Wv it 140x Fill in Form

What is the WV IT 140X Fill In Form

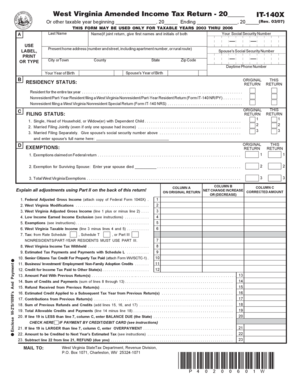

The WV IT 140X fill in form is the official document used by taxpayers in West Virginia to amend their state income tax returns. This form allows individuals to correct errors or make changes to previously filed returns, ensuring accurate reporting of income, deductions, and credits. It is specifically designed for those who need to update their tax information for any given tax year, including the years 2017, 2020, and others.

Steps to Complete the WV IT 140X Fill In Form

Completing the WV IT 140X fill in form involves several key steps:

- Obtain the form: Access the WV IT 140X from the West Virginia State Tax Department's website or other official sources.

- Review your original return: Gather your original tax return and any relevant documents to identify the necessary corrections.

- Fill in the form: Input the correct information in the designated fields, ensuring accuracy in all entries.

- Provide explanations: If applicable, include a brief explanation of the changes being made to clarify your amendments.

- Sign and date the form: Ensure that you sign and date the form to validate your submission.

- Submit the form: Follow the submission methods available, whether online, by mail, or in person.

Legal Use of the WV IT 140X Fill In Form

The WV IT 140X fill in form is legally recognized for amending tax returns in West Virginia. To ensure compliance with state regulations, it is essential to complete the form accurately and submit it within the designated time frame. The form must be signed by the taxpayer or their authorized representative to be considered valid. Adhering to the legal requirements helps prevent potential penalties or issues with the West Virginia State Tax Department.

Form Submission Methods

Taxpayers have multiple options for submitting the WV IT 140X fill in form:

- Online submission: Utilize the West Virginia State Tax Department's online portal for electronic filing.

- Mail: Send the completed form to the appropriate address provided by the state tax authority.

- In-person: Visit a local tax office to submit the form directly and receive immediate assistance if needed.

Required Documents

When completing the WV IT 140X fill in form, taxpayers should gather the following documents:

- Original tax return for the year being amended.

- Supporting documents related to the changes, such as W-2s, 1099s, or receipts for deductions.

- Any correspondence from the West Virginia State Tax Department regarding the original return.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the WV IT 140X fill in form. Generally, taxpayers must submit their amended returns within three years from the original filing date or within two years from the date the tax was paid, whichever is later. Staying informed about these deadlines helps ensure compliance and avoids penalties.

Quick guide on how to complete wv it 140x fill in form

Complete Wv It 140x Fill In Form effortlessly on any gadget

Web-based document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Wv It 140x Fill In Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign Wv It 140x Fill In Form without hassle

- Locate Wv It 140x Fill In Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about missing or lost files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choosing. Edit and eSign Wv It 140x Fill In Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv it 140x fill in form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a West Virginia amended tax return?

A West Virginia amended tax return is a modified version of your original state tax return that corrects errors or makes changes to your filing information. This document can help you claim additional deductions, correct reported income, or fix any mistakes on your original return to ensure accurate tax reporting.

-

How can airSlate SignNow assist with filing a West Virginia amended tax return?

airSlate SignNow simplifies the process of preparing and submitting your West Virginia amended tax return by allowing you to easily eSign and send documents electronically. With its user-friendly interface, you can manage your tax forms efficiently and ensure that they are submitted timely and securely.

-

What are the costs associated with filing a West Virginia amended tax return using airSlate SignNow?

Using airSlate SignNow to handle your West Virginia amended tax return is cost-effective, with various pricing plans to suit your business needs. You can choose from different subscription options, ensuring you pay only for the features that enhance your tax filing experience.

-

Are there features specifically designed for managing a West Virginia amended tax return?

Yes, airSlate SignNow offers features tailored for managing your West Virginia amended tax return, including document tracking, reminders for filing deadlines, and secure eSigning options. These tools help streamline your tax preparation process and keep your filing organized.

-

What benefits does airSlate SignNow provide for businesses filing a West Virginia amended tax return?

Employing airSlate SignNow for your West Virginia amended tax return offers numerous benefits, such as reduced paperwork and faster turnaround times. The electronic platform enhances accuracy and ensures that all your tax documents are securely stored and easily accessible whenever you need them.

-

Can I integrate airSlate SignNow with other software for filing a West Virginia amended tax return?

Absolutely! airSlate SignNow supports various integrations with popular accounting and tax preparation software, making it easier to file your West Virginia amended tax return. This integration streamlines your workflow, allowing you to import data directly and reduce manual entry errors.

-

Is the process for filing a West Virginia amended tax return straightforward with airSlate SignNow?

Yes, the process for filing your West Virginia amended tax return with airSlate SignNow is designed to be user-friendly. Simply upload your amended return, add the necessary information, eSign, and submit it directly through the platform, minimizing hassle and time spent on paperwork.

Get more for Wv It 140x Fill In Form

- Doh 301 marriage certificate form town of jackson new york

- Nn7000e form

- Ccmis phs 1345 form

- Bdvr 108 form

- Form i 9 employment eligibility verification barry university barry

- Legal for service contract template form

- Football player contract template 787751797 form

- Football team contract template form

Find out other Wv It 140x Fill In Form

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document