Guaranty Promissory Note Form

What is the guaranty promissory note

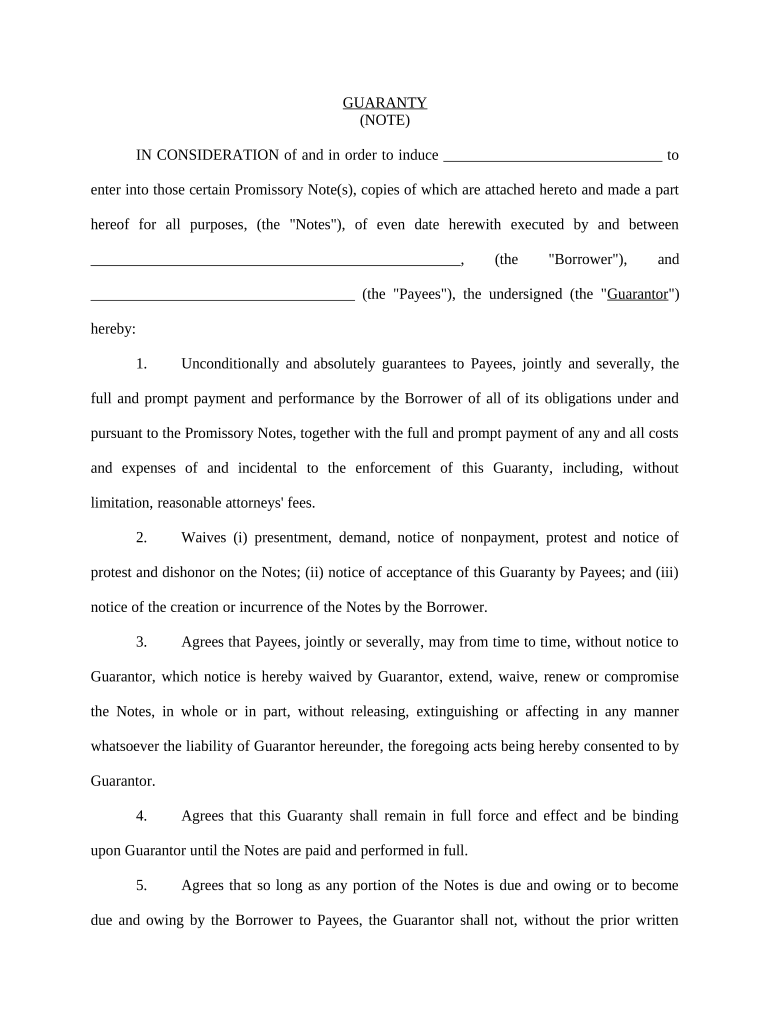

A guaranty promissory note is a legally binding document that outlines a borrower's promise to repay a loan, with an additional guarantor who agrees to fulfill the obligation if the borrower defaults. This type of note provides extra security for lenders, ensuring that they have recourse to a second party if the primary borrower fails to meet their repayment terms. The document typically includes details such as the loan amount, interest rate, repayment schedule, and the obligations of both the borrower and the guarantor.

Key elements of the guaranty promissory note

Understanding the key elements of a guaranty promissory note is essential for both borrowers and guarantors. Important components include:

- Borrower Information: The name and contact details of the individual or entity borrowing the funds.

- Guarantor Information: The name and contact details of the person or entity guaranteeing the loan.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the borrowed amount, which may be fixed or variable.

- Repayment Terms: The schedule outlining when payments are due, including any grace periods.

- Default Clauses: Conditions under which the borrower is considered in default and the rights of the lender in such cases.

Steps to complete the guaranty promissory note

Completing a guaranty promissory note involves several key steps to ensure its validity and enforceability:

- Gather necessary information about the borrower and guarantor, including names, addresses, and contact details.

- Determine the loan amount and interest rate, ensuring both parties agree on these terms.

- Outline the repayment schedule, specifying due dates and any applicable grace periods.

- Include default clauses to protect the lender's interests in case of non-payment.

- Review the document for accuracy and completeness before signing.

- Have both the borrower and guarantor sign the note in the presence of a witness or notary, if required by state law.

Legal use of the guaranty promissory note

The legal use of a guaranty promissory note is governed by state laws and regulations. To ensure that the document is enforceable, it must meet specific legal requirements, including:

- Clear identification of all parties involved.

- A detailed description of the loan terms.

- Proper signatures from both the borrower and guarantor.

- Compliance with applicable state and federal laws regarding lending and borrowing.

It is advisable to consult with a legal professional to ensure that the note adheres to relevant laws and protects the interests of all parties involved.

How to use the guaranty promissory note

Using a guaranty promissory note effectively involves understanding its purpose and ensuring proper execution. The note serves as a formal agreement between the borrower and lender, with the guarantor providing additional security. To use the note:

- Present the completed note to the lender as part of the loan application process.

- Ensure that both the borrower and guarantor understand their obligations as outlined in the document.

- Keep a copy of the signed note for personal records, as it may be required for future reference or in case of disputes.

Examples of using the guaranty promissory note

Guaranty promissory notes are commonly used in various scenarios, including:

- A parent guarantees a loan for their child to purchase a car.

- A business owner secures a loan for expansion with a personal guarantor.

- A friend agrees to guarantee a loan for another friend starting a small business.

These examples illustrate how guaranty promissory notes can provide security for lenders while assisting borrowers in obtaining necessary funds.

Quick guide on how to complete guaranty promissory note

Complete Guaranty Promissory Note effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents rapidly without any delays. Manage Guaranty Promissory Note on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to alter and eSign Guaranty Promissory Note with minimal effort

- Obtain Guaranty Promissory Note and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred gadget. Edit and eSign Guaranty Promissory Note and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a guaranty promissory note?

A guaranty promissory note is a legal document that ensures that one party will repay a loan or debt in case the primary borrower defaults. This instrument is essential for lenders to minimize risk, as it provides an additional layer of security. Understanding this note is vital for businesses seeking to expand their financing options.

-

How can airSlate SignNow help with guaranty promissory notes?

airSlate SignNow simplifies the process of creating and signing guaranty promissory notes. With its user-friendly interface, you can easily generate legally binding documents and collect digital signatures securely. This streamlines your workflow and helps ensure smooth transactions.

-

What are the costs associated with using airSlate SignNow for guaranty promissory notes?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing guaranty promissory notes. We offer several tiers tailored to different business needs, ensuring you get the best value for your documentation and eSignature requirements. Always check our website for the latest pricing updates.

-

Are there any features specific to guaranty promissory notes in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to enhance the creation and management of guaranty promissory notes. You can customize templates, automate workflows, and track document status in real-time. These features ensure that your guaranty promissory note process is efficient and organized.

-

What benefits does using airSlate SignNow provide for guaranty promissory notes?

Using airSlate SignNow for your guaranty promissory notes allows for faster processing, increased security, and improved compliance. With digital signatures, you expedite your transaction times, while providing both parties with the security of a legally binding agreement. This enhances trust and efficiency in your business dealings.

-

Can I integrate airSlate SignNow with other applications for managing guaranty promissory notes?

Absolutely! airSlate SignNow supports integrations with a variety of applications to enhance your document management process, including CRM systems and cloud storage services. This flexibility allows you to easily incorporate your guaranty promissory notes into your existing workflows and systems.

-

What security measures does airSlate SignNow offer for guaranty promissory notes?

airSlate SignNow implements robust security measures to protect your guaranty promissory notes. Features include encryption, secure cloud storage, and compliance with industry standards to ensure your sensitive information remains confidential. We prioritize safeguarding your documents and data at all times.

Get more for Guaranty Promissory Note

- Alaska property disclosure wasilla real estate news valley form

- Alaska rental agreement formsak lease templates

- Azcentralcom and the arizona republic phoenix and arizona form

- Free arizona standard residential lease agreement template form

- Home inspection waiver form

- Roommate rental agreement template get free sample form

- Al owner finance land sale contract form

- Seller information sheet

Find out other Guaranty Promissory Note

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now