Promissory Note Form

What is the Promissory Note Form

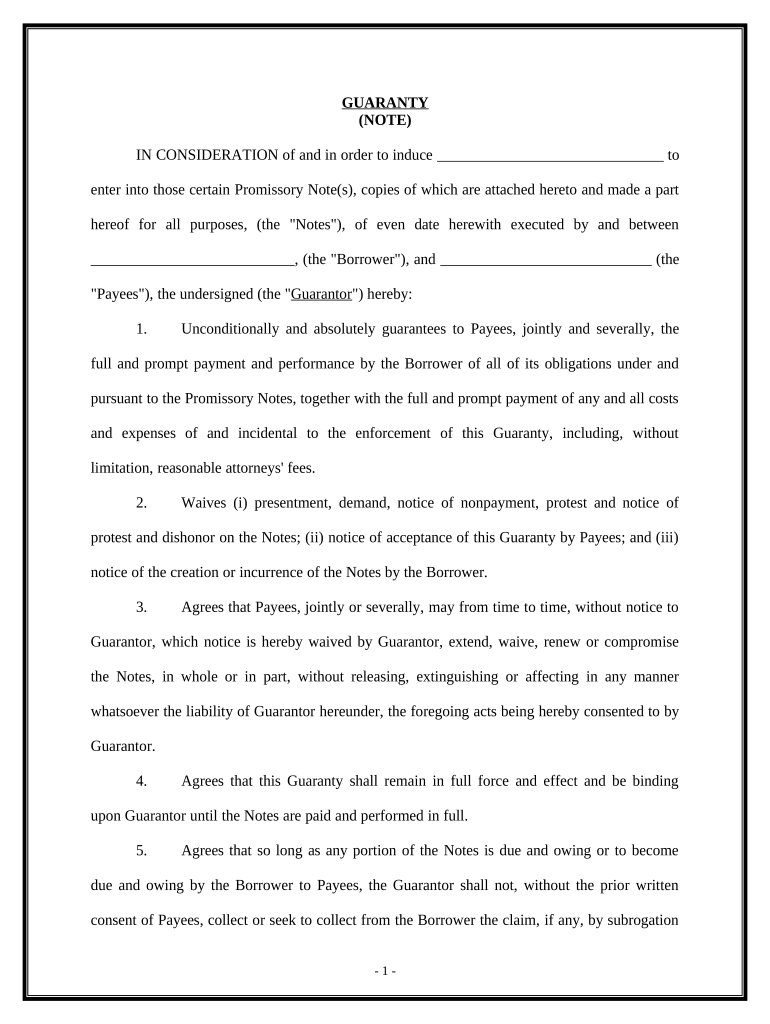

The promissory note form is a legal document that outlines a borrower's promise to repay a specified sum of money to a lender under agreed terms. This form includes essential details such as the loan amount, interest rate, repayment schedule, and the consequences of default. It serves as a binding contract between the individual borrower and the lender, ensuring that both parties understand their rights and obligations. The promissory note can be used in various scenarios, including personal loans, business financing, and real estate transactions.

Key elements of the Promissory Note Form

When completing a promissory note form, several key elements must be included to ensure its validity:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: Schedule detailing how and when payments will be made.

- Default Clauses: Conditions under which the borrower may default and the lender's rights in such cases.

- Signatures: Signatures of both parties to validate the agreement.

Steps to complete the Promissory Note Form

Completing a promissory note form involves several straightforward steps:

- Gather Information: Collect all necessary details about the borrower, lender, and loan specifics.

- Choose a Template: Select a reliable template that meets your needs.

- Fill in the Details: Accurately input all required information, ensuring clarity and correctness.

- Review the Document: Carefully check for any errors or omissions.

- Sign the Document: Both parties should sign the note to make it legally binding.

- Distribute Copies: Provide copies to both the borrower and lender for their records.

Legal use of the Promissory Note Form

The legal use of a promissory note form hinges on its compliance with state and federal regulations. It must clearly outline the terms of the loan and be signed by both parties. In the United States, promissory notes are governed by the Uniform Commercial Code (UCC), which provides guidelines for enforceability. Properly executed promissory notes can be used in court to enforce repayment, making it crucial for both parties to understand their rights and obligations under the agreement.

How to obtain the Promissory Note Form

Obtaining a promissory note form is a straightforward process. Individuals can find templates online through legal document services or financial institutions. Many state government websites also provide standardized forms that comply with local laws. It is advisable to choose a template that aligns with the specific requirements of the loan agreement to ensure that all necessary legal elements are included.

Digital vs. Paper Version

Both digital and paper versions of the promissory note form have their advantages. Digital forms offer convenience, allowing for easy editing and sharing, while paper forms may be preferred for traditional transactions. Regardless of the format, it is essential to ensure that the document is signed and dated properly. Digital signatures, when executed through compliant platforms, can provide the same legal standing as handwritten signatures, making them a viable option for modern transactions.

Quick guide on how to complete promissory note form 497328565

Complete Promissory Note Form effortlessly on any device

Virtual document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to acquire the necessary form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your files rapidly without delays. Handle Promissory Note Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and eSign Promissory Note Form without any hassle

- Locate Promissory Note Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specially provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or a sharing link, or download it to your computer.

No more lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Promissory Note Form and ensure stellar communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What advantages does airSlate SignNow offer to an individual borrower?

airSlate SignNow provides individual borrowers with a streamlined solution for sending and signing documents electronically. This service enhances efficiency by reducing the time spent on paperwork, allowing borrowers to focus on their financial goals. Additionally, our platform ensures security and convenience, making it easier for borrowers to manage their documents digitally.

-

How does airSlate SignNow ensure the security of documents for an individual borrower?

Security is a top priority for airSlate SignNow, especially for individual borrowers. Our platform employs advanced encryption technology and secure cloud storage to protect sensitive information throughout the signing process. As an individual borrower, you can trust that your data remains confidential and secure.

-

What is the pricing structure for individual borrowers using airSlate SignNow?

airSlate SignNow offers competitive pricing tailored to the needs of individual borrowers. You can choose from various subscription plans that provide flexibility based on your document signing frequency. This cost-effective solution ensures that individual borrowers can access essential features without breaking the bank.

-

Can individual borrowers integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows individual borrowers to seamlessly integrate with a variety of applications, enhancing usability. This capability enables you to connect your signing processes with popular tools like Google Drive, Dropbox, and CRM systems. These integrations help individual borrowers streamline their workflow and improve overall productivity.

-

What features does airSlate SignNow offer to benefit individual borrowers?

airSlate SignNow offers a range of features specifically designed to benefit individual borrowers, including customizable templates and in-app collaboration. These tools empower borrowers to simplify document creation and speed up the signing process. Moreover, features like mobile signing ensure that individual borrowers can manage their documents anytime, anywhere.

-

Is it easy for individual borrowers to get started with airSlate SignNow?

Absolutely! airSlate SignNow provides individual borrowers with a user-friendly interface that simplifies the onboarding process. With straightforward instructions and resources, borrowers can quickly create an account, upload their documents, and start eSigning with minimal hassle. Our goal is to ensure that individual borrowers can begin using our platform with confidence.

-

How does airSlate SignNow enhance the document tracking experience for individual borrowers?

airSlate SignNow offers robust document tracking features that cater to individual borrowers' needs. You can monitor the status of your documents in real time, receiving notifications when they are viewed or signed. This transparency allows individual borrowers to stay informed and manage their important transactions effectively.

Get more for Promissory Note Form

Find out other Promissory Note Form

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later