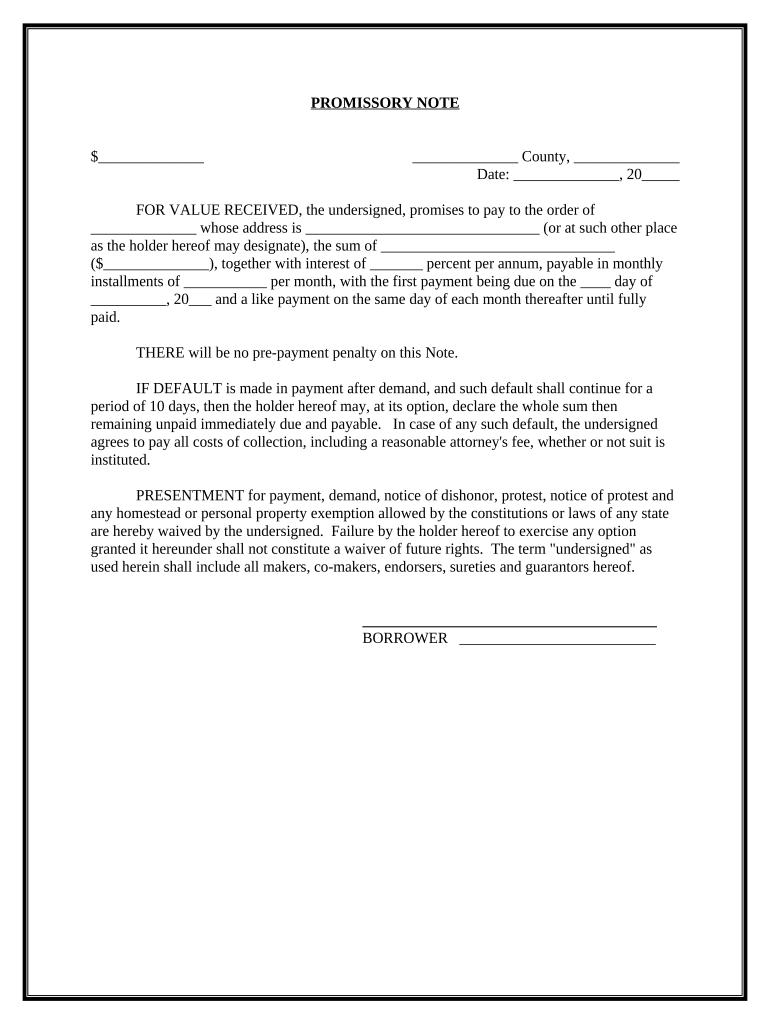

Promissory Note Installment Payments Form

What is the promissory note installment payments?

A promissory note installment payment is a written agreement in which one party promises to pay another party a specific amount of money over a set period, typically in regular installments. This type of note serves as a legal instrument that outlines the terms of the loan, including the payment schedule, interest rate, and consequences of default. It is commonly used in various financial transactions, such as personal loans, real estate purchases, and business financing.

Key elements of the promissory note installment payments

Understanding the key elements of a promissory note installment payment is essential for both lenders and borrowers. The main components typically include:

- Principal amount: The total amount borrowed or the face value of the note.

- Interest rate: The percentage charged on the principal, which can be fixed or variable.

- Payment schedule: The frequency and amount of each installment payment, often monthly.

- Maturity date: The date by which the loan must be fully repaid.

- Default terms: Conditions that define what happens if payments are missed or late.

Steps to complete the promissory note installment payments

Completing a promissory note installment payment involves several important steps to ensure clarity and legality:

- Draft the note: Clearly outline all terms, including the amount, interest rate, and payment schedule.

- Review legal requirements: Ensure compliance with state laws regarding promissory notes.

- Sign the document: Both parties should sign the note to indicate agreement.

- Distribute copies: Provide copies to all parties involved for their records.

- Maintain records: Keep track of payments made and any correspondence related to the note.

Legal use of the promissory note installment payments

The legal use of a promissory note installment payment is governed by various laws and regulations. In the United States, the enforceability of such notes is primarily determined by state law. For a promissory note to be legally binding, it must meet certain criteria, including clear terms, the intent to create a legal obligation, and proper signatures. Furthermore, compliance with federal and state regulations regarding lending practices is crucial to avoid legal issues.

How to use the promissory note installment payments

Using a promissory note installment payment effectively requires understanding its application in financial transactions. Borrowers can utilize this note to secure funding for personal or business needs, while lenders can use it to formalize the loan agreement. It is essential for both parties to communicate openly about the terms and expectations to prevent misunderstandings. Additionally, utilizing digital tools like eSignature platforms can streamline the process, making it easier to complete and store the document securely.

Examples of using the promissory note installment payments

Promissory note installment payments can be applied in various scenarios, including:

- A family member lending money to another family member for a home purchase.

- A business owner financing equipment through a loan agreement with a supplier.

- An individual taking out a personal loan from a financial institution to consolidate debt.

Each example highlights the versatility of promissory notes in facilitating financial transactions while ensuring that both parties are protected by clear, documented agreements.

Quick guide on how to complete promissory note installment payments

Complete Promissory Note Installment Payments effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without complications. Manage Promissory Note Installment Payments on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Promissory Note Installment Payments with ease

- Locate Promissory Note Installment Payments and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Promissory Note Installment Payments to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is note installment in airSlate SignNow?

Note installment in airSlate SignNow refers to the process of scheduling and managing payment plans for signed agreements. This feature allows businesses to create structured payment options for clients, ensuring clarity and improving cash flow. By utilizing note installments, organizations can facilitate easier transactions and enhance customer satisfaction.

-

How does airSlate SignNow's note installment feature work?

The note installment feature in airSlate SignNow enables users to set up payment schedules directly within their documents. Once the terms are agreed upon and signed electronically, airSlate SignNow manages notifications and reminders for both parties. This streamlined process helps reduce missed payments and improves financial planning.

-

What are the benefits of using note installment for businesses?

Using note installments with airSlate SignNow provides signNow benefits, including improved cash management and enhanced customer relations. It allows businesses to offer flexible payment options, making products or services more accessible to clients. Additionally, it helps automate tracking and reminders, freeing up time for employees to focus on core tasks.

-

Is there a cost associated with the note installment feature in airSlate SignNow?

Yes, there may be costs connected to using the note installment feature in airSlate SignNow, depending on your subscription plan. airSlate SignNow offers various pricing tiers, and users should review their options to choose the plan that best fits their needs. Overall, the feature is designed to be cost-effective while providing advanced functionalities.

-

Can I integrate other tools with note installment functionality?

Absolutely! airSlate SignNow offers various integrations that complement the note installment feature. You can seamlessly connect with tools like CRM systems and accounting software to enhance workflow automation. Such integrations help businesses maintain a centralized approach to document management and financial tracking.

-

What types of documents can utilize the note installment feature?

The note installment feature can be utilized with various types of documents, including contracts, invoices, and sales agreements. This versatility allows businesses across multiple industries to manage payments effectively. By embedding installment terms in these documents, organizations can accommodate diverse client needs.

-

How secure is the note installment process in airSlate SignNow?

The note installment process in airSlate SignNow is designed with security in mind, utilizing industry-standard encryption and compliance protocols. This ensures that both the documents and payment details are protected throughout the transaction. Users can trust that their sensitive information remains confidential while providing secure payment options to clients.

Get more for Promissory Note Installment Payments

Find out other Promissory Note Installment Payments

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure