Royalty Form

What is the Royalty Form

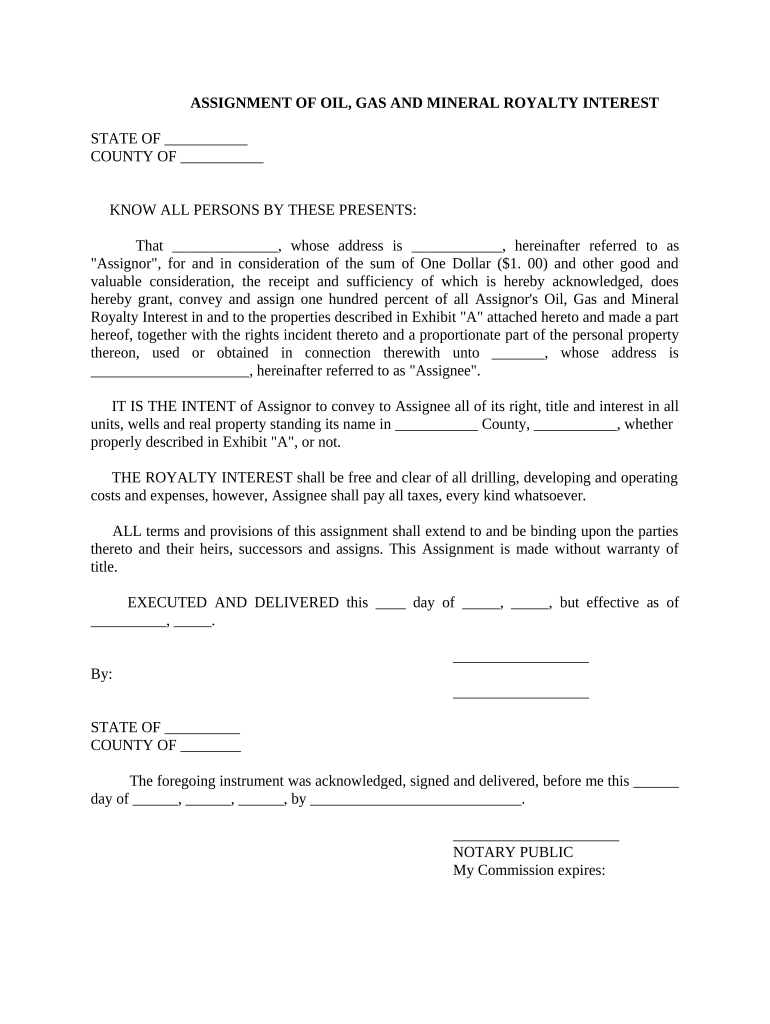

The royalty form is a legal document used to report and manage the distribution of royalties, typically related to mineral rights, oil, and gas production. This form serves as a record of the agreement between the parties involved, detailing how royalties will be calculated and distributed. It is crucial for ensuring that all parties understand their rights and obligations regarding the royalties generated from the extraction of natural resources.

How to use the Royalty Form

Using the royalty form involves several key steps. First, gather all necessary information about the property and the parties involved. This may include details about the mineral rights, ownership percentages, and any relevant agreements. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled, it should be reviewed for accuracy before being signed by all parties. Finally, submit the completed form to the appropriate authority or organization that manages the royalties.

Steps to complete the Royalty Form

Completing the royalty form requires attention to detail. Follow these steps to ensure accuracy:

- Gather essential documents, including property deeds and previous royalty agreements.

- Fill in the property details, including location and ownership information.

- Specify the percentage of royalties each party is entitled to receive.

- Include any additional terms or conditions related to the royalty distribution.

- Review the form for completeness and accuracy.

- Obtain signatures from all involved parties to validate the agreement.

- Submit the form to the appropriate entity for processing.

Legal use of the Royalty Form

The legal use of the royalty form is governed by various laws and regulations that ensure its enforceability. To be considered legally binding, the form must comply with federal and state laws, including those related to contract formation and property rights. It is essential that all parties involved fully understand the terms outlined in the form, as any discrepancies may lead to disputes or legal challenges. Proper execution and adherence to legal standards are crucial for the form's validity.

Key elements of the Royalty Form

Several key elements must be included in the royalty form to ensure its effectiveness and legality:

- Parties Involved: Clearly identify all parties who will receive royalties.

- Property Description: Provide a detailed description of the property associated with the royalties.

- Royalty Percentage: Specify the percentage of royalties each party will receive.

- Payment Terms: Outline how and when payments will be made.

- Signatures: Ensure that all parties sign the form to validate the agreement.

Who Issues the Form

The royalty form is typically issued by the entity responsible for managing the royalties, which may include government agencies, oil and gas companies, or private landowners. In some cases, legal professionals may also provide the form to ensure compliance with relevant laws. It is important to obtain the correct version of the form from a reliable source to ensure that all legal requirements are met.

Quick guide on how to complete royalty form

Easily Prepare Royalty Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Royalty Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign Royalty Form Effortlessly

- Obtain Royalty Form and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or misplaced files, tedious form searches, and errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Royalty Form and ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a royalty form?

A royalty form is a legal document that outlines the terms and conditions under which royalties are paid. It is essential for artists, authors, and creators to ensure they receive compensation for their work. By utilizing a royalty form, you can streamline the process of documenting agreements and ensuring compliance.

-

How does airSlate SignNow simplify the creation of royalty forms?

airSlate SignNow simplifies the creation of royalty forms by providing an intuitive interface and customizable templates. You can easily modify existing templates to meet your specific needs, allowing you to quickly generate professional-looking royalty forms without any hassle. This saves time and reduces the potential for errors.

-

What are the main benefits of using airSlate SignNow for royalty forms?

Using airSlate SignNow for royalty forms offers several benefits, including streamlined document management, easy e-signature capabilities, and secure storage. These features enhance productivity by eliminating the need for paperwork and ensuring that all parties have quick access to signed documents. Additionally, the platform is cost-effective, making it a great choice for businesses of all sizes.

-

Are there any costs associated with using airSlate SignNow for royalty forms?

Yes, while airSlate SignNow offers a free trial, there are subscription plans designed to fit various budgets. Each plan includes access to features needed for creating and managing royalty forms, such as templates and integrations with other tools. Reviewing these options will help you choose a plan that meets your business's needs.

-

Can I integrate airSlate SignNow with other applications for managing royalty forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including cloud storage services and CRM systems. This facilitates easy access to your royalty forms and enhances overall workflow efficiency, as you can manage documents across different platforms effortlessly.

-

Is there customer support available for using airSlate SignNow with royalty forms?

Yes, airSlate SignNow offers excellent customer support to assist users with any issues related to royalty forms. Whether you need help with setup, troubleshooting, or best practices, their support team is available to ensure you make the most of your experience. Additionally, a comprehensive knowledge base is available for self-help.

-

What types of businesses can benefit from using royalty forms with airSlate SignNow?

Various businesses, including publishers, music labels, and product manufacturers, can greatly benefit from using royalty forms with airSlate SignNow. The tool is tailored to meet the specific needs of professionals who require a reliable way to manage agreements regarding royalties. Its flexibility and ease of use make it suitable for both small enterprises and large corporations.

Get more for Royalty Form

- Student record access form

- Available tests carlson college of veterinary medicine oregon form

- Usf application addendum form 425192094

- Participant application impact is a physical activity program for children youth and young adults with special needs more than form

- Office of financial aid uhv catalog university of houston form

- Nrotc preparatory program npp scholarship naval form

- Issuing of certificatesschoolgraduate school of form

- Blue sheet doi rev012505 blue sheet doi rev012505 form

Find out other Royalty Form

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online