Successor Custodian Form

What is the Successor Custodian Form

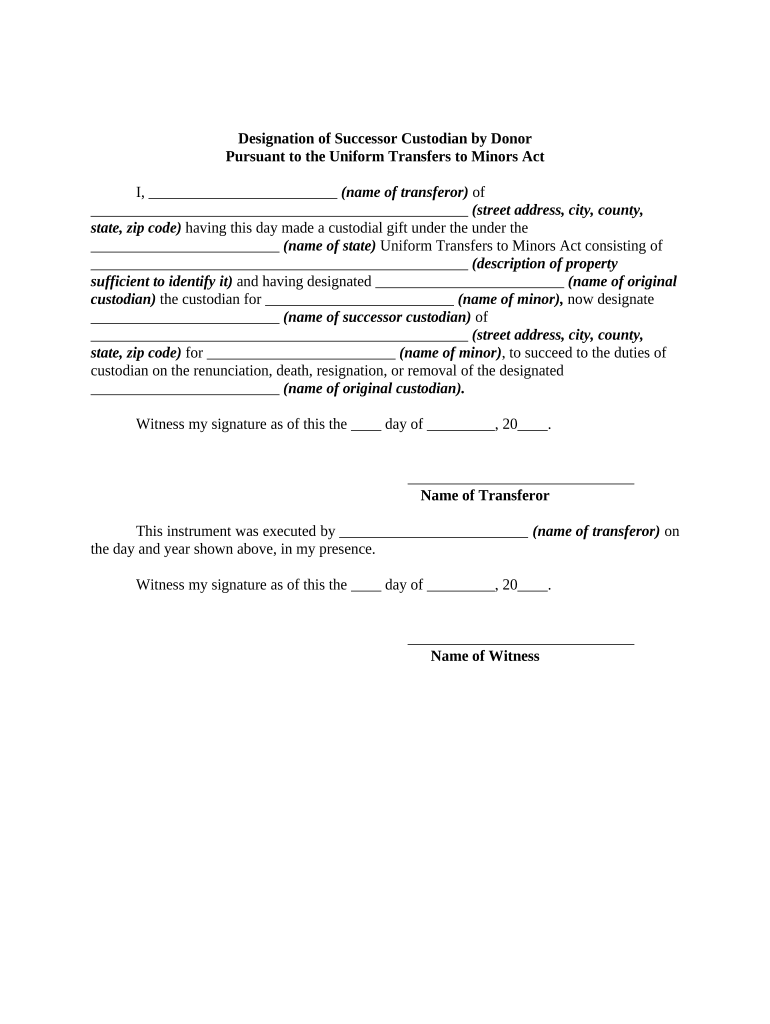

The Successor Custodian Form is a legal document used to designate a new custodian for assets held in a custodial account for minors. This form is particularly relevant under the Uniform Transfers to Minors Act (UTMA), which allows for the transfer of assets to minors while providing guidelines for their management. The form ensures that the new custodian has the authority to manage and control the assets until the minor reaches the age of majority. It is essential for parents or guardians who wish to appoint a successor custodian in the event of their incapacity or death.

Steps to complete the Successor Custodian Form

Completing the Successor Custodian Form involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information, including the current custodian's details, the successor custodian's information, and the minor's information. Next, fill out the form carefully, ensuring that all sections are completed. It is important to provide clear and accurate information to avoid any potential disputes. After completing the form, both the current and successor custodians should sign it, and it may need to be notarized depending on state regulations. Finally, keep a copy of the completed form for your records and submit it as required by your state’s laws.

Legal use of the Successor Custodian Form

The legal use of the Successor Custodian Form is governed by the Uniform Transfers to Minors Act, which outlines the responsibilities and rights of custodians. This form must be executed correctly to ensure that the transfer of custodianship is recognized by financial institutions and other entities holding the minor's assets. It is important to comply with state-specific laws regarding the form's execution and submission. Failure to do so may result in delays or complications in the management of the minor's assets. Consulting with a legal professional can provide guidance on the proper use of the form and ensure compliance with all applicable laws.

How to obtain the Successor Custodian Form

The Successor Custodian Form can typically be obtained from various sources, including state government websites, financial institutions, or legal service providers. Many states provide downloadable versions of the form on their official websites, ensuring that individuals have access to the most current version. Additionally, legal professionals can assist in obtaining the form and provide advice on its proper use. It is advisable to ensure that the form you are using is the correct version for your state, as requirements may vary.

Key elements of the Successor Custodian Form

Key elements of the Successor Custodian Form include the identification of the current custodian, the successor custodian, and the minor for whom the assets are held. The form typically requires the full names, addresses, and signatures of both custodians. It may also include specific details about the assets being transferred, such as account numbers or descriptions of property. Additionally, there may be a section for notarization or witness signatures, depending on state requirements. Ensuring that all key elements are accurately filled out is crucial for the form's validity.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Successor Custodian Form can be done through various methods, depending on state regulations and the preferences of the parties involved. Many states allow for online submission through their official government portals, which can expedite the process. Alternatively, the form can be submitted by mail to the appropriate state agency or financial institution managing the custodial account. In some cases, in-person submission may be required, particularly if notarization is necessary. It is important to verify the submission method accepted by the relevant authority to ensure compliance.

Quick guide on how to complete successor custodian form

Finalize Successor Custodian Form seamlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed files, as you can easily find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Successor Custodian Form on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Successor Custodian Form effortlessly

- Find Successor Custodian Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, stressful form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Modify and eSign Successor Custodian Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are custodian minors, and how does airSlate SignNow support them?

Custodian minors refer to individuals under the legal age that require a designated adult to manage their financial accounts or legal documents. airSlate SignNow provides tools that allow custodians to easily eSign and manage documents on behalf of minors, ensuring compliance and security throughout the process.

-

Is airSlate SignNow secure for managing documents for custodian minors?

Yes, airSlate SignNow prioritizes security with advanced encryption and authentication methods. This ensures that documents for custodian minors are protected from unauthorized access while allowing custodial parents or guardians to manage and eSign necessary paperwork seamlessly.

-

What features does airSlate SignNow offer for custodian minors?

AirSlate SignNow offers a range of features tailored for custodian minors, including customizable templates, multi-party signing, and secure document storage. These features facilitate efficient document management, making it easier for custodians to handle legal obligations related to minors.

-

How much does airSlate SignNow cost for services involving custodian minors?

AirSlate SignNow offers a variety of pricing plans that cater to different user needs, including those managing documents for custodian minors. Pricing is competitive and includes options for a monthly or annual subscription, allowing custodians to choose a plan that best fits their requirements.

-

Can airSlate SignNow integrate with other tools for managing custodian minors' documents?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, including CRMs and project management tools. This feature enhances workflow for custodians managing documents for minors by allowing them to connect with other platforms for a comprehensive solution.

-

What are the benefits of using airSlate SignNow for custodians of minors?

Using airSlate SignNow simplifies the document signing process for custodians of minors, providing an efficient, reliable solution. Benefits include cloud-based access, real-time updates, and the ability to track signatures, all of which help custodians manage their responsibilities more effectively.

-

What types of documents can custodians manage using airSlate SignNow?

Custodians can manage a wide range of documents using airSlate SignNow, including legal agreements, medical consent forms, and educational authorizations for minors. This versatility ensures that custodians have the tools they need to comply with legal requirements efficiently.

Get more for Successor Custodian Form

Find out other Successor Custodian Form

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself