Note Demand Form

What is the Note Demand?

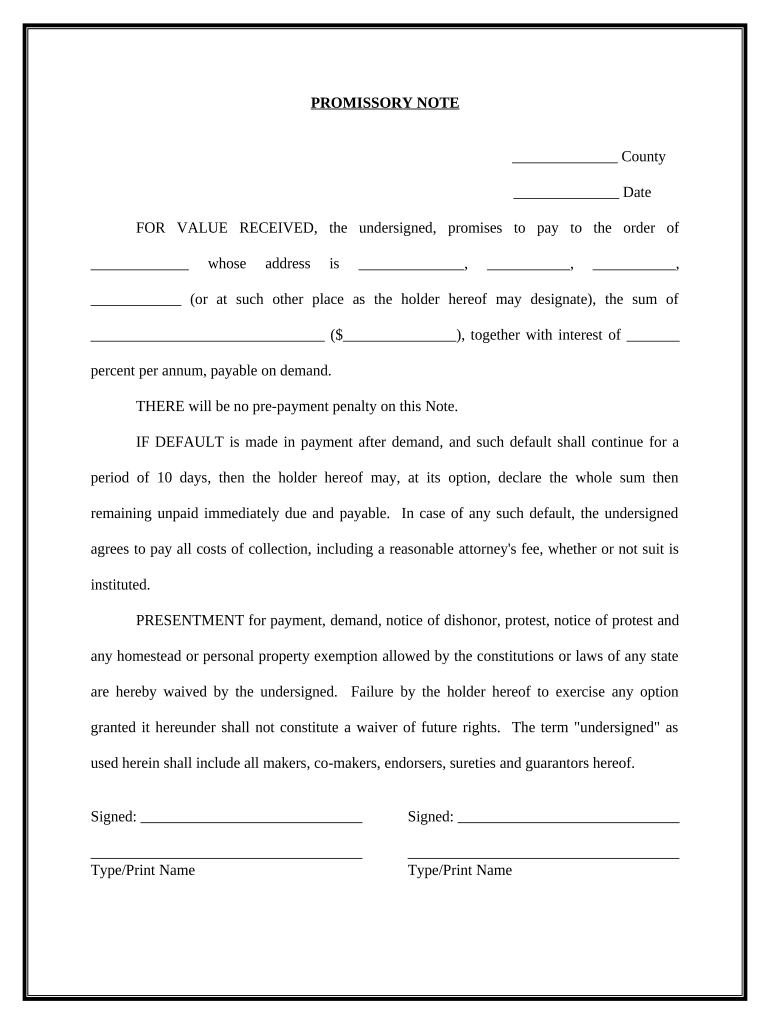

A note demand is a formal request for payment of a debt, typically associated with a promissory note. This document outlines the terms of the loan and specifies the amount owed, interest rates, and repayment schedule. It serves as a critical tool for creditors to formally demand payment from borrowers. Understanding the structure and content of a note demand is essential for both lenders and borrowers to ensure clarity and compliance with legal requirements.

How to Use the Note Demand

Using a note demand involves several steps to ensure that the request for payment is clear and legally binding. First, identify the parties involved, including the creditor and debtor. Next, clearly state the amount owed and any relevant details about the original agreement, such as the loan date and interest rate. It is important to include a deadline for payment to avoid confusion. Finally, deliver the note demand through a method that provides proof of receipt, such as certified mail or electronic delivery with a read receipt.

Steps to Complete the Note Demand

Completing a note demand requires careful attention to detail to ensure its effectiveness. Follow these steps:

- Gather all relevant information, including the original promissory note and any communication regarding the debt.

- Draft the note demand, including the debtor's name, the amount owed, and any applicable interest.

- Specify a clear due date for payment, allowing reasonable time for the debtor to respond.

- Include any consequences of non-payment, such as potential legal action or additional fees.

- Sign and date the document to validate it.

- Send the note demand using a reliable delivery method that confirms receipt.

Legal Use of the Note Demand

The legal use of a note demand is crucial for enforcing debt obligations. It is essential to ensure that the document complies with applicable laws, including the Fair Debt Collection Practices Act (FDCPA). A properly executed note demand can serve as evidence in court if the debtor fails to pay. Additionally, it is important to maintain records of all communications and payments related to the demand, as this documentation can support any legal claims that may arise.

Key Elements of the Note Demand

To create an effective note demand, certain key elements must be included:

- Creditor and Debtor Information: Clearly identify both parties involved.

- Amount Owed: Specify the total amount due, including any interest or fees.

- Payment Terms: Outline the terms of repayment, including due dates and methods of payment.

- Consequences of Non-Payment: Detail any potential legal actions or penalties that may occur if payment is not made.

- Delivery Method: Use a method that provides proof of receipt to ensure the debtor receives the demand.

Examples of Using the Note Demand

Examples of using a note demand can vary based on the context and relationship between the creditor and debtor. For instance, a landlord may issue a note demand to a tenant for overdue rent payments. Similarly, a business may send a note demand to a client for unpaid invoices. In both cases, the note demand serves as a formal reminder of the debt and initiates the process of recovery.

Quick guide on how to complete note demand

Prepare Note Demand with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to customary printed and physically signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly and without delays. Manage Note Demand on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The most efficient way to modify and eSign Note Demand effortlessly

- Obtain Note Demand and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign Note Demand and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a demand form and how can airSlate SignNow help?

A demand form is a document that allows users to formally request specific actions or services from another party. airSlate SignNow simplifies the creation and management of demand forms by providing an intuitive interface for designing, sending, and securely signing documents electronically.

-

Can I customize my demand form using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your demand form to meet your business requirements. You can add fields, logos, and branding elements to make the demand form reflect your organization’s identity, ensuring a professional appearance.

-

What are the pricing options for using airSlate SignNow for my demand forms?

airSlate SignNow offers several pricing plans to accommodate different business needs. Pricing is based on the features you need, such as the number of users and advanced functionalities for handling demand forms, making it a scalable solution for businesses of all sizes.

-

Does airSlate SignNow provide templates for demand forms?

Absolutely! airSlate SignNow provides a variety of templates for demand forms that can be easily customized. These templates save time and ensure that all necessary information is included, streamlining your document creation process.

-

How do I track the status of my demand forms sent through airSlate SignNow?

With airSlate SignNow, you can easily track the status of your sent demand forms. The platform provides real-time updates on whether your demand forms are viewed, signed, or still pending, enabling proactive follow-ups for timely processing.

-

What integrations does airSlate SignNow offer for managing demand forms?

airSlate SignNow integrates with various third-party applications to enhance your workflow. You can connect with CRM systems, project management tools, and cloud storage solutions, making it easier to manage demand forms alongside your existing systems.

-

How secure are the demand forms processed through airSlate SignNow?

The security of your demand forms is a top priority for airSlate SignNow. All documents are encrypted, and the platform complies with GDPR and other data protection regulations, ensuring that your sensitive information remains safe during the entire signing process.

Get more for Note Demand

Find out other Note Demand

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors