Terminate Corporation Form

What is the Terminate Corporation

The term "terminate corporation" refers to the formal process of dissolving an S corporation, which is a specific type of business entity in the United States. This process involves legally ceasing the corporation's operations and ensuring that all obligations, such as debts and taxes, are settled. Terminating an S corporation may arise from various reasons, including changes in business strategy, financial difficulties, or the owners' decision to pursue other ventures. Understanding the implications of this process is crucial, as it affects the corporation's legal status and the personal liability of its shareholders.

Steps to Complete the Terminate Corporation

Completing the termination of an S corporation involves several key steps to ensure compliance with state and federal regulations. The following steps outline the general process:

- Board Resolution: The board of directors must adopt a resolution to dissolve the corporation, which typically requires a majority vote.

- Shareholder Approval: Following the board resolution, shareholders must approve the dissolution, often requiring a formal meeting and vote.

- Filing Articles of Dissolution: Submit the Articles of Dissolution to the appropriate state agency, which officially terminates the corporation's existence.

- Settling Debts and Obligations: Ensure all outstanding debts, taxes, and obligations are paid. This step is essential to avoid personal liability for shareholders.

- Final Tax Returns: File final tax returns with the IRS and state tax authorities, indicating that the corporation has ceased operations.

Legal Use of the Terminate Corporation

The legal use of terminating an S corporation involves adhering to specific laws and regulations that govern corporate dissolution. Each state has its own requirements, which may include filing specific forms and notifying creditors. It is essential to comply with these legal obligations to prevent potential liabilities for the shareholders. Additionally, maintaining accurate records throughout the process is crucial, as these documents may be necessary for future reference or legal inquiries.

Required Documents

To successfully terminate an S corporation, several documents are typically required. These may include:

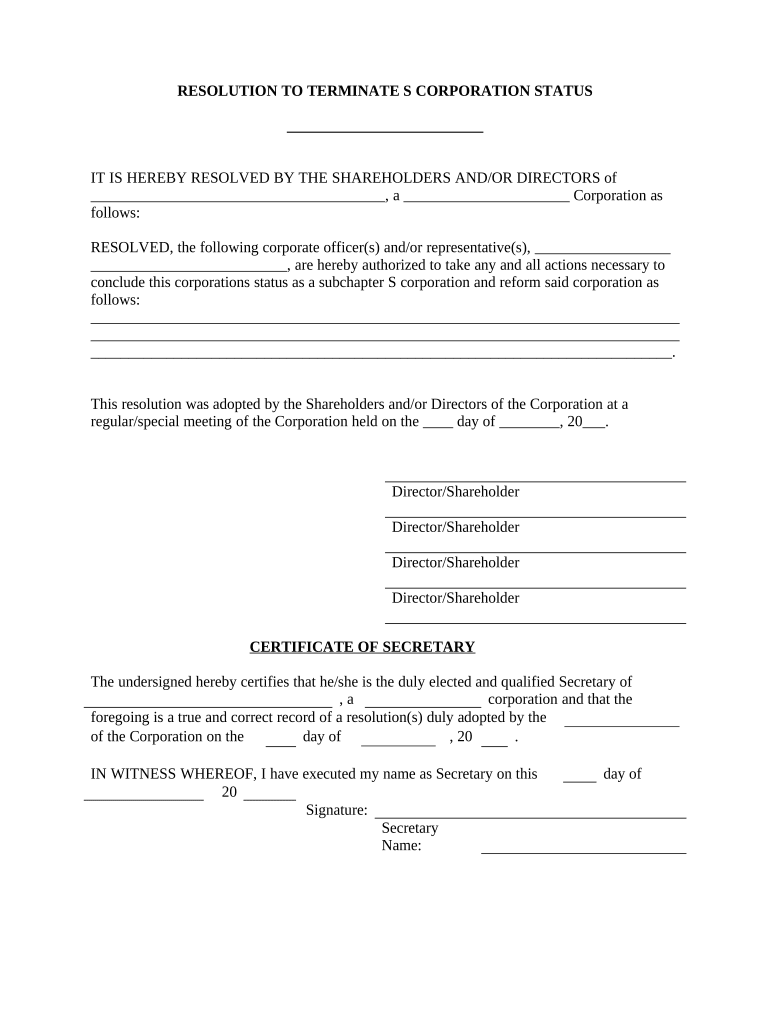

- Board Resolution: A formal document that outlines the decision to dissolve the corporation.

- Shareholder Approval Records: Documentation of the vote taken by shareholders to approve the dissolution.

- Articles of Dissolution: The official form filed with the state to legally dissolve the corporation.

- Final Tax Returns: Copies of the final federal and state tax returns submitted to tax authorities.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when terminating an S corporation. Generally, the Articles of Dissolution should be filed promptly after shareholder approval to avoid penalties. Additionally, final tax returns must be submitted by the due date, which is typically the same as the corporation's usual tax filing deadline. Failure to meet these deadlines can result in fines or complications in the dissolution process.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for terminating an S corporation. These guidelines include requirements for filing final tax returns and how to report the dissolution on tax forms. It is essential to follow these guidelines carefully to ensure compliance and avoid any potential tax liabilities. Consulting a tax professional may also be beneficial to navigate the complexities of the tax implications associated with terminating an S corporation.

Quick guide on how to complete terminate corporation

Complete Terminate Corporation effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as a flawless eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Terminate Corporation on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Terminate Corporation effortlessly

- Obtain Terminate Corporation and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Terminate Corporation and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to terminate an S corporation?

To terminate an S corporation means to end its status as an S corporation, usually by withdrawing the election made with the IRS. This process involves filing specific forms to notify the IRS and may have tax implications. Understanding how to effectively terminate an S corporation is vital for avoiding penalties and maintaining compliance.

-

What are the steps to terminate an S corporation?

To terminate an S corporation, you first need to get consent from shareholders owning more than 50% of the shares. Then, you can file IRS Form 8832 to change the entity's classification. Additionally, informing state authorities and managing any outstanding taxes will help you successfully terminate an S corporation.

-

What are the tax implications when you terminate an S corporation?

When you terminate an S corporation, it can lead to different tax implications, including the potential need to pay corporate taxes. Any unrealized income can be recognized in the year of termination. Consulting with a tax professional can help you navigate the complexities of taxes upon deciding to terminate an S corporation.

-

How can airSlate SignNow help in the process of terminating an S corporation?

AirSlate SignNow offers businesses the ability to send, sign, and manage termination documents digitally. This streamlines the process of terminating an S corporation by making it easy to obtain necessary signatures on forms like IRS Form 8832. Using airSlate SignNow can save both time and resources during this crucial transition.

-

Is there a cost associated with terminating an S corporation?

Yes, there may be costs associated with terminating an S corporation, including potential fees for filing taxes and legal assistance. Additionally, using services like airSlate SignNow may incur costs for document preparation and electronic signatures. It’s important to weigh these costs against the benefits of ensuring a smooth termination process.

-

What features does airSlate SignNow provide for business document management?

AirSlate SignNow offers features such as e-signature capabilities, document templates, and the ability to track document status. These features make it simpler to handle necessary documentation related to terminating an S corporation. By utilizing these tools, businesses can ensure a more efficient process and better document organization.

-

Can I integrate airSlate SignNow with other tools for managing my S corporation termination?

Yes, airSlate SignNow allows integration with various business tools to streamline your workflow. Whether it’s CRM systems or accounting software, these integrations can help facilitate the documentation needed to terminate an S corporation efficiently. This flexibility enhances productivity and ensures all your business processes are connected.

Get more for Terminate Corporation

- Real estate disclosure form 2011

- New hampshire residential real estate sales disclosure statement form

- New hampshire security deposit receipt formdocx

- Rfta packet form

- Nevada regional housing authority rfta 2010 form

- Rfta housing application for reno nv form

- Rfta packet las vegas 2013 form

- New jersey residential lease agreement form

Find out other Terminate Corporation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word