Adverse Action Notice Form

Understanding Adverse Real Property Rights

Adverse real property rights refer to the legal claims an individual may have over a property that they do not own, based on continuous and open use of the property. This concept is rooted in the principle of adverse possession, allowing a person to claim ownership of land under certain conditions. To successfully claim adverse property rights, the individual must demonstrate that their use of the property is exclusive, continuous, and without the permission of the actual owner for a specified period, which varies by state.

Steps to Complete a Notice to Claim Adverse Possession

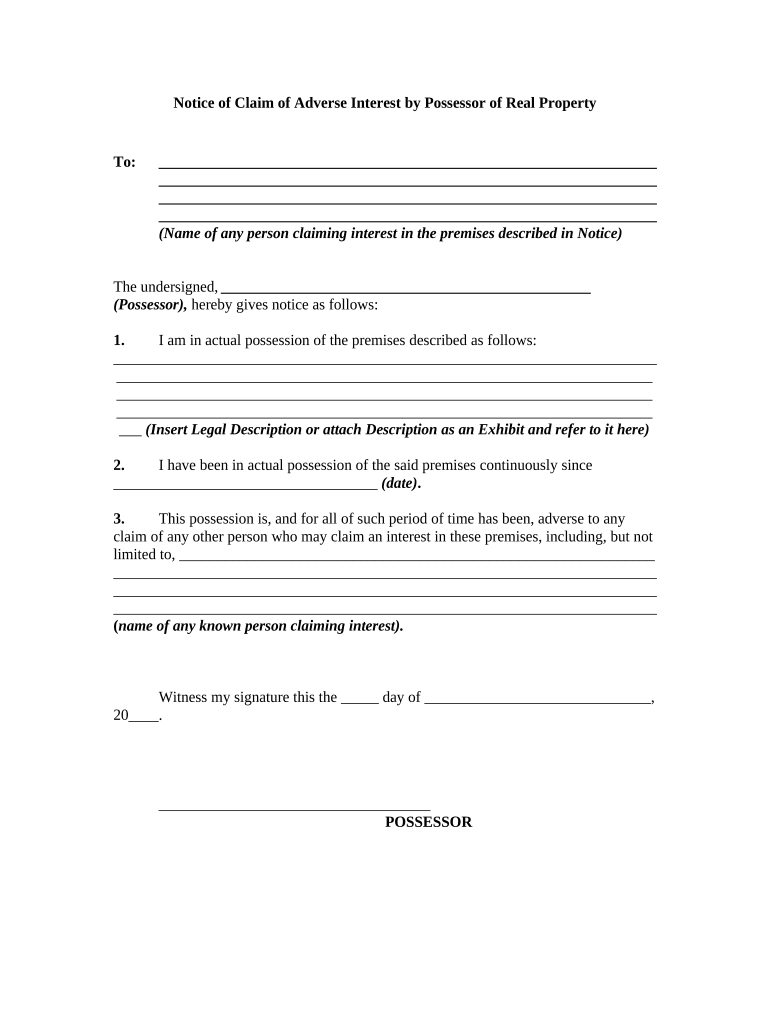

Filing a notice to claim adverse possession involves several key steps:

- Gather necessary documentation proving your use of the property, including photographs and witness statements.

- Complete the notice to claim form, ensuring all required information is accurately filled out.

- Submit the notice to the appropriate local government office, such as the county recorder or assessor's office.

- Keep a copy of the submitted notice for your records, along with any confirmation of receipt from the office.

Legal Use of the Notice to Claim Adverse Possession

The legal use of a notice to claim adverse possession is crucial for establishing a valid claim to property rights. This notice serves as a formal declaration of your intent to claim ownership based on adverse possession. It is important to ensure that the notice complies with state-specific laws, as requirements can vary significantly. Consulting with a legal professional may be beneficial to navigate the complexities of property law and ensure that your claim is valid.

Required Documents for Filing an Adverse Claim

When filing an adverse claim, certain documents are typically required to support your application. These may include:

- A completed notice to claim adverse possession form.

- Proof of continuous and exclusive use of the property, such as utility bills or tax records.

- Witness statements or affidavits attesting to your use of the property.

- Any relevant photographs or maps that illustrate your use and occupancy of the property.

State-Specific Rules for Adverse Possession Claims

Each state in the U.S. has its own rules governing adverse possession claims. These rules dictate the duration of possession required, the type of use that qualifies, and the process for filing a claim. For example, some states may require a period of continuous possession for as little as five years, while others may require ten years or more. Understanding your state's specific regulations is essential to successfully navigating the adverse possession process.

Penalties for Non-Compliance with Adverse Claim Procedures

Failing to comply with the necessary procedures when filing an adverse claim can lead to various penalties. These may include the dismissal of your claim, potential legal action from the property owner, or even fines. It is vital to adhere to all filing requirements and deadlines to protect your interests and ensure that your claim is recognized legally.

Quick guide on how to complete adverse action notice

Complete Adverse Action Notice effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Adverse Action Notice on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Adverse Action Notice smoothly

- Locate Adverse Action Notice and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in a few clicks from any device you prefer. Modify and eSign Adverse Action Notice and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is adverse real property and how does it affect my business?

Adverse real property refers to real estate that is subject to claims or issues that could impact ownership or use. Businesses dealing with such properties need to address these issues promptly to avoid legal complications. airSlate SignNow helps streamline the documentation process, ensuring that you can manage agreements related to adverse real property efficiently.

-

How can airSlate SignNow assist with documentation for adverse real property?

airSlate SignNow simplifies the process of creating, sending, and signing documents related to adverse real property. With customizable templates and easy eSigning, you can ensure that your contracts and agreements are legally binding and compliant. This efficiency helps mitigate risks associated with adverse real property.

-

What is the pricing structure for using airSlate SignNow for adverse real property transactions?

airSlate SignNow offers a flexible pricing structure to accommodate various business needs, including those involved in adverse real property transactions. You can choose from different plans based on the number of users and features required. This cost-effective solution ensures you can manage real estate documentation without exceeding your budget.

-

Does airSlate SignNow offer integrations relevant to managing adverse real property?

Yes, airSlate SignNow seamlessly integrates with various platforms that are crucial for managing adverse real property. Whether you're using CRM systems, file storage, or project management tools, our integrations enhance your workflows. This connectivity allows you to efficiently handle all aspects related to adverse real property.

-

What are the main benefits of using airSlate SignNow for adverse real property agreements?

The main benefits of using airSlate SignNow for adverse real property agreements include enhanced efficiency, improved accuracy, and legal compliance. Our platform reduces the time spent on paperwork, allowing you to focus on addressing any issues with the property. Additionally, it ensures that all parties are on the same page with clear and verifiable documents.

-

Is airSlate SignNow secure for handling sensitive information related to adverse real property?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to adverse real property are protected. We use advanced encryption and regular security audits to safeguard your data. Trust us to keep your sensitive information secure while you manage important real estate transactions.

-

Can I customize documents for adverse real property using airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of documents related to adverse real property. You can create templates specifically tailored to your needs, adding fields for signatures, dates, and special clauses. This level of customization ensures that your agreements are precise and fit the requirements of your business transactions.

Get more for Adverse Action Notice

Find out other Adverse Action Notice

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple