Money Lending Licence Form PDF

What is the money lending licence form pdf

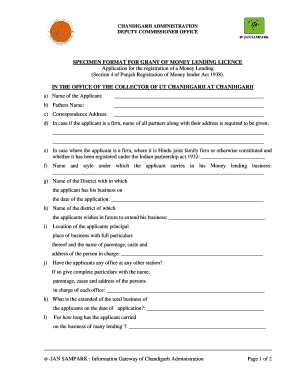

The money lending licence form pdf is a crucial document for individuals or businesses seeking to operate as licensed money lenders. This form serves as an official application to obtain the necessary permissions from regulatory authorities to engage in lending activities legally. It typically includes essential information about the applicant, such as their business structure, financial history, and compliance with relevant laws. Understanding this form is vital for ensuring adherence to state and federal regulations governing money lending practices.

Steps to complete the money lending licence form pdf

Completing the money lending licence form pdf involves several key steps to ensure accuracy and compliance. Begin by gathering all required information, including personal identification, business details, and financial statements. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to any specific requirements outlined by your state’s regulatory body. After completing the form, review it for any errors or omissions before submitting it. Finally, retain a copy for your records and submit the original form according to the specified method.

Legal use of the money lending licence form pdf

The legal use of the money lending licence form pdf is essential for ensuring that lending activities comply with state and federal regulations. This form must be filled out accurately and submitted to the appropriate regulatory authority to obtain a valid lending license. Failure to use this form correctly can result in penalties, including fines or the revocation of the ability to lend money legally. It is crucial to understand the legal implications of the information provided in the form and to ensure that all disclosures are complete and truthful.

Required documents

When applying for a money lending licence, several documents are typically required to support the application. These may include:

- Proof of identity, such as a government-issued ID

- Business formation documents, such as articles of incorporation or partnership agreements

- Financial statements demonstrating the applicant's financial stability

- Background checks or credit reports as mandated by state regulations

- Any additional documents specified by the regulatory authority

Gathering these documents beforehand can streamline the application process and help avoid delays.

Who issues the form

The money lending licence form pdf is typically issued by state regulatory agencies responsible for overseeing financial institutions and lending practices. Each state may have its own specific agency or department that manages the licensing process for money lenders. It is essential to identify the correct agency in your state to ensure that you are using the appropriate form and following the correct procedures for submission.

Application process & approval time

The application process for obtaining a money lending licence involves several steps, starting with the submission of the completed form and required documents to the relevant regulatory authority. After submission, the agency will review the application to ensure compliance with all legal requirements. The approval time can vary significantly depending on the state and the complexity of the application. Typically, applicants can expect a processing period ranging from a few weeks to several months. It is advisable to check with the specific agency for estimated timelines and any potential delays.

Quick guide on how to complete money lending licence form pdf

Complete Money Lending Licence Form Pdf effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly and smoothly. Manage Money Lending Licence Form Pdf on any device with the airSlate SignNow apps available for Android or iOS and improve any document-related process today.

How to adjust and eSign Money Lending Licence Form Pdf with ease

- Find Money Lending Licence Form Pdf and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Adjust and eSign Money Lending Licence Form Pdf and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the money lending licence form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lending certificate?

A lending certificate is a financial document used to verify a borrower's eligibility for a loan. It outlines the terms of lending, such as the loan amount, interest rate, and repayment schedule. Utilizing airSlate SignNow, you can easily create, send, and eSign lending certificates for seamless lending processes.

-

How does airSlate SignNow simplify the lending certificate process?

AirSlate SignNow streamlines the lending certificate process by providing an easy-to-use platform where you can create and customize documents. The solution enables quick eSigning, reducing turnaround time on loans. Additionally, automated reminders ensure that all parties complete the process promptly.

-

What benefits do I get from using airSlate SignNow for lending certificates?

Using airSlate SignNow for lending certificates offers several benefits, including enhanced security, reduced paperwork, and real-time tracking. The platform's user-friendly interface makes it simple to manage your documents effectively. Ultimately, this improves the overall efficiency of your lending operations.

-

Are there any integrations available for managing lending certificates?

Yes, airSlate SignNow offers various integrations to enhance the management of lending certificates. You can connect with popular platforms such as CRM software and cloud storage services for better document management and collaboration. These integrations help streamline your workflow and keep all your documents organized.

-

What is the pricing for using airSlate SignNow for lending certificates?

AirSlate SignNow offers competitive pricing plans designed to suit various business needs, including options for small businesses and enterprises. You can choose a plan that provides the right features for managing lending certificates. Visit the airSlate SignNow website for detailed pricing information and find the best option for your organization.

-

Can I customize my lending certificate templates with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize lending certificate templates to match your brand and specific requirements. This can include adding your company's logo, adjusting approvals, and specifying document details. Customized templates make the process more professional and tailored to your needs.

-

How secure are my lending certificates when using airSlate SignNow?

AirSlate SignNow prioritizes security, employing advanced measures like encryption and access controls to protect your lending certificates. You can rest assured that your sensitive financial documents are safe from unauthorized access. This level of security helps maintain compliance and builds trust with your clients.

Get more for Money Lending Licence Form Pdf

- Aircraft airworthiness checklist form

- Ohio cdl self certification online form

- Hdfc bank statement form pdf

- National insurance fire claim form

- Blank weekly time management schedule student worldcampus psu form

- Police report request parkeronlineorg form

- Par q form

- Construction employment contract template form

Find out other Money Lending Licence Form Pdf

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will