Living Trust Revocable Form

What is the Living Trust Revocable

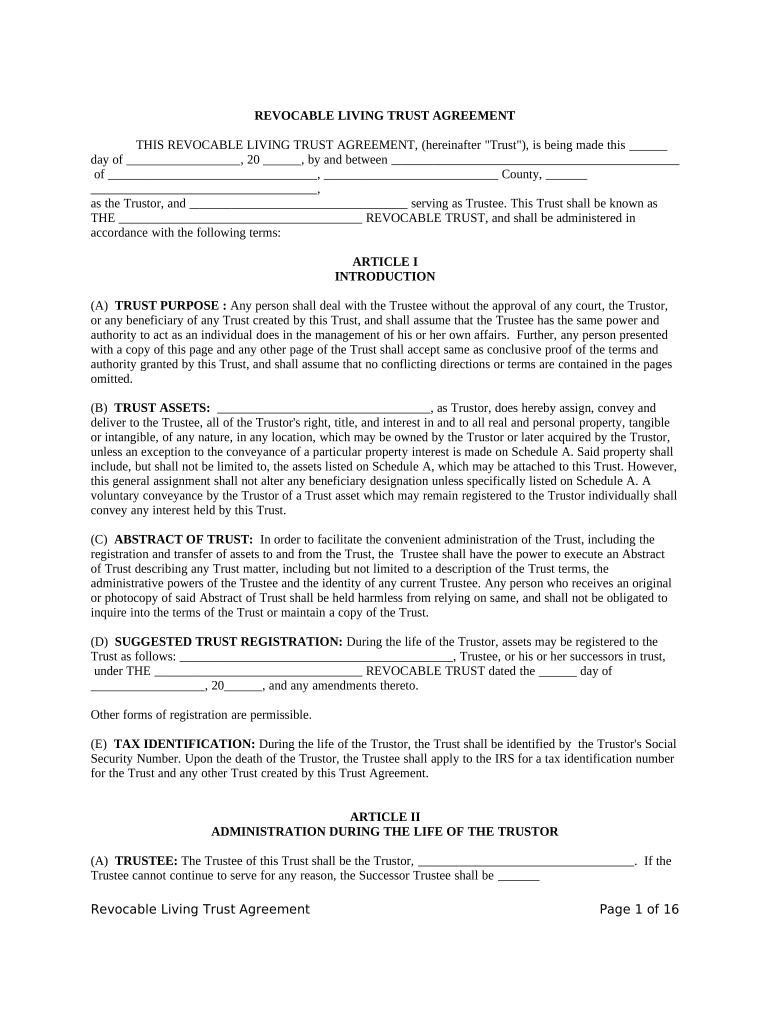

A living trust revocable is a legal document that allows individuals to place their assets into a trust during their lifetime. This type of trust can be altered or revoked at any time while the grantor is alive, providing flexibility and control over asset management. The primary purpose of a living trust revocable is to facilitate the transfer of assets upon the grantor's death, avoiding the lengthy and often costly probate process. It can include various assets, such as real estate, bank accounts, and personal property, making it a versatile estate planning tool.

How to Use the Living Trust Revocable

Using a living trust revocable involves several key steps. First, the grantor must create the trust document, which outlines the terms and conditions of the trust, including the designation of a trustee and beneficiaries. Next, the grantor transfers ownership of assets into the trust, which may require changing titles or account names. It is essential to keep the trust updated by adding or removing assets as needed. The grantor retains the right to manage the trust and can make changes or revoke it entirely at any time during their lifetime.

Steps to Complete the Living Trust Revocable

Completing a living trust revocable requires careful attention to detail. Here are the essential steps:

- Draft the trust document, including all necessary provisions.

- Choose a reliable trustee, who can be the grantor or another trusted individual.

- Transfer assets into the trust, ensuring proper documentation for each asset.

- Review and update the trust periodically to reflect changes in circumstances or wishes.

- Inform beneficiaries about the existence of the trust and its terms.

Legal Use of the Living Trust Revocable

The legal use of a living trust revocable is recognized across the United States, providing a valid means of estate planning. It allows the grantor to maintain control over their assets while ensuring a smooth transition to beneficiaries after death. The trust must comply with state laws, which may vary regarding the requirements for creation and execution. It is advisable to consult with a legal professional to ensure that the trust meets all legal standards and effectively serves its intended purpose.

Key Elements of the Living Trust Revocable

Several key elements define a living trust revocable:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets and ensuring the terms are followed.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Terms of the Trust: Specific instructions on how the assets should be managed and distributed.

State-Specific Rules for the Living Trust Revocable

State-specific rules govern the creation and management of living trusts revocable. These rules can affect how the trust is structured, the formalities required for execution, and the tax implications. Some states may have specific requirements for notarization or witnessing the trust document. It is crucial for individuals to understand their state’s regulations to ensure compliance and avoid potential legal issues. Consulting a local attorney experienced in estate planning can provide valuable insights into these state-specific rules.

Quick guide on how to complete living trust revocable

Complete Living Trust Revocable easily on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, adjust, and eSign your paperwork swiftly without delays. Manage Living Trust Revocable on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Living Trust Revocable effortlessly

- Locate Living Trust Revocable and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Adjust and eSign Living Trust Revocable and ensure optimal communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust revocable?

A living trust revocable is a legal document that allows you to manage your assets during your lifetime and specify the distribution of those assets after you pass away. This type of trust can be altered or revoked at any time, making it a flexible estate planning tool. By establishing a living trust revocable, you can avoid probate and ensure a smoother transition of your assets to beneficiaries.

-

How does a living trust revocable work?

A living trust revocable works by transferring ownership of your assets into the trust while you are still alive. You retain full control over these assets, allowing you to manage or alter the trust as needed. After your death, the trust assets are distributed to your beneficiaries according to your specified instructions, bypassing probate.

-

What are the benefits of using a living trust revocable?

The benefits of using a living trust revocable include avoiding probate, ensuring privacy of your estate, and allowing flexibility in managing your assets. Additionally, a living trust revocable can help facilitate the management of your assets in case you become incapacitated. Overall, it provides a streamlined way to handle estate planning.

-

What is the cost of setting up a living trust revocable?

The cost of setting up a living trust revocable can vary depending on factors such as complexity and attorney fees. Generally, you can expect to spend between $1,000 and $3,000 for professional assistance in creating a comprehensive trust. However, airSlate SignNow offers affordable solutions to help you create and manage your living trust revocable efficiently.

-

Can I change a living trust revocable after it is created?

Yes, one of the key features of a living trust revocable is its flexibility. You can make changes or revoke the trust at any time while you are alive, provided you are mentally competent. This adaptability allows you to update your trust according to changes in your financial situation or personal life.

-

Does a living trust revocable provide asset protection?

A living trust revocable does not provide asset protection from creditors, as you still retain control over the assets. However, it can help simplify the distribution of your estate and protect your loved ones from the lengthy probate process. For stronger asset protection, consider discussing additional legal strategies with a qualified estate planning attorney.

-

How do I integrate airSlate SignNow with a living trust revocable?

Integrating airSlate SignNow with your living trust revocable is a seamless process, enabling you to eSign and manage trust-related documents online. Once you create your living trust revocable via our platform, you can easily send, sign, and store all necessary documents in one secure location. This ensures you have everything organized and accessible when needed.

Get more for Living Trust Revocable

- Disaster recovery plan examples template form

- Csep bakersfield form

- Acvf form

- Family and medical leave request form the university of

- San jac transcript request form

- Scholarship disbursement form

- Paid medical director of surgical services agreement and duties form

- Chemistry 3331 olafs daugulis olafs chem uh form

Find out other Living Trust Revocable

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile