Debt Collector Communications Form

What is the Debt Collector Communications

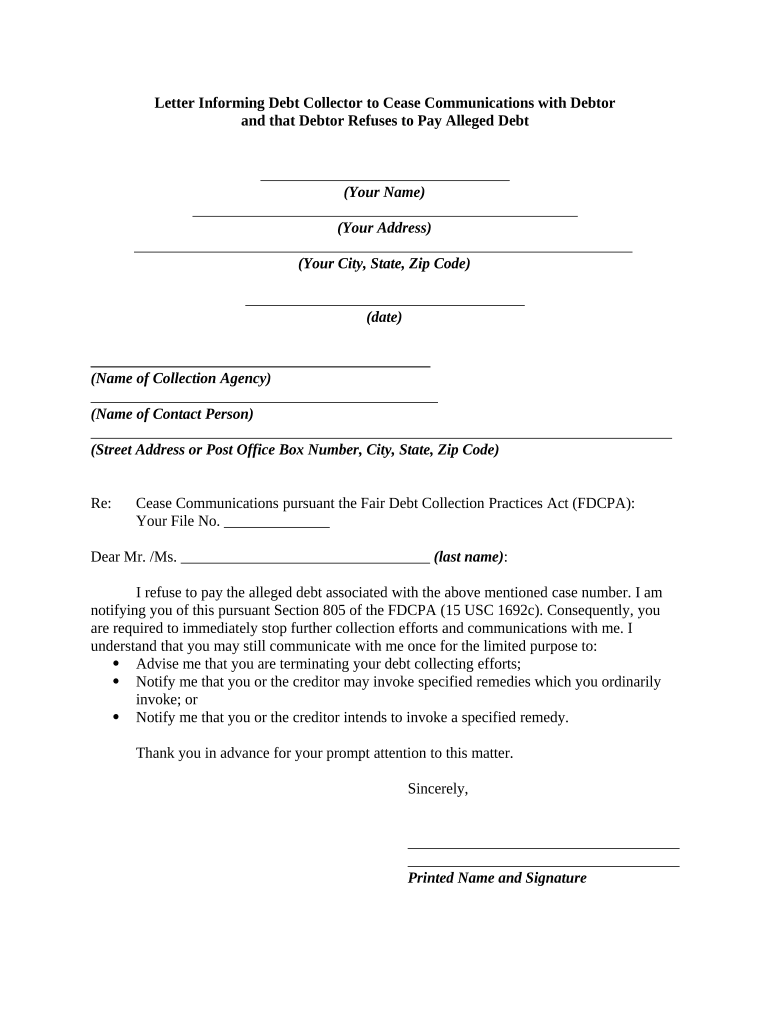

The debt collector communications form serves as a formal document used to communicate with debtors regarding outstanding debts. This form is essential for ensuring that all communications adhere to legal standards and protect the rights of both the debtor and the creditor. It typically includes details about the debt, the creditor's information, and any relevant legal disclaimers. Understanding this form is crucial for both parties to navigate the debt collection process effectively.

How to use the Debt Collector Communications

Using the debt collector communications form involves several key steps. First, gather all necessary information about the debt, including the amount owed and the debtor's contact details. Next, complete the form accurately, ensuring that all required fields are filled out. After completing the form, it can be sent to the debtor via mail or electronically, depending on the preferred method of communication. Always keep a copy for your records to maintain a clear audit trail.

Steps to complete the Debt Collector Communications

Completing the debt collector communications form requires careful attention to detail. Follow these steps for proper completion:

- Begin by entering the creditor's name and contact information at the top of the form.

- Clearly state the amount owed, including any interest or fees applicable.

- Include the debtor's name and address to ensure accurate delivery.

- Provide a brief description of the debt, including the original creditor if applicable.

- Review the form for accuracy and completeness before submission.

Legal use of the Debt Collector Communications

The legal use of the debt collector communications form is governed by various laws, including the Fair Debt Collection Practices Act (FDCPA). This act outlines the rights of debtors and the responsibilities of debt collectors. It is crucial for debt collectors to ensure that their communications do not violate these regulations. Proper use of the form can help prevent legal issues and ensure that all parties are treated fairly throughout the debt collection process.

Key elements of the Debt Collector Communications

Several key elements must be included in the debt collector communications form to ensure its effectiveness and legality. These elements include:

- Creditor's name and contact information.

- Debtor's name and address.

- Detailed description of the debt, including the original amount and any accrued interest.

- Clear instructions for the debtor on how to respond or make payments.

- Legal disclaimers that inform the debtor of their rights under applicable laws.

Examples of using the Debt Collector Communications

Examples of using the debt collector communications form can vary based on the specific situation. For instance, a creditor may use this form to notify a debtor of an overdue payment, outlining the total amount due and the consequences of non-payment. Another example could involve a debt collector reaching out to a debtor to negotiate a payment plan, providing clear terms and conditions. These examples highlight the versatility of the form in different debt collection scenarios.

Quick guide on how to complete debt collector communications

Complete Debt Collector Communications effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without any interruptions. Handle Debt Collector Communications on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Debt Collector Communications without hassle

- Obtain Debt Collector Communications and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Edit and eSign Debt Collector Communications to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are debt collector communications?

Debt collector communications refer to the interactions between debt collectors and individuals regarding outstanding debts. These communications can take various forms, including phone calls, emails, and letters. Understanding these communications is crucial for consumers to manage and respond to debts effectively.

-

How can airSlate SignNow enhance debt collector communications?

airSlate SignNow offers a streamlined platform that allows businesses to send and eSign documents related to debt collection. By utilizing our solution, companies can ensure that debt collector communications are documented and legally binding. This helps in maintaining clear records and strengthens overall communications with clients and debtors.

-

Is airSlate SignNow affordable for small businesses focused on debt collection?

Yes, airSlate SignNow is a cost-effective solution suitable for small businesses involved in debt collection. Our pricing plans are designed to accommodate various budgets, ensuring that even small firms can utilize efficient debt collector communications without high costs. This affordability allows for improved communication practices without compromising on quality.

-

What features does airSlate SignNow offer for debt collector communications?

Our platform includes features such as templates for debt communication letters, secure electronic signatures, and real-time document tracking. These tools enhance the efficiency of debt collector communications by allowing quick turnaround times and ensuring compliance. Moreover, users can personalize their communications for better engagement.

-

Can airSlate SignNow integrate with other tools used for debt collection?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and accounting software that are commonly used in debt collection processes. This interoperability allows for streamlined debt collector communications and efficient management of documents across platforms. Users can enhance their workflows signNowly through these integrations.

-

What benefits can businesses expect from using airSlate SignNow for debt collector communications?

Businesses can expect improved efficiency, better transparency, and enhanced compliance when using airSlate SignNow for debt collector communications. By automating and centralizing documentation processes, businesses can reduce errors and response times. Additionally, our platform supports secure communications that protect sensitive information.

-

How does airSlate SignNow ensure security in debt collector communications?

airSlate SignNow takes security seriously with features like end-to-end encryption and secure cloud storage. This ensures that all debt collector communications are protected from unauthorized access. Our compliance with industry standards further enhances the safety of sensitive documents and communications.

Get more for Debt Collector Communications

Find out other Debt Collector Communications

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy