Debt Collector Not Form

What is the Debt Collector Not

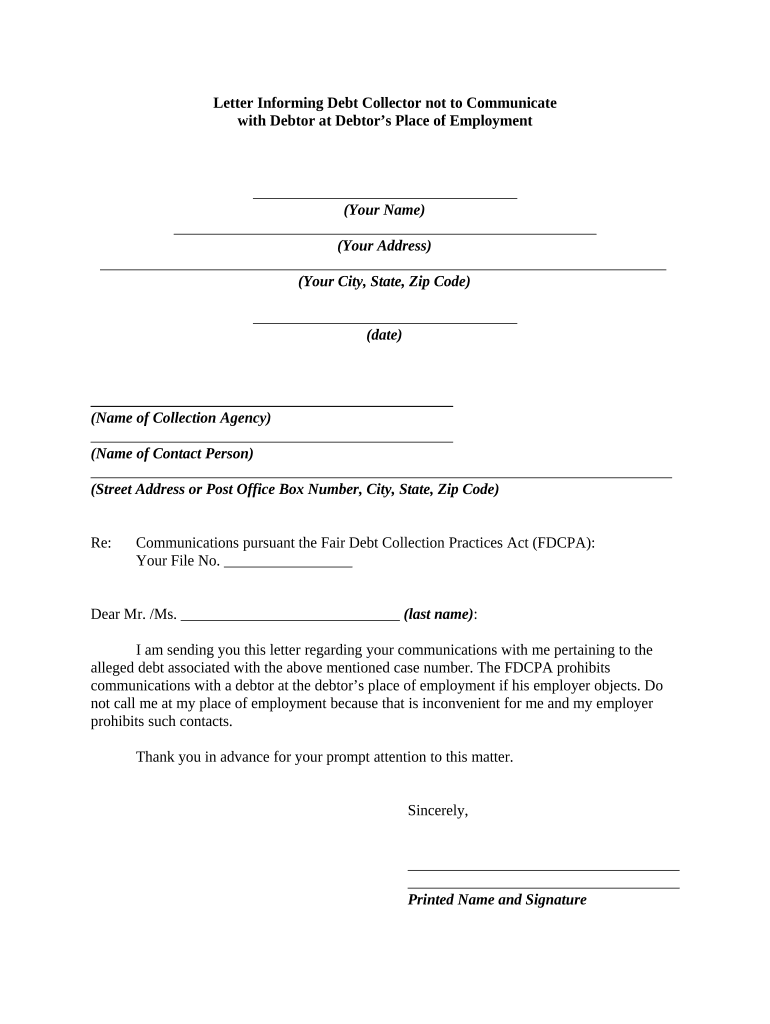

The Debt Collector Not form serves as an important document in the context of debt collection practices. It provides a mechanism for individuals to formally communicate their objections or disputes regarding debts that they may not owe or believe to be inaccurate. This form can help protect consumers from aggressive collection tactics and ensure that their rights are upheld under the Fair Debt Collection Practices Act (FDCPA).

How to use the Debt Collector Not

Using the Debt Collector Not form involves several straightforward steps. First, gather all relevant information regarding the debt in question, including the name of the creditor and any account numbers. Next, clearly state your reasons for disputing the debt on the form. It is essential to provide as much detail as possible to support your claims. Once completed, send the form to the debt collector via certified mail to ensure it is received and documented.

Steps to complete the Debt Collector Not

Completing the Debt Collector Not form requires careful attention to detail. Follow these steps:

- Begin by filling in your personal information, including your name, address, and contact details.

- Provide the debt collector's information, including their name and address.

- Clearly outline the debt you are disputing, including any relevant account numbers.

- Explain your reasons for disputing the debt, citing any inaccuracies or lack of validation.

- Sign and date the form to validate your dispute.

Legal use of the Debt Collector Not

The Debt Collector Not form is legally recognized under U.S. law, specifically the Fair Debt Collection Practices Act. This act protects consumers from unfair debt collection practices and allows individuals to formally dispute debts. By using this form, consumers can assert their rights and request that the debt collector cease communication until the debt is validated.

Key elements of the Debt Collector Not

Several key elements must be included in the Debt Collector Not form to ensure its effectiveness:

- Personal Information: Your name, address, and contact information.

- Debt Details: Information about the debt, including the creditor's name and account number.

- Dispute Explanation: A clear and concise statement outlining why you believe the debt is inaccurate or invalid.

- Signature: Your signature and date to authenticate the form.

State-specific rules for the Debt Collector Not

While the Debt Collector Not form is governed by federal law, some states may have additional regulations or requirements. It is important to check your state’s specific laws regarding debt collection practices. This may include additional disclosures or consumer protections that enhance your rights when disputing a debt.

Quick guide on how to complete debt collector not

Effortlessly Prepare Debt Collector Not on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to access the appropriate forms and securely store them online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without any delays. Manage Debt Collector Not on any device using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Debt Collector Not with Ease

- Obtain Debt Collector Not and click on Get Form to begin.

- Use the tools available to finalize your document.

- Emphasize key sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the information and click on the Done button to record your changes.

- Choose how you want to share your form—via email, SMS, or invite link—or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Debt Collector Not to ensure superior communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if a debt collector notifies me about a debt?

If a debt collector notifies you about a debt, it's essential to verify the legitimacy of the claim. You can request a validation notice, which a legitimate debt collector must provide. airSlate SignNow can help you securely document your communications with the collector to ensure you're protected. Always remember to know your rights when dealing with debt collectors.

-

How can airSlate SignNow help businesses communicate with debt collectors?

airSlate SignNow provides an efficient platform for businesses to send and eSign documents, ensuring clear communication with debt collectors. With our document tracking feature, you can monitor all communications regarding debts. This helps businesses maintain a professional image and avoid misunderstandings with debt collectors. Use our service to keep your records organized and accessible.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for new users to explore the platform's features. You can experience how our solution makes document management easy and cost-effective before committing. This gives you the opportunity to see how our services can help you avoid pitfalls associated with debt collectors and improve your document workflows. Sign up today to get started!

-

What features does airSlate SignNow offer to manage contracts effectively?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning. These tools enable businesses to manage contracts efficiently and ensure that all parties are on the same page. By using our platform, you can prevent issues with debt collectors not receiving the correct information or documents. Optimize your contract management today with airSlate SignNow.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications including Google Drive, Salesforce, and many more. This allows you to streamline your workflows and have all necessary documentation at your fingertips. Integrating our service with your existing software means you can avoid complications, including those related to debt collectors not accessing your records.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from a budget-friendly option. Our cost-effective solution ensures that you get all the essential features without overspending. Choosing the right plan can help your business stay organized and lessen complications with debt collectors not having clear records. Visit our pricing page to find the best fit for your organization.

-

How secure is my information with airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols to ensure that your documents and personal information are safe from unauthorized access. By using our eSigning solution, you can confidently communicate with stakeholders without worrying about debt collectors not adhering to privacy standards. Trust us to protect your data thoroughly.

Get more for Debt Collector Not

Find out other Debt Collector Not

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter