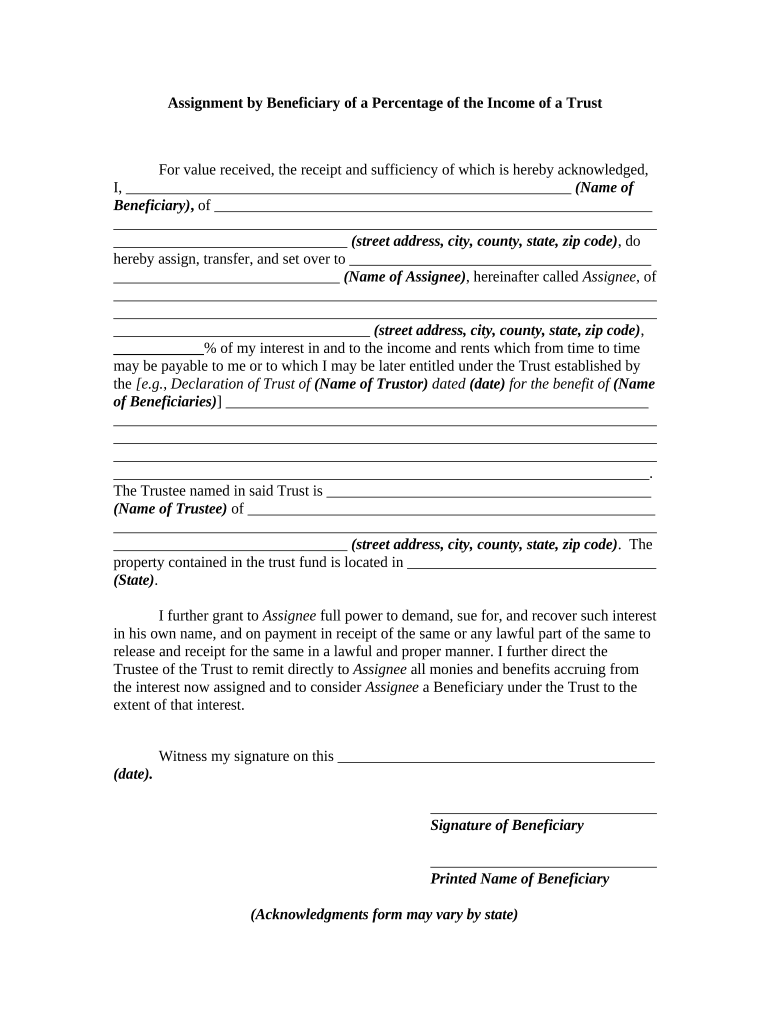

Beneficiary Income Form

What is the Beneficiary Income

Beneficiary income refers to the earnings generated from assets held in a trust or estate that are designated for the benefit of a specific individual or group. This income can include dividends, interest, rental income, and other financial returns. Understanding beneficiary income is crucial for both trustees and beneficiaries, as it impacts tax obligations and the distribution of funds. The IRS has specific guidelines on how this income should be reported, especially in cases where the primary income beneficiary of a trust passes away.

How to use the Beneficiary Income

Using beneficiary income effectively involves understanding how it is reported and distributed. Beneficiaries typically receive income distributions according to the terms set forth in the trust document. It is important for beneficiaries to keep accurate records of all income received, as this information will be necessary for tax reporting. Additionally, beneficiaries should consult with financial advisors or tax professionals to ensure compliance with IRS regulations regarding the reporting of this income.

Steps to complete the Beneficiary Income

Completing the beneficiary income form requires careful attention to detail. Here are the key steps:

- Gather necessary documentation, including trust agreements and financial statements.

- Identify the income sources and calculate the total beneficiary income for the reporting period.

- Fill out the beneficiary income form accurately, ensuring all figures match the supporting documents.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate tax authority by the specified deadline.

IRS Guidelines

The IRS provides specific guidelines on how beneficiary income should be reported for tax purposes. Beneficiaries must report income received from trusts on their individual tax returns. The IRS requires that beneficiaries receive a Schedule K-1 form from the trust, which outlines the income distributed to them. It is essential for beneficiaries to understand these guidelines to avoid potential penalties or issues with compliance.

Legal use of the Beneficiary Income

The legal use of beneficiary income is governed by both state and federal laws. Beneficiaries have the right to receive income as stipulated in the trust document, and trustees are obligated to manage the trust in accordance with these legal requirements. It is important for both parties to understand their rights and responsibilities to ensure that the trust operates smoothly and in compliance with applicable laws.

Required Documents

To accurately report beneficiary income, certain documents are required. These include:

- Trust agreement or will outlining the terms of the trust.

- Financial statements detailing income generated from trust assets.

- Schedule K-1 form provided by the trust to report distributions to beneficiaries.

- Any additional documentation that supports income calculations, such as bank statements or investment reports.

Quick guide on how to complete beneficiary income 497329768

Finish Beneficiary Income seamlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and electronically sign your documents swiftly without delays. Handle Beneficiary Income on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Beneficiary Income with ease

- Obtain Beneficiary Income and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Beneficiary Income, ensuring excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is beneficiary income and how does it work in airSlate SignNow?

Beneficiary income refers to the funds received by individuals from a trust or another entity upon the death of a benefactor. In airSlate SignNow, you can create and manage legally binding documents that facilitate the transfer of beneficiary income with secure electronic signatures.

-

How can airSlate SignNow help with managing beneficiary income documentation?

airSlate SignNow provides businesses with tools to swiftly prepare, sign, and store beneficiary income documents. With our user-friendly interface, you can streamline the document management process, ensuring timely and secure transactions related to beneficiary income.

-

Is there a cost associated with using airSlate SignNow for beneficiary income management?

Yes, airSlate SignNow offers various pricing plans to cater to your needs. These plans are cost-effective, especially for managing beneficiary income documents, as they reduce turnaround time and enhance workflow efficiency.

-

Can I integrate airSlate SignNow with other platforms for beneficiary income management?

Absolutely! airSlate SignNow offers seamless integration with several platforms, enabling you to manage beneficiary income documents alongside your existing workflows. This ensures that you can maintain organizational efficiency without sacrificing the quality of your documentation processes.

-

What are the key features of airSlate SignNow that benefit beneficiary income documentation?

Key features include customizable templates, secure eSignature capabilities, and automated workflows. These features collectively enhance the management of beneficiary income documents by providing speed, security, and compliance.

-

How does airSlate SignNow ensure the security of beneficiary income documents?

airSlate SignNow prioritizes document security with bank-level encryption and compliance with industry standards. This ensures that sensitive beneficiary income information is kept safe and confidential throughout the signing process.

-

Can airSlate SignNow help reduce the turnaround time for beneficiary income documentation?

Yes, using airSlate SignNow signNowly reduces the turnaround time for beneficiary income documentation. Our platform enables quick collaboration, rapid eSigning, and efficient document routing, ensuring that you can handle beneficiary income matters swiftly and effectively.

Get more for Beneficiary Income

- State of oregon contractor tools new home warranties oregongov form

- Motion for expungement instruction sheet state of south dakota form

- Transmutation or postnuptial agreement to convert communityproperty into separate property form

- Takoma park standard residential lease form english aws

- This agreement was created solely by d form

- Procedure for enforcing foreign state federal and foreign country form

- Building maintenance service agreement form

- Form 16b 11

Find out other Beneficiary Income

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure