Collateral Assignment of Life Insurance Policy Form

What is the collateral assignment of life insurance policy?

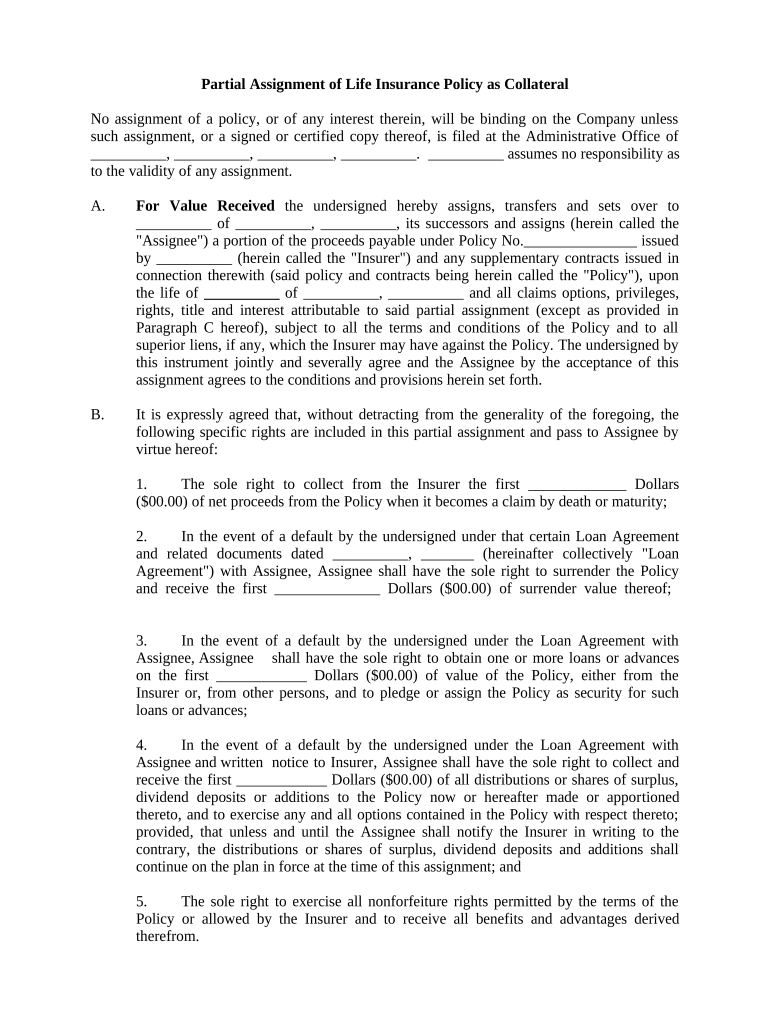

A collateral assignment of life insurance policy is a legal arrangement where a policyholder designates a lender or a third party as a beneficiary for a specific purpose, typically to secure a loan. In this scenario, the lender has rights to the policy's death benefit in the event of the policyholder's passing. This form of assignment does not transfer ownership of the policy but grants the lender a claim to the benefits, ensuring that the loan is repaid. Understanding this arrangement is crucial for both policyholders and lenders to navigate financial obligations effectively.

How to use the collateral assignment of life insurance policy

Using a collateral assignment of life insurance policy involves several key steps. First, the policyholder must complete the assignment form, clearly indicating the lender's details and the specific terms of the assignment. The policyholder then submits this form to the insurance company for approval. Once approved, the lender will receive notification of the assignment. It is essential to keep a copy of the assignment for personal records. This process ensures that both parties understand their rights and responsibilities regarding the policy and any associated loans.

Steps to complete the collateral assignment of life insurance policy

Completing the collateral assignment of life insurance policy involves a systematic approach:

- Obtain the form: Request the collateral assignment form from your insurance provider or access it online.

- Fill out the form: Provide necessary details, including the policy number, lender information, and the amount secured by the assignment.

- Review the terms: Ensure that all terms are clear and understood by both the policyholder and the lender.

- Sign the form: The policyholder must sign the form, and in some cases, the lender may also need to sign.

- Submit the form: Send the completed form to the insurance company for processing and approval.

- Confirm the assignment: After processing, ensure that you receive confirmation from the insurance company regarding the assignment.

Key elements of the collateral assignment of life insurance policy

Several key elements define the collateral assignment of life insurance policy:

- Policyholder: The individual who owns the life insurance policy and initiates the assignment.

- Lender: The entity or individual receiving the assignment as collateral for a loan.

- Assignment terms: Specific conditions under which the lender can claim the death benefit, including the amount secured and any limitations.

- Insurance company: The provider of the life insurance policy that must approve the assignment.

- Legal documentation: The completed assignment form serves as the legal document outlining the arrangement.

Legal use of the collateral assignment of life insurance policy

The legal use of a collateral assignment of life insurance policy is governed by state laws and regulations. This form of assignment must comply with applicable legal frameworks to be enforceable. It is crucial for both the policyholder and lender to understand their rights under the assignment. Legal considerations may include the necessity of notarization, the impact of state-specific laws on the assignment, and the implications for the policyholder's estate. Consulting with a legal professional can provide clarity on these matters.

Examples of using the collateral assignment of life insurance policy

Collateral assignments of life insurance policies are commonly used in various scenarios:

- Business loans: A business owner may use their life insurance policy as collateral to secure a loan for expansion.

- Mortgage financing: Homebuyers might assign their life insurance policy to a lender as collateral for a mortgage.

- Personal loans: Individuals may leverage their life insurance policies to obtain personal loans, ensuring repayment through the policy's death benefit.

Quick guide on how to complete collateral assignment of life insurance policy

Effortlessly Prepare Collateral Assignment Of Life Insurance Policy on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely archive it online. airSlate SignNow offers all the resources you require to create, modify, and electronically sign your documents swiftly, without holdups. Manage Collateral Assignment Of Life Insurance Policy seamlessly on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign Collateral Assignment Of Life Insurance Policy with Ease

- Acquire Collateral Assignment Of Life Insurance Policy and click on Obtain Form to begin.

- Utilize our provided tools to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with specialized tools from airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all details carefully and click on the Complete button to save your changes.

- Select how you wish to share your form, through email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or mishandled documents, tedious form searches, or errors requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Collateral Assignment Of Life Insurance Policy to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment life insurance policy collateral form?

An assignment life insurance policy collateral form is a document used to designate a life insurance policy as collateral for a loan or obligation. This form outlines the specifics of the assignment and ensures that the lender has a claim against the policy in case of default. Using an assignment life insurance policy collateral form can help secure financing while safeguarding your investment.

-

How do I complete an assignment life insurance policy collateral form?

Completing an assignment life insurance policy collateral form involves filling out your personal information, details about the life insurance policy, and the terms of the collateral agreement. It’s crucial to provide accurate details to avoid legal complications. airSlate SignNow simplifies this process by allowing you to fill out and sign documents digitally, ensuring a fast turnaround.

-

What are the benefits of using an assignment life insurance policy collateral form?

The primary benefit of using an assignment life insurance policy collateral form is that it can facilitate access to necessary funds, either for personal loans or business financing. Additionally, it helps in securing better loan terms by providing a safety net for lenders. This form offers peace of mind knowing that your life insurance can act as a financial resource.

-

Is there a fee associated with using an assignment life insurance policy collateral form?

Using an assignment life insurance policy collateral form may incur fees depending on your insurance provider and any notary requirements. Typically, the costs associated with drafting and filing this form are minor compared to the benefits it can provide. Choose airSlate SignNow for a cost-effective way to manage these forms and documents.

-

Can I use airSlate SignNow for my assignment life insurance policy collateral form?

Yes, airSlate SignNow is designed to streamline the process of creating, signing, and managing various forms, including the assignment life insurance policy collateral form. The platform offers user-friendly tools and integrations that make it easy to handle your documentation electronically. This ensures your form is completed quickly and securely.

-

How secure is the submission of an assignment life insurance policy collateral form through airSlate SignNow?

When you submit an assignment life insurance policy collateral form via airSlate SignNow, your data is protected with advanced encryption and security protocols. The platform prioritizes the confidentiality and integrity of your documents. You can trust that your sensitive information is handled with the utmost care.

-

Can I modify my assignment life insurance policy collateral form after it has been signed?

Modifications to an assignment life insurance policy collateral form after signing can be complex and depend on the parameters set in the initial agreement. If changes are necessary, it's advisable to consult with your attorney or financial advisor. airSlate SignNow provides the flexibility to create new versions of your document for any required updates.

Get more for Collateral Assignment Of Life Insurance Policy

Find out other Collateral Assignment Of Life Insurance Policy

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy