Continuing Guaranty Form

What is the Continuing Guaranty

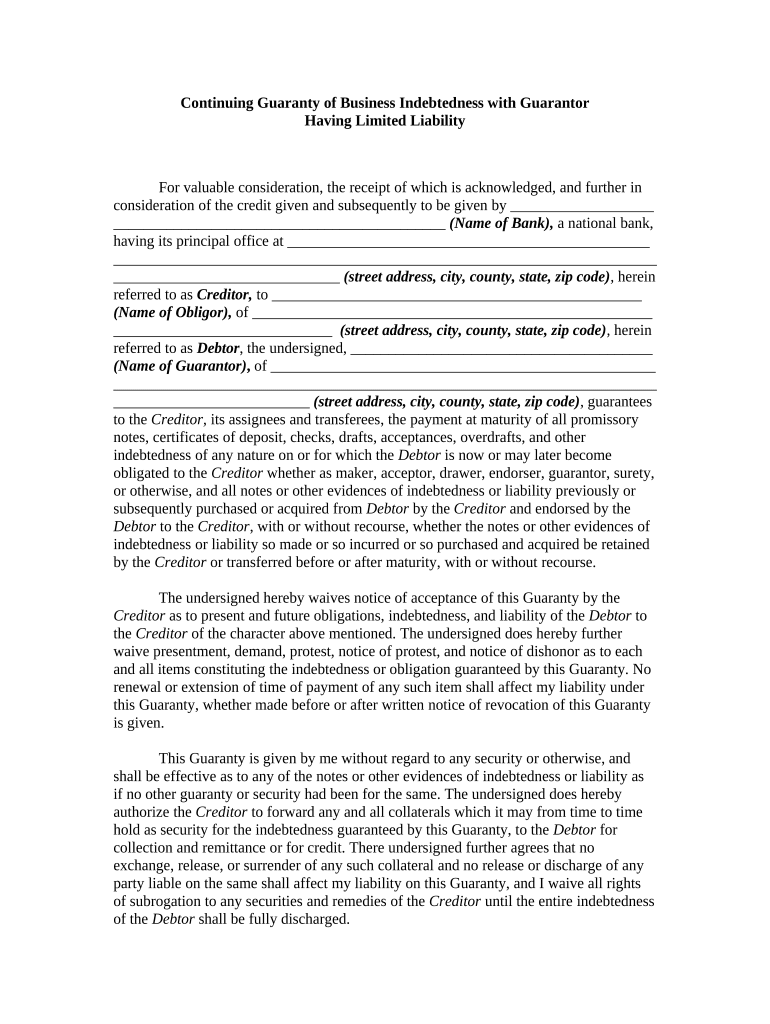

A continuing guaranty is a legal agreement where one party (the guarantor) agrees to be responsible for the debts or obligations of another party (the principal) to a third party (the creditor). This type of guaranty remains in effect until it is revoked or the obligations are fulfilled. It is commonly used in business transactions, particularly in loans and credit agreements, providing assurance to creditors that they will receive payment even if the principal defaults.

Key elements of the Continuing Guaranty

Understanding the key elements of a continuing guaranty is crucial for both guarantors and creditors. Essential components include:

- Parties Involved: Identification of the guarantor, principal, and creditor.

- Scope of Guarantee: Clear definition of the obligations covered by the guaranty, including any limits on the amount guaranteed.

- Duration: Specification of how long the guaranty remains in effect, typically until the obligations are satisfied or the guaranty is formally revoked.

- Legal Compliance: Adherence to applicable laws and regulations governing guaranties in the state where the agreement is executed.

Steps to complete the Continuing Guaranty

Completing a continuing guaranty involves several important steps to ensure that the document is legally binding and effective. These steps include:

- Drafting the Document: Clearly outline the terms of the guaranty, including the obligations being guaranteed.

- Reviewing the Terms: Both the guarantor and the creditor should review the terms to ensure mutual understanding and agreement.

- Signing the Guaranty: The guarantor must sign the document, ideally in the presence of a witness or notary to enhance its legality.

- Storing the Document: Keep a copy of the signed guaranty in a secure location for future reference.

Legal use of the Continuing Guaranty

The legal use of a continuing guaranty is governed by state laws, which may vary. Generally, for a continuing guaranty to be enforceable, it must meet specific legal requirements, including:

- Written Agreement: The guaranty must be in writing to be enforceable under the Statute of Frauds.

- Clear Terms: The obligations of the guarantor should be clearly defined to avoid ambiguity.

- Consideration: There must be consideration, meaning the guarantor receives something of value in exchange for their promise.

How to use the Continuing Guaranty

Using a continuing guaranty effectively requires understanding its application in various scenarios. It is commonly employed in:

- Loan Agreements: Creditors may require a continuing guaranty from a third party to secure repayment of loans.

- Commercial Leases: Landlords often request a continuing guaranty from business owners to ensure rent payments.

- Supplier Contracts: Suppliers may seek a guaranty to mitigate the risk of non-payment by a business customer.

Examples of using the Continuing Guaranty

Practical examples of a continuing guaranty can illustrate its significance. For instance:

- A small business owner may provide a continuing guaranty to secure a line of credit for inventory purchases.

- A parent might sign a continuing guaranty for their child's student loan, ensuring repayment if the child defaults.

- A partnership may require a continuing guaranty from one of its members to secure a lease for business premises.

Quick guide on how to complete continuing guaranty

Effortlessly Prepare Continuing Guaranty on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Continuing Guaranty on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

Edit and eSign Continuing Guaranty with Ease

- Obtain Continuing Guaranty and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the document or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of sifting through forms, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Continuing Guaranty and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a continuing guaranty, and how does it work?

A continuing guaranty is a legal agreement where a guarantor agrees to take responsibility for another party's obligations under a contract. In the context of airSlate SignNow, this allows businesses to securely send, sign, and manage documents that require such guarantees, ensuring seamless compliance and support in financial transactions.

-

How can airSlate SignNow help with the management of continuing guaranty documents?

airSlate SignNow streamlines the process of managing continuing guaranty documents by providing a user-friendly platform for electronic signatures. With our solution, users can easily create, send, and store these important contracts securely, reducing paperwork and enhancing efficiency in business operations.

-

Is there a pricing plan for businesses needing a continuing guaranty?

Yes, airSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes needing a continuing guaranty. Our plans are competitively priced to provide excellent value while giving you access to advanced features tailored to manage and execute legal documents with ease.

-

What key features does airSlate SignNow offer for continuing guaranty agreements?

Key features for managing continuing guaranty agreements on airSlate SignNow include customizable templates, real-time tracking, and secure electronic signatures. These features enhance your ability to create legally binding documents quickly and efficiently, while maintaining compliance throughout the process.

-

Are there any benefits to using airSlate SignNow for continuing guaranty documentation?

Using airSlate SignNow for continuing guaranty documentation provides benefits such as increased efficiency, reduced turnaround times, and improved security of documents. The platform ensures that all transactions are securely stored and easily accessible, giving you peace of mind and more time to focus on your business.

-

Can airSlate SignNow integrate with other business tools for managing continuing guaranty?

Absolutely! airSlate SignNow offers integrations with various business tools and software, allowing you to manage your continuing guaranty documents seamlessly alongside your existing workflows. This integration capability enhances productivity and streamlines processes, making your operations more efficient.

-

How does the electronic signature process work for a continuing guaranty in airSlate SignNow?

The electronic signature process for a continuing guaranty in airSlate SignNow is simple and secure. Users can upload their documents, specify signers, and send requests for signatures, all within the platform. This process ensures that all parties can sign quickly and securely from any device, anywhere.

Get more for Continuing Guaranty

- Maxpreps basketball stat sheet printable form

- Hotel registration form

- Grocery list template printable form

- League waiver form

- Dj paul peterson contract 2012indd high energy dj service form

- Distributor application form

- Entry form amp artist contract the mann art gallery mannartgallery

- Permission slip form

Find out other Continuing Guaranty

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF