Letter Request Credit Application Form

What is the Letter Request Credit Application

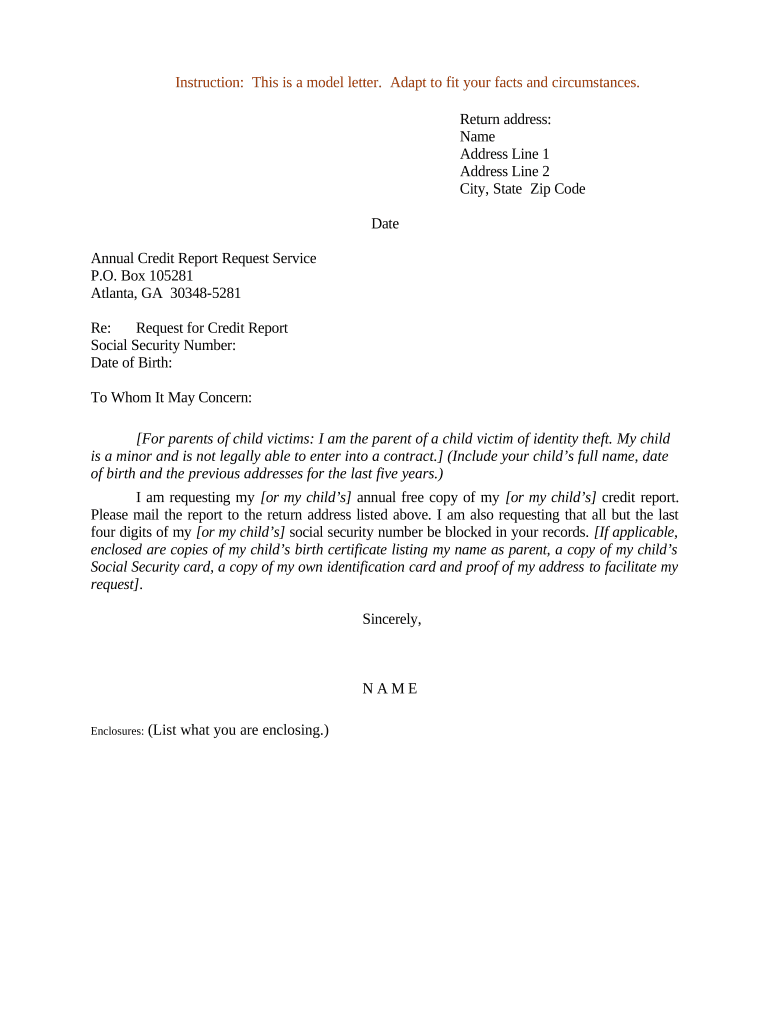

The Letter Request Credit Application is a formal document used by individuals or businesses to request credit from a lender or financial institution. This letter outlines the applicant's request for a specific amount of credit, details their financial situation, and may include supporting documentation to justify the request. It serves as a crucial first step in the credit application process, allowing lenders to assess the applicant's creditworthiness and financial stability.

Key elements of the Letter Request Credit Application

A well-structured Letter Request Credit Application typically includes several key elements:

- Applicant Information: Full name, address, and contact details of the applicant.

- Recipient Information: Name and address of the lender or financial institution.

- Credit Request Details: The specific amount of credit requested and the purpose of the credit.

- Financial Information: A brief overview of the applicant's financial situation, including income, debts, and assets.

- Supporting Documentation: Any relevant documents that support the credit request, such as income statements or tax returns.

Steps to complete the Letter Request Credit Application

Completing a Letter Request Credit Application involves several important steps:

- Gather Information: Collect all necessary personal and financial information, including income and expenses.

- Draft the Letter: Write the letter using a clear and professional tone, ensuring all key elements are included.

- Review and Edit: Carefully proofread the letter for any errors or omissions before finalizing it.

- Attach Supporting Documents: Include any relevant documents that strengthen your application.

- Submit the Application: Send the letter to the appropriate lender or financial institution via the preferred method.

Legal use of the Letter Request Credit Application

The Letter Request Credit Application must comply with legal standards to be considered valid. This includes ensuring that all information provided is accurate and truthful. Misrepresentation or fraudulent information can lead to legal consequences, including denial of the credit request and potential legal action. It is essential to be aware of state-specific regulations that may apply to credit applications.

Examples of using the Letter Request Credit Application

There are various scenarios in which an individual or business may use a Letter Request Credit Application:

- Personal Loans: Individuals seeking personal loans for major purchases, such as a car or home renovation.

- Business Financing: Small businesses applying for credit to expand operations or manage cash flow.

- Credit Cards: Consumers requesting credit card limits or new accounts based on their financial needs.

Form Submission Methods (Online / Mail / In-Person)

Submitting a Letter Request Credit Application can be done through various methods, depending on the lender's preferences:

- Online Submission: Many lenders offer online portals where applicants can fill out and submit their applications electronically.

- Mail: Applicants may choose to print the letter and send it via postal mail to the lender's address.

- In-Person Submission: Some individuals prefer to deliver their application in person, allowing for immediate interaction with a lender representative.

Quick guide on how to complete letter request credit application

Effortlessly Prepare Letter Request Credit Application on Any Device

Digital document management has become favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without complications. Manage Letter Request Credit Application seamlessly on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Alter and eSign Letter Request Credit Application Effortlessly

- Obtain Letter Request Credit Application and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Letter Request Credit Application to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit application email template?

A credit application email template is a pre-designed, customizable email format that businesses can use to request credit applications from potential clients. By using this template, companies can streamline their application process, ensuring they collect all necessary information efficiently and professionally. With airSlate SignNow, you can easily incorporate this template into your workflow.

-

How can I create a credit application email template using airSlate SignNow?

Creating a credit application email template with airSlate SignNow is simple and user-friendly. You can start by selecting a pre-existing template and customizing the fields to suit your specific needs. Once tailored, you can save it for future use, making it easy to send out credit applications quickly and consistently.

-

What features does the credit application email template offer?

The credit application email template includes features such as customizable fields, eSignature options, and automated follow-up reminders. These functionalities enhance the efficiency of the application process, ensuring that no steps are missed. Additionally, you can track the status of submissions, providing valuable insights into your application flow.

-

Is the credit application email template customizable?

Yes, the credit application email template is fully customizable with airSlate SignNow. You can adjust various elements, including the email's tone, layout, and required fields. This flexibility ensures that the email reflects your brand's voice and caters to your clients' specific needs.

-

What are the benefits of using a credit application email template?

Using a credit application email template can signNowly streamline your operations and improve response rates. It saves time by eliminating the need to compose emails from scratch while ensuring that all necessary information is requested. Additionally, a well-structured template enhances professionalism and helps build trust with your clients.

-

How does airSlate SignNow integrate with other software for credit application management?

airSlate SignNow offers seamless integrations with various software systems, making it easier to manage credit applications across different platforms. Whether you use CRM, accounting, or project management tools, you can connect them with SignNow to automate data transfer and keep your documents organized. This enhances your overall workflow efficiency and accuracy.

-

What is the pricing structure for using the credit application email template with airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Depending on your requirements, you can choose a plan that includes access to the credit application email template along with other features. For detailed information on pricing tiers and features, it’s best to visit the airSlate SignNow website or contact their sales team.

Get more for Letter Request Credit Application

Find out other Letter Request Credit Application

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile