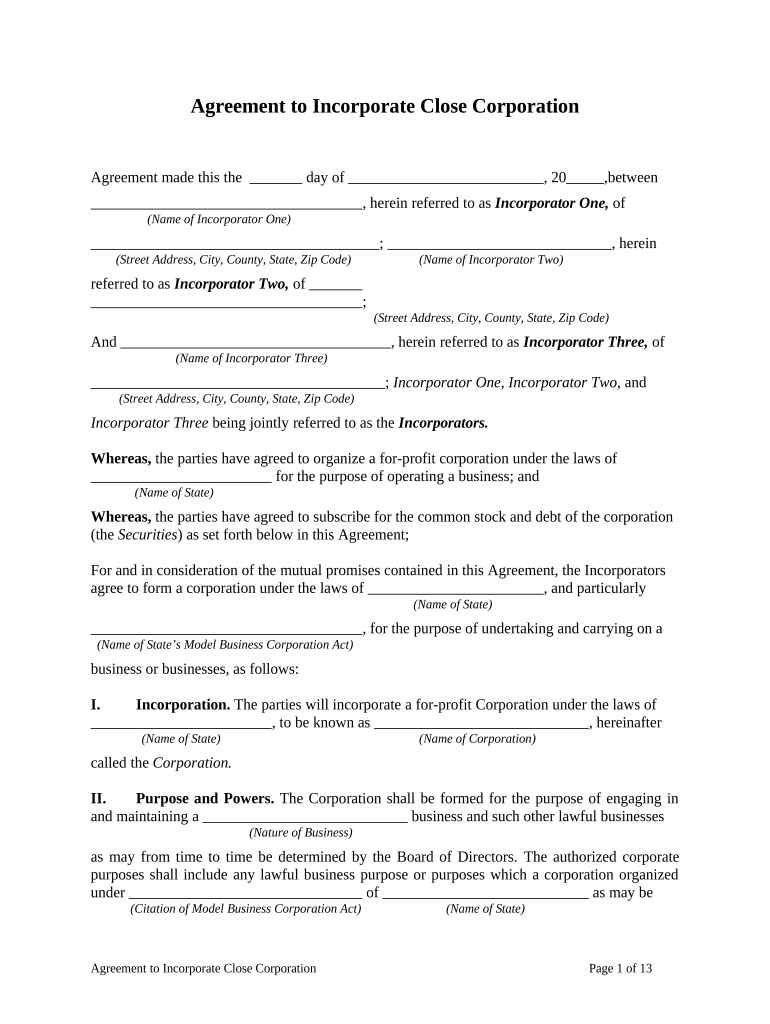

Close Corporation Form

What is the close corporation?

A close corporation is a specific type of business entity that combines elements of both a corporation and a partnership. It is typically owned by a small group of individuals, often family members or close friends, who have a significant degree of control over the business operations. Unlike traditional corporations, close corporations have fewer formalities and regulations, allowing for more flexibility in management and decision-making. This structure is particularly advantageous for small businesses seeking to maintain a tight-knit ownership group while enjoying the benefits of limited liability protection.

Key elements of the close corporation

Several key elements define a close corporation:

- Limited liability: Owners are protected from personal liability for business debts, similar to shareholders in a traditional corporation.

- Ownership restrictions: Shares are typically held by a limited number of individuals, often requiring consent for any transfer of ownership.

- Management flexibility: Close corporations can operate without a board of directors, allowing owners to manage the business directly.

- Informal structure: Fewer regulatory requirements lead to a more relaxed operational environment, which can enhance decision-making speed.

Steps to complete the close corporation

Completing a close corporation agreement involves several important steps:

- Determine eligibility: Ensure that the business meets the criteria for forming a close corporation in your state.

- Draft the agreement: Create a close corporation agreement that outlines the rights and responsibilities of the owners, including provisions for management, profit distribution, and transfer of shares.

- File necessary documents: Submit the required formation documents to the appropriate state agency, often the Secretary of State.

- Obtain necessary licenses: Ensure that the business has all required local and state licenses to operate legally.

- Maintain compliance: Regularly review the agreement and make necessary updates to remain compliant with state laws and regulations.

Legal use of the close corporation

The legal use of a close corporation involves adhering to specific regulations and requirements set forth by state law. While close corporations enjoy certain benefits, they must also comply with applicable laws to maintain their status. This includes filing annual reports, keeping accurate records, and ensuring that all business activities align with the terms outlined in the close corporation agreement. Legal counsel can provide guidance to ensure compliance and help navigate any potential legal issues that may arise.

State-specific rules for the close corporation

Each state in the United States has its own regulations governing close corporations. These rules can vary significantly, affecting aspects such as formation, management, and reporting requirements. It is crucial for business owners to familiarize themselves with their state's specific laws to ensure proper compliance. Consulting with a legal expert or business advisor can provide valuable insights into state-specific rules and help navigate the complexities of forming and operating a close corporation.

Form submission methods

When submitting a close corporation agreement, there are typically several methods available:

- Online submission: Many states offer online portals where business owners can file their formation documents electronically.

- Mail: Physical copies of the close corporation agreement can often be mailed to the appropriate state agency.

- In-person: Some states allow for in-person submission at designated offices, providing an opportunity for immediate feedback and assistance.

Quick guide on how to complete close corporation

Effortlessly Prepare Close Corporation on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the needed form and securely save it online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents swiftly and without hold-ups. Manage Close Corporation on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Ways to Edit and eSign Close Corporation with Ease

- Obtain Close Corporation and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Edit and eSign Close Corporation and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a close corporation agreement?

A close corporation agreement is a legal document that outlines the management structure and operating procedures of a close corporation. It is essential for defining the rights and responsibilities of each shareholder, ensuring clarity and reducing potential disputes.

-

How do I create a close corporation agreement with airSlate SignNow?

Creating a close corporation agreement with airSlate SignNow is straightforward. You can use our customizable templates to tailor the document to your needs, allowing for easy edits and adjustments before sending it out for eSignature.

-

What are the main benefits of having a close corporation agreement?

Having a close corporation agreement provides numerous benefits, including protection from personal liability, clear guidelines on the management and operation of your business, and a framework for resolving disputes among shareholders. This agreement can signNowly enhance your corporation's stability.

-

Is airSlate SignNow secure for signing a close corporation agreement?

Yes, airSlate SignNow is highly secure for electronically signing a close corporation agreement. Our platform utilizes advanced encryption technologies to protect your documents, ensuring that your information remains confidential and secure.

-

Can I integrate airSlate SignNow with other business tools for managing close corporation agreements?

Absolutely! airSlate SignNow offers various integrations with popular business tools, making it easy to manage your close corporation agreements alongside your existing workflows. These integrations facilitate seamless document management and collaboration.

-

How much does it cost to use airSlate SignNow for a close corporation agreement?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs. Whether you are a small startup or a larger enterprise, you can find a plan that fits your budget while providing the necessary features for managing your close corporation agreements.

-

Can I modify my close corporation agreement after signing?

Yes, with airSlate SignNow, you can modify your close corporation agreement even after it has been signed, provided all parties agree to the changes. This flexibility ensures that your agreement can adapt to the evolving needs of your business.

Get more for Close Corporation

Find out other Close Corporation

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online