use the Transfer Stock Agreement Template

Using the transfer stock agreement template involves several straightforward steps. First, gather all necessary information about the transaction, including the names and addresses of the parties, the number of shares being transferred, and the agreed-upon price. Next, fill out the template with this information, ensuring accuracy and clarity. After completing the document, both parties should review it to confirm that all details are correct. Once agreed upon, both parties can sign the document, either in person or electronically, to finalize the transfer. Utilizing a trusted eSignature platform can help streamline this process and ensure the document is legally binding.

Steps to Complete the Transfer Stock Agreement Template

Completing the transfer stock agreement template involves a series of clear steps:

- Gather Information: Collect all necessary details regarding the parties involved and the stock being transferred.

- Fill Out the Template: Input the required information into the template, ensuring all fields are accurately completed.

- Review the Document: Both parties should carefully review the completed agreement to ensure accuracy and mutual understanding.

- Sign the Agreement: Both parties can sign the document, either physically or using an electronic signature tool.

- Retain Copies: Each party should keep a signed copy of the agreement for their records.

Key Elements of the Transfer Stock Agreement Template

Several key elements are essential for the effectiveness of a transfer stock agreement template. These include:

- Parties Involved: Clearly identify the seller and buyer, including their legal names and contact information.

- Stock Details: Specify the type and number of shares being transferred, along with any relevant stock certificate numbers.

- Purchase Price: State the agreed-upon price for the shares and the payment method.

- Effective Date: Indicate the date on which the transfer will take effect.

- Signatures: Include spaces for both parties to sign, affirming their agreement to the terms outlined in the document.

Legal Use of the Transfer Stock Agreement Template

The legal use of the transfer stock agreement template is crucial for ensuring that the transfer of shares is recognized by governing bodies and protects the interests of both parties. To be legally binding, the agreement must meet specific criteria, including clear identification of the parties, explicit terms of the transfer, and proper execution through signatures. Additionally, compliance with relevant laws, such as state securities regulations, is essential. Utilizing a reputable eSignature service can further enhance the document's legal standing by providing a digital certificate and maintaining an audit trail of the signing process.

Examples of Using the Transfer Stock Agreement Template

There are various scenarios in which a transfer stock agreement template can be utilized effectively. For instance:

- Private Sales: When an individual sells shares of a privately held corporation to another individual.

- Corporate Transactions: In mergers or acquisitions, where shares are transferred between companies.

- Gift Transfers: When stock shares are gifted to family members or friends, a transfer stock agreement can clarify the terms.

These examples illustrate the versatility of the template in different contexts, ensuring that all parties are protected and informed during the transfer process.

Quick guide on how to complete transfer stock agreement template

Effortlessly Prepare Transfer Stock Agreement Template on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle Transfer Stock Agreement Template on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Transfer Stock Agreement Template

- Find Transfer Stock Agreement Template and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that task.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Transfer Stock Agreement Template and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a transfer stock agreement template?

A transfer stock agreement template is a legal document designed to facilitate the sale or transfer of stock between parties. It outlines the terms and conditions of the transfer, including the number of shares, pricing, and parties involved. Using airSlate SignNow's user-friendly platform, you can easily customize and eSign this document.

-

How do I create a transfer stock agreement template with airSlate SignNow?

Creating a transfer stock agreement template with airSlate SignNow is straightforward. Start by selecting a pre-existing template or create your own from scratch. Our platform provides user-friendly tools to add fields and customize content, making it easy to tailor the agreement to your specific needs.

-

Is the transfer stock agreement template legally binding?

Yes, a transfer stock agreement template created and signed through airSlate SignNow is legally binding, provided it meets state and federal legal requirements. Our eSigning features ensure compliance with eSignature laws, granting you peace of mind during your stock transfer transactions.

-

What features does airSlate SignNow offer for the transfer stock agreement template?

airSlate SignNow offers various features to enhance your transfer stock agreement template experience. You can easily collaborate with stakeholders, track document status, and set reminders for signing deadlines. Additionally, our secure cloud storage ensures your agreements are safe and accessible whenever you need them.

-

What are the benefits of using airSlate SignNow for a transfer stock agreement template?

Using airSlate SignNow for your transfer stock agreement template offers numerous benefits, including time-saving electronic signatures, simplified document management, and enhanced security. Our cost-effective solution also allows for seamless communication among parties, helping to expedite the transfer process.

-

Can I integrate airSlate SignNow with other software for my transfer stock agreement template?

Absolutely! airSlate SignNow provides various integrations with popular software applications, making it easy to incorporate your transfer stock agreement template into your existing workflows. Whether you use CRM, accounting, or project management tools, integration is seamless and boosts overall efficiency.

-

What is the pricing model for airSlate SignNow when using a transfer stock agreement template?

airSlate SignNow offers flexible pricing plans to accommodate businesses of various sizes using the transfer stock agreement template. You can choose from a free trial or several subscription options that include advanced features, ensuring you find a plan that fits your budget and requirements.

Get more for Transfer Stock Agreement Template

Find out other Transfer Stock Agreement Template

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online