Grievance Form Neighborhood Health Partnership, Inc 2011-2026

What is the Grievance Form Neighborhood Health Partnership, Inc

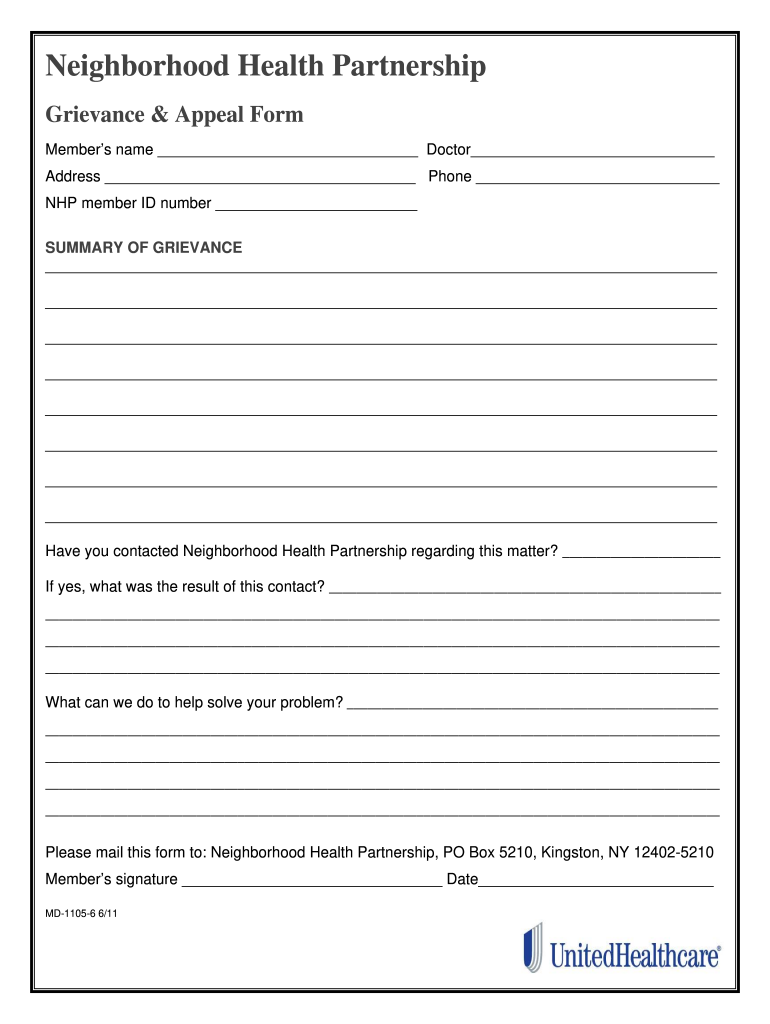

The Grievance Form for Neighborhood Health Partnership, Inc is a crucial document designed for individuals who wish to formally express concerns or complaints regarding services received. This form serves as a structured method for patients and members to communicate issues related to their healthcare experience, ensuring that their voices are heard and addressed appropriately. It is essential for maintaining the quality and accountability of health services provided by the organization.

How to use the Grievance Form Neighborhood Health Partnership, Inc

Using the Grievance Form involves a straightforward process. First, individuals should acquire the form, which can typically be found on the Neighborhood Health Partnership, Inc website or requested directly from their customer service. After obtaining the form, fill it out with accurate details about the grievance, including specific incidents, dates, and any relevant supporting information. Once completed, the form can be submitted according to the instructions provided, ensuring that it reaches the appropriate department for review.

Steps to complete the Grievance Form Neighborhood Health Partnership, Inc

Completing the Grievance Form effectively requires careful attention to detail. Follow these steps:

- Obtain the Grievance Form from the official website or customer service.

- Provide your personal information, including your name, contact details, and member ID if applicable.

- Clearly describe the nature of your grievance, including specific events and dates.

- Attach any supporting documents that may help clarify your situation.

- Review the completed form for accuracy and completeness.

- Submit the form via the designated method, whether online, by mail, or in person.

Key elements of the Grievance Form Neighborhood Health Partnership, Inc

Several key elements must be included in the Grievance Form to ensure it is processed effectively. These elements typically include:

- Personal Information: Name, address, and contact details of the individual submitting the grievance.

- Description of Grievance: A detailed account of the issue, including dates, locations, and involved parties.

- Desired Resolution: An explanation of what outcome the individual is seeking.

- Supporting Documentation: Any relevant documents that substantiate the grievance.

Legal use of the Grievance Form Neighborhood Health Partnership, Inc

The Grievance Form is not only a tool for communication but also a legal document. It must be completed in accordance with applicable laws and regulations governing healthcare services. This includes adherence to privacy laws such as HIPAA, which protect the confidentiality of patient information. Proper use of the form ensures that grievances are documented legally and can be referenced in future discussions or disputes.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Grievance Form can be done through various methods, providing flexibility to individuals. Common submission methods include:

- Online Submission: Many organizations offer a secure online portal for submitting grievances directly.

- Mail: The completed form can be printed and sent to the appropriate address via postal service.

- In-Person: Individuals may choose to deliver the form directly to a designated office, ensuring immediate receipt.

Quick guide on how to complete grievance form neighborhood health partnership inc

The simplest method to obtain and endorse Grievance Form Neighborhood Health Partnership, Inc

On the scale of an entire organization, inefficient workflows surrounding paper approvals can take up a signNow amount of productive time. Endorsing documents such as Grievance Form Neighborhood Health Partnership, Inc is an integral part of operations across various sectors, which is why the effectiveness of each agreement’s lifecycle has such a considerable impact on the organization’s overall productivity. With airSlate SignNow, endorsing your Grievance Form Neighborhood Health Partnership, Inc is as straightforward and quick as possible. This platform provides you with the most current version of virtually any document. Even better, you can sign it immediately without the need to install any third-party applications or print physical copies.

Steps to obtain and endorse your Grievance Form Neighborhood Health Partnership, Inc

- Browse our library by category or use the search function to find the document you require.

- Check the document preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to start editing right away.

- Fill out your form and enter any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Grievance Form Neighborhood Health Partnership, Inc.

- Select the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move on to sharing options as needed.

With airSlate SignNow, you have everything you need to manage your documentation efficiently. You can search for, fill out, modify, and even dispatch your Grievance Form Neighborhood Health Partnership, Inc in one tab without any complications. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

My neighborhood road has a a lot potholes. What can I do to get it fixed? Do I need to fill out a request form to the government?

First, you need to find out who has maintenance responsibility for the street. Sometimes, it’s the municipality, sometimes, the county, sometimes, the state. It could also be privately maintained.Let’s say it’s a city maintained street. Contact the city Public Works department and report the condition of the street. Most Public Works departments should have a priority list of streets in need of repair. They should be able to tell you where your street ranks on that list. If you think it’s too far down on the list, you might contact your City Councilman/Alderman to complain. It’d be a good idea to get as many of your neighbors to do the same thing.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What do you need from your partners in order to fill out a k1-form? We all used LLC's to split our partnership up, so do I just need thier EINs or do I need their personal SSN as well?

Assuming each LLC is a single member disregarded entity, then you need the individual's SSN not the EIN of the LLC. You also put the individual's name on the K1 not the name of the LLC. If the LLC's are any other type of entity, then use the EIN and name of the LLC.You also need each partner's address and capital, loss and profit percentage.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the grievance form neighborhood health partnership inc

How to generate an eSignature for the Grievance Form Neighborhood Health Partnership Inc online

How to create an eSignature for the Grievance Form Neighborhood Health Partnership Inc in Google Chrome

How to create an eSignature for signing the Grievance Form Neighborhood Health Partnership Inc in Gmail

How to generate an electronic signature for the Grievance Form Neighborhood Health Partnership Inc right from your smartphone

How to make an eSignature for the Grievance Form Neighborhood Health Partnership Inc on iOS devices

How to make an eSignature for the Grievance Form Neighborhood Health Partnership Inc on Android OS

People also ask

-

What is a neighborhood health partnership?

A neighborhood health partnership is a collaborative initiative designed to enhance healthcare access and quality within specific communities. By leveraging resources and expertise, these partnerships aim to address local health needs, improve outcomes, and foster healthier environments for residents. Understanding this can be crucial for businesses looking to align with community health initiatives.

-

How does airSlate SignNow support neighborhood health partnerships?

airSlate SignNow provides a streamlined eSigning solution that facilitates efficient document management for neighborhood health partnerships. With this tool, organizations can securely send and sign important health-related documents, ensuring compliance and improving communication. This can greatly enhance operational efficiency and collaboration among partners.

-

What features does airSlate SignNow offer for neighborhood health partnerships?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and integrations with popular applications, which are essential for neighborhood health partnerships. These features help streamline workflows and ensure that all partners can quickly access and sign documents. Additionally, the user-friendly interface makes it easy for all stakeholders to engage.

-

Is airSlate SignNow affordable for neighborhood health partnerships?

Yes, airSlate SignNow offers a cost-effective solution for neighborhood health partnerships. With flexible pricing plans, organizations can choose an option that best fits their budget and needs. This affordability ensures that even smaller partnerships can access advanced eSigning and document management capabilities.

-

Can airSlate SignNow integrate with other tools used by neighborhood health partnerships?

Absolutely! AirSlate SignNow integrates seamlessly with numerous popular applications like Google Workspace, Microsoft Office, and CRM systems, making it ideal for neighborhood health partnerships. This means that organizations can continue using their existing tools while enhancing their document signing processes. These integrations promote improved productivity across all teams.

-

What are the benefits of using airSlate SignNow for neighborhood health partnerships?

Using airSlate SignNow offers several benefits for neighborhood health partnerships, including increased operational efficiency, faster document turnaround, and enhanced security for sensitive information. This solution minimizes paper usage and helps ensure that all documents are processed quickly and reliably. Ultimately, these advantages lead to better collaboration and improved health service delivery.

-

How does airSlate SignNow ensure the security of documents for neighborhood health partnerships?

AirSlate SignNow prioritizes security with end-to-end encryption, secure cloud storage, and compliance with industry standards like HIPAA. This ensures that all documents handled within neighborhood health partnerships are protected against unauthorized access. Trust and confidentiality are critical in health-related initiatives, and airSlate SignNow helps maintain these standards.

Get more for Grievance Form Neighborhood Health Partnership, Inc

- Bill of sale with warranty by individual seller kentucky form

- Bill of sale with warranty for corporate seller kentucky form

- Bill of sale without warranty by individual seller kentucky form

- Bill of sale without warranty by corporate seller kentucky form

- Kentucky chapter 13 form

- Order confirming chapter 13 plan kentucky form

- Ky chapter 13 form

- Kentucky motion form

Find out other Grievance Form Neighborhood Health Partnership, Inc

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF