Sole Proprietorship Form

What is the Sole Proprietorship Form

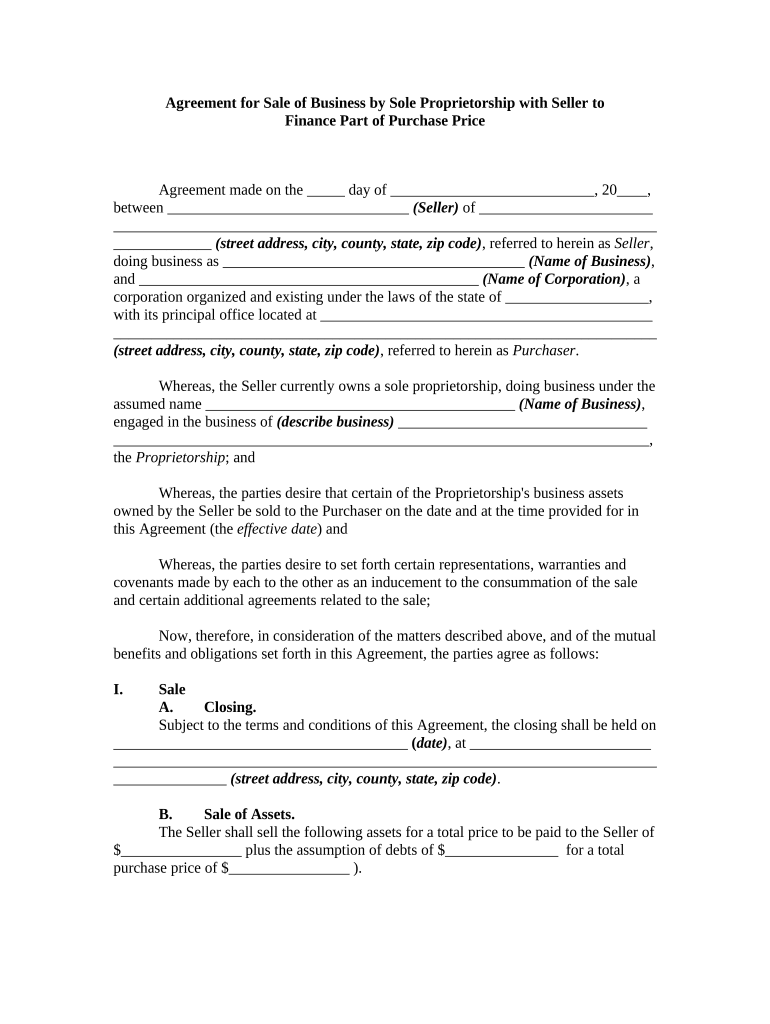

The sole proprietorship form is a legal document that establishes a business as a sole proprietorship, which is a type of business entity owned and operated by a single individual. This form is essential for individuals who wish to operate their business under their name or a fictitious name. By completing this form, the owner registers their business with the appropriate state authorities, allowing them to conduct business legally. It is important to understand that a sole proprietorship does not create a separate legal entity, meaning the owner is personally liable for all debts and obligations incurred by the business.

Steps to Complete the Sole Proprietorship Form

Completing the sole proprietorship form involves several key steps to ensure accuracy and compliance with state regulations. Here is a general outline of the process:

- Gather necessary information, including your name, address, and business details.

- Choose a business name, ensuring it complies with state naming regulations.

- Fill out the sole proprietorship form, providing all required information accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate state agency, either online or by mail.

Legal Use of the Sole Proprietorship Form

The legal use of the sole proprietorship form is crucial for establishing the business's legitimacy. Once filed, this form serves as proof that the owner is operating a business under a specific name. It also helps in obtaining necessary permits and licenses required by local and state authorities. Additionally, having this form on file can protect the business owner’s rights and interests in case of disputes or legal issues. Understanding the legal implications of this form is essential for any sole proprietor.

How to Obtain the Sole Proprietorship Form

Obtaining the sole proprietorship form is a straightforward process. Most states provide the form online through their official business registration websites. You can also visit local government offices, such as the county clerk's office, to request a physical copy. Ensure you select the correct form specific to your state, as requirements may vary. Once you have the form, you can fill it out and submit it according to your state's guidelines.

Key Elements of the Sole Proprietorship Form

The sole proprietorship form typically includes several key elements that must be completed accurately. These elements may include:

- Owner's full name and contact information.

- Business name, if different from the owner's name.

- Business address.

- Description of the business activities.

- Signature of the owner, certifying the accuracy of the information provided.

State-Specific Rules for the Sole Proprietorship Form

Each state has its own rules and regulations regarding the sole proprietorship form. It is essential to familiarize yourself with your state's specific requirements, which may include additional documentation, fees, or specific filing procedures. Some states may require a fictitious name registration if the business operates under a name different from the owner's legal name. Checking with your state’s business registration office can provide clarity on these requirements.

Quick guide on how to complete sole proprietorship form

Effortlessly prepare Sole Proprietorship Form on any device

Digital document management has gained traction among organizations and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the tools required to generate, edit, and eSign your documents promptly without any holdups. Manage Sole Proprietorship Form on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The easiest method to modify and eSign Sole Proprietorship Form with ease

- Obtain Sole Proprietorship Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize critical sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that reason.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your desired method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Sole Proprietorship Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sole proprietorship form pdf?

A sole proprietorship form pdf is a document that officially registers an individual as a sole proprietor for their business. This form outlines the business details and provides important information needed for tax and legal purposes. Using a sole proprietorship form pdf can streamline your business establishment process.

-

How can airSlate SignNow help with my sole proprietorship form pdf?

airSlate SignNow allows you to efficiently fill, sign, and store your sole proprietorship form pdf online. Our platform is designed to save you time with easy document management and allows you to send your forms securely to any party. This means you can focus more on your business and less on paperwork.

-

Is there a cost associated with using airSlate SignNow for my sole proprietorship form pdf?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including handling your sole proprietorship form pdf. We provide a free trial, allowing you to explore our features without upfront costs. Choose the plan that fits your specific requirements.

-

What features does airSlate SignNow offer for managing sole proprietorship form pdf?

With airSlate SignNow, features include easy eSigning, document editing, and secure cloud storage for your sole proprietorship form pdf. Our user-friendly interface ensures that you can manage your forms quickly and effortlessly. Streamline your document workflow and enhance your productivity with these powerful tools.

-

Can I integrate airSlate SignNow with other software for my sole proprietorship form pdf?

Absolutely! airSlate SignNow seamlessly integrates with various software applications to enhance your document management experience, including those for accounting and project management. This allows you to incorporate your sole proprietorship form pdf into your existing workflows, making it easier to manage your business operations.

-

What are the benefits of using airSlate SignNow for my sole proprietorship form pdf?

Using airSlate SignNow for your sole proprietorship form pdf offers convenience, security, and efficiency. You can access your documents anytime, anywhere, which is particularly useful for busy entrepreneurs. Additionally, the platform ensures that your documents are safe and comply with legal standards.

-

How long does it take to complete a sole proprietorship form pdf on airSlate SignNow?

Completing a sole proprietorship form pdf on airSlate SignNow is quick and easy; most users can finish the process in just a few minutes. The intuitive design of our platform guides you through each step, ensuring you can efficiently fill out necessary information. This speed allows you to swiftly move forward with your business setup.

Get more for Sole Proprietorship Form

Find out other Sole Proprietorship Form

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word