Uniform Minors

What is the Uniform Minors

The Uniform Transfers to Minors Act (UTMA) provides a legal framework for transferring assets to minors without the need for a formal trust. This act allows adults to manage assets on behalf of minors until they reach the age of majority, typically eighteen or twenty-one, depending on state laws. Under this act, gifts can include cash, stocks, bonds, and real estate, making it a versatile option for parents and guardians looking to secure their children's financial future.

How to use the Uniform Minors

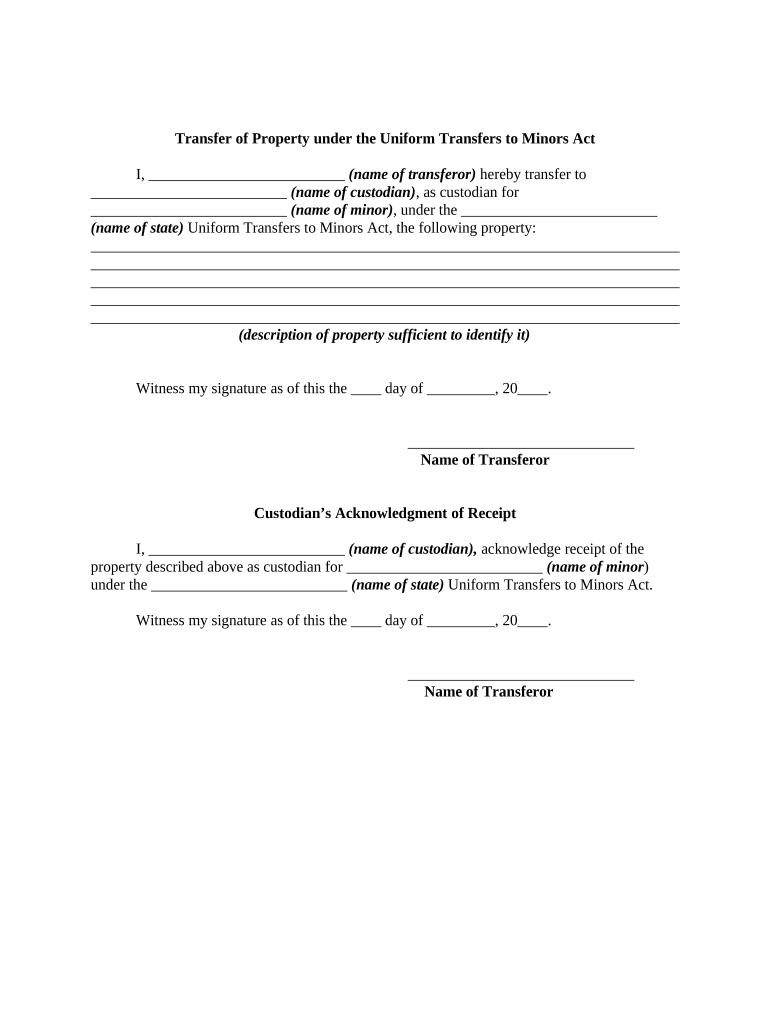

Using the Uniform Transfers to Minors Act involves several key steps. First, the adult initiating the transfer must select a custodian who will manage the assets until the minor reaches the age of majority. Next, the adult must complete a transfer property form, specifying the assets being transferred and the chosen custodian. Once the form is filled out, it should be submitted to the appropriate financial institution or agency handling the assets. It is essential to keep records of the transfer for future reference and compliance with state laws.

Steps to complete the Uniform Minors

Completing the transfer under the Uniform Transfers to Minors Act involves the following steps:

- Select a custodian who will manage the assets for the minor.

- Complete the transfer property form, detailing the assets being transferred.

- Submit the completed form to the financial institution or agency overseeing the assets.

- Ensure that all records of the transfer are maintained for compliance and future reference.

Legal use of the Uniform Minors

The legal use of the Uniform Transfers to Minors Act requires adherence to specific regulations. The assets transferred must be for the benefit of the minor, and the custodian must act in the minor's best interests. Additionally, the act provides guidelines for how the custodian can manage and invest the assets. It is important to understand that the custodian has a fiduciary duty to manage the assets prudently and in accordance with the law.

Key elements of the Uniform Minors

Several key elements define the Uniform Transfers to Minors Act:

- Custodianship: An adult is appointed as the custodian to manage the assets until the minor reaches the age of majority.

- Asset Types: The act allows for various types of assets to be transferred, including cash, securities, and real estate.

- Age of Majority: The act specifies the age at which the minor gains control over the assets, typically eighteen or twenty-one years old.

- Fiduciary Duty: The custodian must manage the assets responsibly and in the best interest of the minor.

State-specific rules for the Uniform Minors

While the Uniform Transfers to Minors Act provides a general framework, each state may have specific rules and variations. These can include differences in the age of majority, reporting requirements, and the types of assets that can be transferred. It is crucial for custodians and adults initiating transfers to familiarize themselves with their state's regulations to ensure compliance and effective management of the assets.

Quick guide on how to complete uniform minors

Effortlessly complete Uniform Minors on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Uniform Minors on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to edit and electronically sign Uniform Minors effortlessly

- Locate Uniform Minors and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your PC.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Uniform Minors and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are uniform minors in the context of document signing?

Uniform minors refer to standardized processes related to the signing of documents by minors. airSlate SignNow allows for easy eSigning and document management, ensuring that any paperwork involving uniform minors is handled securely and efficiently.

-

How does airSlate SignNow ensure compliance with laws regarding uniform minors?

airSlate SignNow complies with legal standards for signing documents involving uniform minors. This ensures that all necessary consents are obtained and properly documented, protecting both the organizations and the minors involved.

-

Is there a cost associated with using airSlate SignNow for managing documents related to uniform minors?

airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes, including those dealing with uniform minors. The pricing is transparent and includes features tailored for efficient document management and eSigning.

-

What features does airSlate SignNow offer for handling documents with uniform minors?

airSlate SignNow provides features like customizable templates, secure eSigning, and tracking options specifically designed for documents involving uniform minors. These features enhance the overall experience while ensuring compliance and efficiency.

-

Can I integrate airSlate SignNow with other tools for managing uniform minors?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easier to manage workflows involving uniform minors. This integration allows for enhanced productivity and better document tracking across different platforms.

-

What benefits does eSigning offer for documents related to uniform minors?

E-signing with airSlate SignNow simplifies the process of obtaining consent on documents related to uniform minors. It speeds up the workflow, ensures security, and provides a clear audit trail, which is essential for compliance.

-

Is airSlate SignNow user-friendly for handling uniform minors' documents?

Absolutely! airSlate SignNow is designed to be intuitive and easy to navigate, making it accessible for users managing documents related to uniform minors. This user-friendliness ensures a smooth experience for both administrators and signers.

Get more for Uniform Minors

Find out other Uniform Minors

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors