Sample Letter to an Insurance Company Form

What is the Sample Letter to an Insurance Company

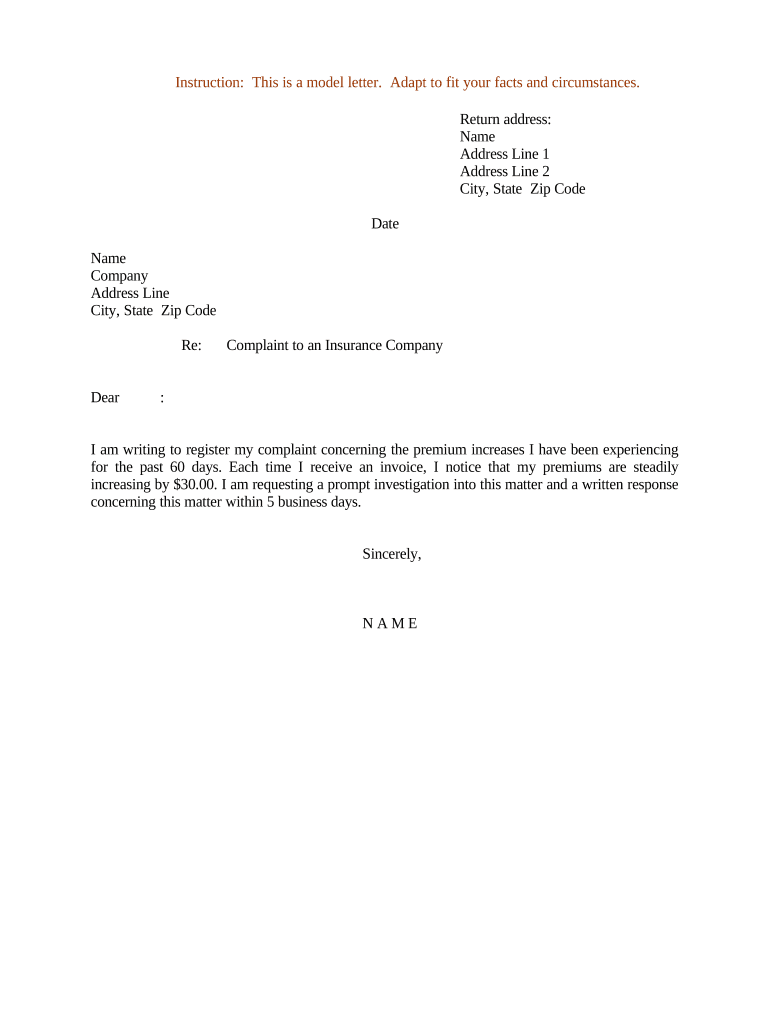

A sample letter to an insurance company serves as a template for individuals seeking to communicate specific issues or requests regarding their insurance policies. This document can be used for various purposes, including filing claims, expressing complaints, or seeking clarification on policy details. By utilizing a structured format, the letter ensures that all necessary information is presented clearly and concisely, which can facilitate a quicker response from the insurance provider.

Key Elements of the Sample Letter to an Insurance Company

When drafting a letter to an insurance company, certain key elements should be included to ensure clarity and effectiveness. These elements typically consist of:

- Your contact information: Include your full name, address, phone number, and email address.

- Policy details: Clearly state your policy number and any relevant account information.

- Date: Include the date on which you are writing the letter.

- Subject line: A brief subject line that summarizes the purpose of the letter, such as "Claim Submission" or "Complaint Regarding Policy."

- Body of the letter: Clearly articulate your issue, request, or complaint, providing any necessary details or documentation.

- Closing: End with a polite closing statement and your signature.

Steps to Complete the Sample Letter to an Insurance Company

Completing a letter to an insurance company involves several straightforward steps. Follow these guidelines to ensure your letter is effective:

- Gather all relevant information, including your policy details and any documentation related to your claim or issue.

- Begin with your contact information at the top of the letter.

- Clearly state the purpose of your letter in the subject line.

- In the body, explain your situation in a logical and organized manner, ensuring you include all necessary details.

- Review your letter for clarity and accuracy before finalizing it.

- Sign the letter and make a copy for your records.

Legal Use of the Sample Letter to an Insurance Company

The sample letter to an insurance company can have legal implications, especially if it pertains to claims or disputes. To ensure that your letter is legally binding, it is important to follow specific guidelines:

- Make sure to comply with relevant state and federal laws regarding insurance communications.

- Keep a copy of the letter and any correspondence for your records, as these may be needed for future reference or legal proceedings.

- Consider sending your letter via certified mail to obtain proof of delivery.

Examples of Using the Sample Letter to an Insurance Company

There are various scenarios in which a sample letter to an insurance company may be utilized. Some common examples include:

- Submitting a claim for damages after a car accident.

- Requesting clarification on coverage limits for a specific policy.

- Filing a complaint regarding delayed claim processing.

- Appealing a denial of coverage for a medically necessary procedure.

Form Submission Methods for the Sample Letter to an Insurance Company

Once your letter is complete, you have several options for submitting it to the insurance company. Common submission methods include:

- Online submission: Many insurance companies offer secure portals for submitting documents electronically.

- Mail: Sending the letter via traditional mail is a common method, particularly for important documents.

- In-person delivery: If convenient, you may choose to deliver the letter directly to your insurance agent or company office.

Quick guide on how to complete sample letter to an insurance company

Effortlessly prepare Sample Letter To An Insurance Company on any device

Digital document management has gained traction among both businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Sample Letter To An Insurance Company on any device via airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The simplest way to modify and eSign Sample Letter To An Insurance Company with ease

- Find Sample Letter To An Insurance Company and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Sample Letter To An Insurance Company and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the purpose of a letter to insurance company?

A letter to an insurance company is used to formally communicate about insurance claims, policy inquiries, or coverage requests. It allows you to provide necessary details and supporting documents, ensuring your request is processed efficiently. This correspondence is crucial for maintaining clear and professional communication regarding your insurance needs.

-

How can airSlate SignNow help with sending a letter to insurance company?

airSlate SignNow simplifies the process of sending a letter to an insurance company by allowing you to create, edit, and eSign documents digitally. With its user-friendly interface, you can quickly prepare your letters and send them securely, ensuring they signNow the right department in a timely manner. Plus, it helps keep track of your correspondence for future reference.

-

Is airSlate SignNow cost-effective for sending letters to insurance companies?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to send letters to insurance companies. With its affordable pricing plans, you can benefit from advanced eSignature features without breaking the bank. This means you can efficiently manage your insurance documentation without incurring signNow costs.

-

What features does airSlate SignNow offer for managing letters to insurance companies?

airSlate SignNow provides several features that enhance the process of managing letters to insurance companies. These include customizable templates, cloud storage, and real-time notifications for document status updates. With these tools, you can streamline your workflow and ensure that your letters are sent and signed promptly.

-

Can I integrate airSlate SignNow with other tools when sending a letter to insurance company?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Microsoft Office, and CRM platforms. This integration allows you to easily retrieve and send letters to insurance companies directly from your existing tools, enhancing your productivity and ensuring a smooth workflow.

-

How secure is the process of sending a letter to insurance company with airSlate SignNow?

Security is a top priority for airSlate SignNow when sending a letter to insurance company. The platform utilizes bank-level encryption and complies with industry standards to protect your sensitive information. This ensures that your correspondence with the insurance company remains confidential and secure throughout the entire process.

-

What are the benefits of using airSlate SignNow for eSigning a letter to insurance company?

Using airSlate SignNow for eSigning a letter to insurance company offers numerous benefits, including faster processing times and enhanced convenience. You can sign documents from anywhere, without needing to print or scan, saving you valuable time. Additionally, this process reduces paper waste and helps maintain an organized digital record of your correspondence.

Get more for Sample Letter To An Insurance Company

- Real estate property information form

- Metco rentals form

- Section 42 application form

- Receipt of beneficiary of estate commissioner of accounts form

- Fc tucker rental application form

- Printable 5 day notice form

- To download pre qualifying questionnaire benson form

- This is an addendum counteroffer to that real estate purchase contract the quotrepcquot with form

Find out other Sample Letter To An Insurance Company

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast