Real Property Form

What is the Real Property Form

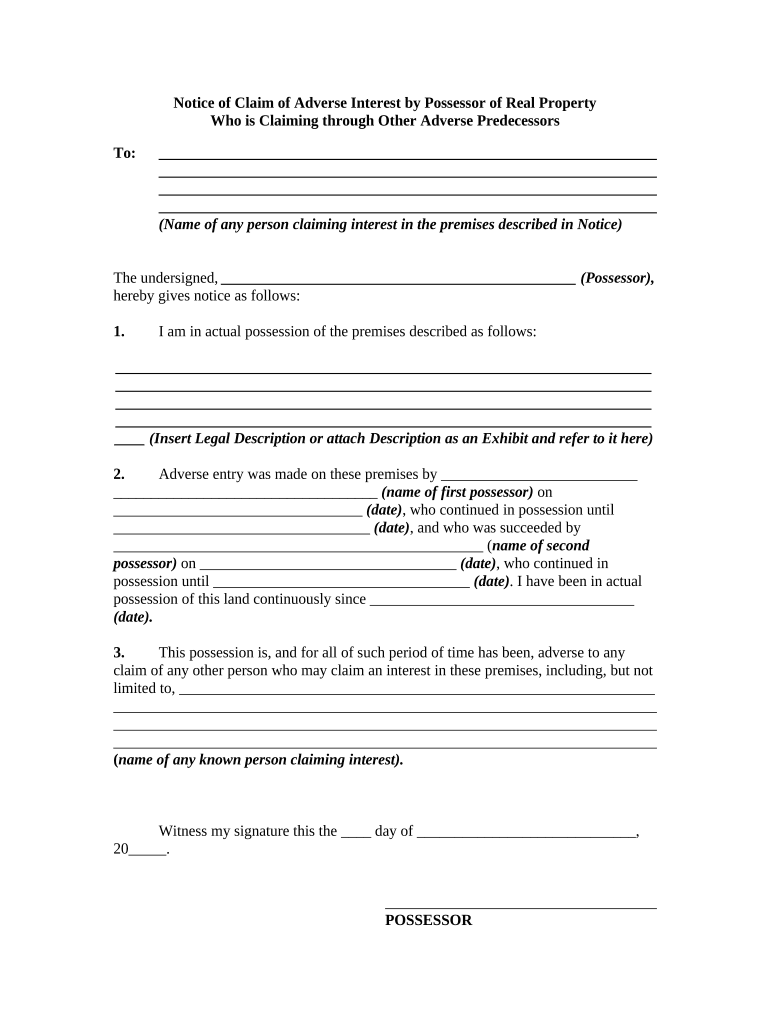

The Real Property Form is a legal document used to assert a claim of adverse property rights. This form is essential for individuals seeking to establish ownership or interest in a property that they have occupied without the permission of the original owner. It serves to notify the property owner and relevant authorities of the claimant's intention to claim rights over the property, often based on principles of adverse possession.

How to use the Real Property Form

Using the Real Property Form involves several steps to ensure that the claim is valid and recognized legally. First, the claimant must complete the form with accurate details about the property, including its location and a description of the claimant's occupancy. Next, the form should be filed with the appropriate local government office, such as the county clerk or recorder's office. It is advisable to keep copies of the submitted form for personal records and future reference.

Steps to complete the Real Property Form

Completing the Real Property Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the property, including the address and any relevant legal descriptions.

- Document the duration and nature of your occupancy, detailing how you have used the property.

- Fill out the form completely, ensuring all sections are addressed accurately.

- Sign the form in the presence of a notary public if required by state law.

- Submit the completed form to the appropriate local authority for processing.

Key elements of the Real Property Form

The Real Property Form includes several key elements that must be accurately filled out to ensure its validity. These elements typically include:

- Claimant's Information: Name, address, and contact details of the person filing the claim.

- Property Description: A detailed description of the property, including boundaries and any identifying information.

- Duration of Occupancy: The length of time the claimant has occupied the property.

- Nature of Use: Explanation of how the property has been used during the claim period.

Legal use of the Real Property Form

The Real Property Form is legally binding when completed and submitted according to state regulations. It is crucial for claimants to understand their state's laws regarding adverse possession, as these laws dictate the requirements for a claim to be valid. Proper use of the form helps protect the claimant's rights and provides a legal basis for asserting ownership or interest in the property.

State-specific rules for the Real Property Form

Each state in the U.S. has its own rules governing the use of the Real Property Form and the process for claiming adverse property rights. Claimants should research their specific state's requirements, including the necessary time period for occupancy, the type of use that qualifies, and any additional documentation that may be needed. Understanding these rules is essential for successfully filing a claim.

Quick guide on how to complete real property form 497329598

Complete Real Property Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and without hindrance. Manage Real Property Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Real Property Form with ease

- Find Real Property Form and then click Get Form to initiate.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Real Property Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are adverse property rights?

Adverse property rights refer to a legal doctrine allowing someone to claim ownership of a property that they do not legally own by demonstrating continuous and open use of the property over a specified period. Understanding these rights is crucial for businesses navigating property transactions and agreements.

-

How can airSlate SignNow help with managing adverse property rights documentation?

airSlate SignNow simplifies the management of documents related to adverse property rights by providing a secure platform for electronic signatures and document sharing. This ensures that agreements and notices concerning adverse property rights are legally binding and easily accessible.

-

Does airSlate SignNow offer features for dispute resolution concerning adverse property rights?

Yes, airSlate SignNow offers features that facilitate dispute resolution by enabling users to sign and share documents related to adverse property rights quickly and securely. The platform's audit trail helps track all modifications and agreements made, ensuring transparency in the resolution process.

-

What pricing plans does airSlate SignNow offer for small businesses dealing with adverse property rights?

airSlate SignNow provides competitive pricing plans tailored for small businesses. These plans include features essential for handling adverse property rights documentation, ensuring you receive a cost-effective solution without compromising the quality of service.

-

Can airSlate SignNow integrate with other platforms related to adverse property rights management?

Yes, airSlate SignNow integrates seamlessly with various third-party applications and platforms commonly used in property management and legal processes. This integration allows users to streamline their workflows and effectively manage documentation related to adverse property rights.

-

What are the benefits of using airSlate SignNow for managing adverse property rights agreements?

Using airSlate SignNow to manage adverse property rights agreements offers several benefits, including enhanced security, increased efficiency, and reduced costs. The platform's user-friendly interface and electronic signature capabilities make it easier to handle important documents quickly.

-

Is airSlate SignNow legally compliant for documents related to adverse property rights?

Absolutely, airSlate SignNow complies with all legal standards and regulations for electronic signatures, ensuring that documents related to adverse property rights are enforceable in court. This compliance provides peace of mind for users in managing their legal documents.

Get more for Real Property Form

- Dmv form 1528

- Missouri form 8821 authorization for release of confidential information

- Affidavit of affixation form 5312 missouri department of revenue dor mo

- Affidavit mo 2018 2019 form

- R 1096 sales tax exemption certificate certcapture form

- Tax alaska 6967165 form

- Instructions for the 2017 alaska salmon production report form

- 4572 electronic filing trading partner agreement tpa form

Find out other Real Property Form

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy