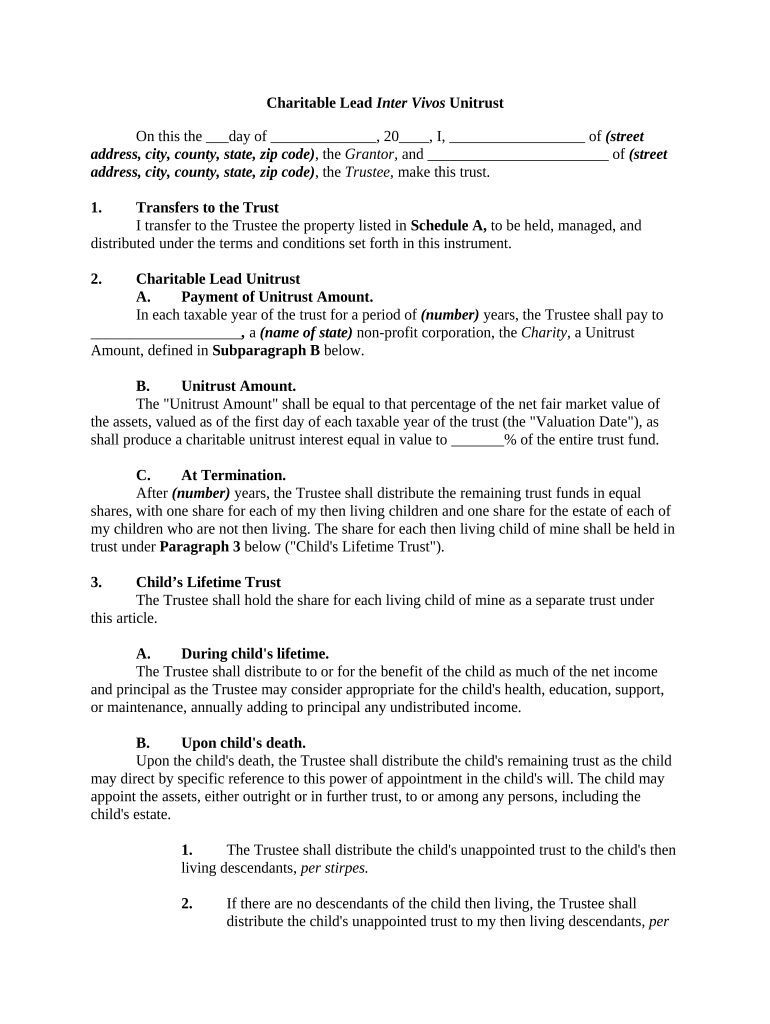

Charitable Lead Unitrust Form

What is the Charitable Lead Unitrust

A charitable lead unitrust is a type of trust that provides financial support to a charitable organization for a specified period while ultimately benefiting the donor's heirs. This trust allows the donor to contribute assets to the trust, which then generates income for the charity during the trust's term. After this period, the remaining assets are transferred to the designated beneficiaries, often family members. This structure can provide tax benefits, including potential deductions for charitable contributions, making it an appealing option for individuals looking to support charitable causes while managing their estate planning.

How to use the Charitable Lead Unitrust

Utilizing a charitable lead unitrust involves several steps to ensure it meets legal requirements and aligns with the donor's financial goals. Initially, the donor must select a charitable organization that will receive the income generated by the trust. Next, the donor decides on the trust's term, which can range from a set number of years to the lifetime of the donor. Once established, assets are transferred into the trust, and the trustee manages these assets to generate income for the charity. It's essential to work with legal and financial professionals to draft the trust document and ensure compliance with IRS regulations.

Steps to complete the Charitable Lead Unitrust

Completing the charitable lead unitrust involves a systematic approach:

- Choose a charitable organization: Select a qualified charity that aligns with your values.

- Determine the trust term: Decide how long the charity will receive income from the trust.

- Draft the trust document: Collaborate with a legal professional to create a legally binding document.

- Transfer assets: Move the chosen assets into the trust, which may include cash, stocks, or real estate.

- Appoint a trustee: Designate a reliable individual or institution to manage the trust.

- Monitor compliance: Regularly review the trust's performance and ensure adherence to tax regulations.

Legal use of the Charitable Lead Unitrust

The legal framework surrounding charitable lead unitrusts is governed by federal and state laws. To ensure legal compliance, the trust must be established according to IRS guidelines, which include specific requirements for the trust's structure and operation. The trust must provide a charitable deduction for the donor, calculated based on the present value of the income that will be paid to the charity. Additionally, the trust must adhere to state laws regarding trusts and estates, which can vary significantly. Consulting with a legal expert is crucial to navigate these complexities and ensure the trust is valid and enforceable.

Key elements of the Charitable Lead Unitrust

Several key elements define a charitable lead unitrust:

- Income distribution: The trust must distribute a fixed percentage of its assets to the charity annually.

- Term of the trust: The duration can be specified as a number of years or until the death of the donor.

- Beneficiaries: After the trust term, remaining assets are distributed to the designated beneficiaries.

- Tax benefits: Donors may receive charitable deductions based on the present value of the charity's income.

- Trustee responsibilities: The trustee manages the trust assets and ensures compliance with legal obligations.

IRS Guidelines

The IRS provides specific guidelines for charitable lead unitrusts to qualify for tax benefits. These guidelines outline the necessary structure, including the requirement that the trust must pay out a fixed percentage of its assets to the charity each year. The trust must also meet the qualifications of a charitable organization under IRS rules. Additionally, donors must file the appropriate forms to claim deductions, which may include IRS Form 5227, used to report charitable lead trusts. Understanding these guidelines is essential for both compliance and maximizing potential tax advantages.

Quick guide on how to complete charitable lead unitrust

Complete Charitable Lead Unitrust effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Charitable Lead Unitrust on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and electronically sign Charitable Lead Unitrust with ease

- Access Charitable Lead Unitrust and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Adjust and electronically sign Charitable Lead Unitrust and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable lead unitrust?

A charitable lead unitrust is a planned giving arrangement where a donor contributes assets to a trust that provides income to a charity for a specified period. This financial strategy allows donors to support charitable organizations while also benefiting from potential tax advantages.

-

How can airSlate SignNow assist with setting up a charitable lead unitrust?

airSlate SignNow simplifies the process of creating and signing documents related to charitable lead unitrust arrangements. Our platform allows you to easily draft, send, and eSign necessary agreements, ensuring a smooth setup and compliance with legal requirements.

-

What are the benefits of using a charitable lead unitrust?

A charitable lead unitrust provides multiple benefits, including lifetime income for the donor, potential tax deductions, and substantial support for chosen charities. This giving strategy not only helps you fulfill philanthropic goals but also enhances your financial portfolio.

-

Are there any costs associated with a charitable lead unitrust?

While the setup of a charitable lead unitrust may involve legal and administrative fees, the long-term benefits often outweigh the initial costs. Using airSlate SignNow, you can manage documentation efficiently, potentially reducing overhead expenses associated with managing the trust.

-

What features does airSlate SignNow offer for managing charitable lead unitrust documents?

airSlate SignNow provides features such as document templates, secure eSigning, and cloud storage for managing charitable lead unitrust documents. This streamlines the entire process, allowing you to focus on your philanthropic objectives without the stress of cumbersome paperwork.

-

Can airSlate SignNow integrate with other financial tools for charitable lead unitrust management?

Yes, airSlate SignNow can integrate with various financial software tools, helping you track and manage assets within your charitable lead unitrust efficiently. This enhances transparency and simplifies the reporting process, making compliance easier.

-

What types of assets can be included in a charitable lead unitrust?

A variety of assets can be placed in a charitable lead unitrust, including cash, stocks, real estate, and other investments. Choosing the right mix of assets can maximize the benefits for both the donor and the charitable organization.

Get more for Charitable Lead Unitrust

Find out other Charitable Lead Unitrust

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online