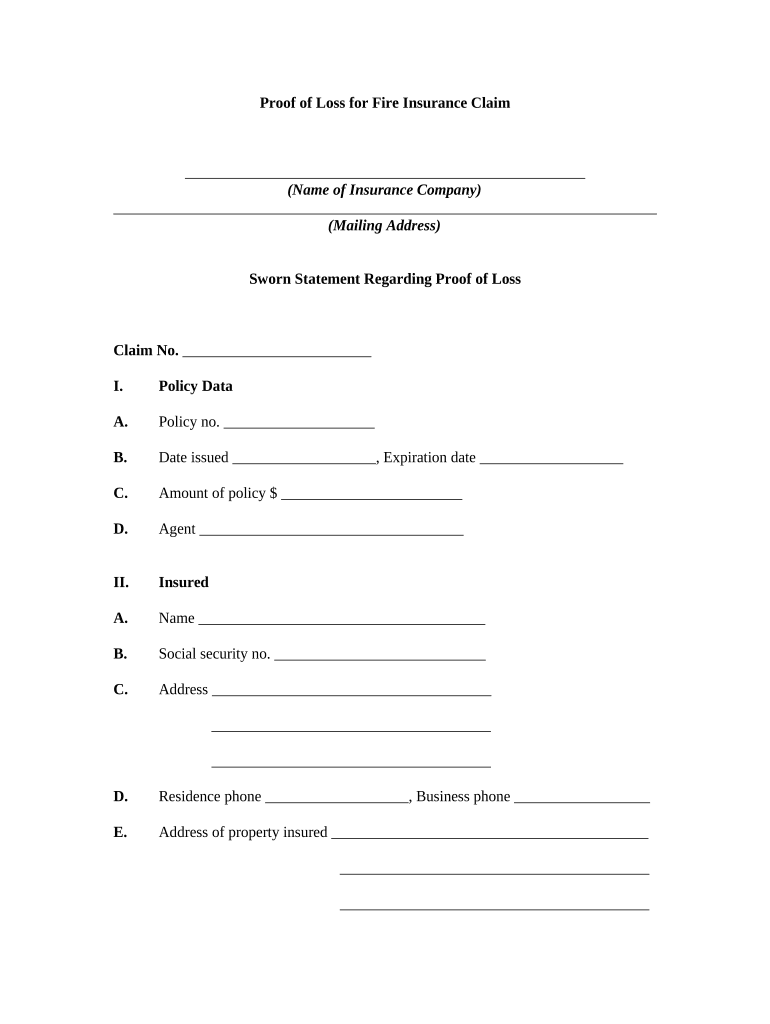

Fire Claim Form

What is the lost wage form?

The lost wage form is a crucial document used primarily in insurance claims to report and verify income loss due to an incident, such as an accident or illness. This form is essential for individuals seeking compensation for wages they were unable to earn during their recovery period. It typically requires detailed information about the claimant's employment status, income, and the duration of the absence from work. By accurately completing this form, claimants can substantiate their financial losses and facilitate the claims process with their insurance provider.

Steps to complete the lost wage form

Completing the lost wage form involves several important steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather necessary documentation: Collect pay stubs, tax returns, and employer statements that reflect your income.

- Provide personal information: Fill in your full name, contact details, and Social Security number.

- Detail your employment history: Include your job title, employer's name, and the dates of employment.

- Specify the incident: Clearly describe the event that caused your wage loss, including dates and circumstances.

- Calculate lost wages: Accurately compute the total amount of wages lost during your absence, including any overtime or bonuses.

- Review and sign: Ensure all information is correct, then sign and date the form to validate your claim.

Required documents for the lost wage form

When submitting a lost wage form, certain documents are typically required to support your claim. These may include:

- Pay stubs: Recent pay stubs that demonstrate your earnings prior to the incident.

- Employer verification letter: A letter from your employer confirming your employment status and the duration of your absence.

- Tax returns: Previous year’s tax returns can provide a comprehensive view of your income.

- Medical records: Documentation from healthcare providers that outlines your condition and treatment timeline.

Form submission methods

The lost wage form can typically be submitted through various methods, depending on the requirements of your insurance provider. Common submission methods include:

- Online submission: Many insurers offer digital platforms for submitting forms directly through their websites.

- Mail: You can print the completed form and send it via postal service to the designated claims address.

- In-person submission: Some claimants may prefer to deliver their forms in person at their insurance company’s local office.

Legal use of the lost wage form

The lost wage form is legally binding, meaning that the information provided must be accurate and truthful. Misrepresentation or falsification of information can lead to penalties, including denial of the claim or legal repercussions. It is important to understand that this form serves as a formal declaration of your financial losses and is often subject to verification by the insurance company. Adhering to legal guidelines ensures that your claim is processed smoothly and efficiently.

Eligibility criteria for the lost wage form

To qualify for compensation using the lost wage form, certain eligibility criteria must be met. Typically, these include:

- Employment status: You must be an employee at the time of the incident, not a contractor or freelancer.

- Documented income loss: You need to provide evidence of lost wages due to an incident covered by your insurance policy.

- Duration of absence: The period for which you are claiming lost wages must align with the time you were unable to work due to the incident.

Quick guide on how to complete fire claim

Effortlessly prepare Fire Claim on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Handle Fire Claim on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Fire Claim with minimal effort

- Locate Fire Claim and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and select the Done button to save your modifications.

- Decide how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Fire Claim and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lost wage form?

A lost wage form is a document used to request compensation for lost income due to various reasons such as injury or illness. It helps individuals provide necessary details to their employers or insurance companies to facilitate payment. By using airSlate SignNow, you can complete and eSign your lost wage form quickly and efficiently.

-

How can airSlate SignNow help with my lost wage form?

airSlate SignNow allows you to create, customize, and electronically sign your lost wage form with ease. Its user-friendly interface streamlines the process, ensuring that your form is completed accurately and quickly. Plus, you can track the status of your document to keep everyone informed.

-

Is there a cost associated with using the lost wage form feature?

airSlate SignNow offers a range of pricing plans, including options suitable for individual users and businesses. Depending on your needs, you can select a plan that provides access to the lost wage form feature at a competitive price. Free trials are also available to test the service before committing.

-

Can I integrate my lost wage form with other applications?

Yes, airSlate SignNow supports integration with various applications, enhancing your productivity. You can connect your lost wage form with tools like Google Drive, Dropbox, and CRM systems, making it easier to manage your documents and workflow. This flexibility ensures that you can keep all your important information organized.

-

What benefits does airSlate SignNow offer for managing lost wage forms?

Using airSlate SignNow for your lost wage forms provides numerous benefits, including speed, efficiency, and enhanced security. The platform ensures that your forms are completed and signed in a timely manner, reducing delays in compensation. Moreover, advanced encryption keeps your sensitive information secure throughout the process.

-

How do I start using the lost wage form feature?

To start using the lost wage form feature, simply sign up for an account on airSlate SignNow. Once registered, you can easily access templates for lost wage forms and customize them to fit your requirements. The intuitive platform guides you through each step, making the process straightforward.

-

Is it safe to use airSlate SignNow for my lost wage form?

Absolutely! airSlate SignNow implements robust security measures, including encryption and secure cloud storage, to protect your lost wage forms and sensitive information. Users can confidently eSign documents without worrying about data bsignNowes or unauthorized access.

Get more for Fire Claim

- Sample defamation complaint form national paralegal college

- Agreement to redeem interest of a single member in an llc form

- This lease made this day of 20 cambridge mn form

- Daily transcript form

- Motion to remedy prosecutorial abuse form

- Sample lease agreement university of nevada reno form

- Marion county local court rules ingov form

- Post conviction relief practice ingov form

Find out other Fire Claim

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF