Application for Open End Unsecured Credit Signature Loan Form

What is the Application For Open End Unsecured Credit Signature Loan

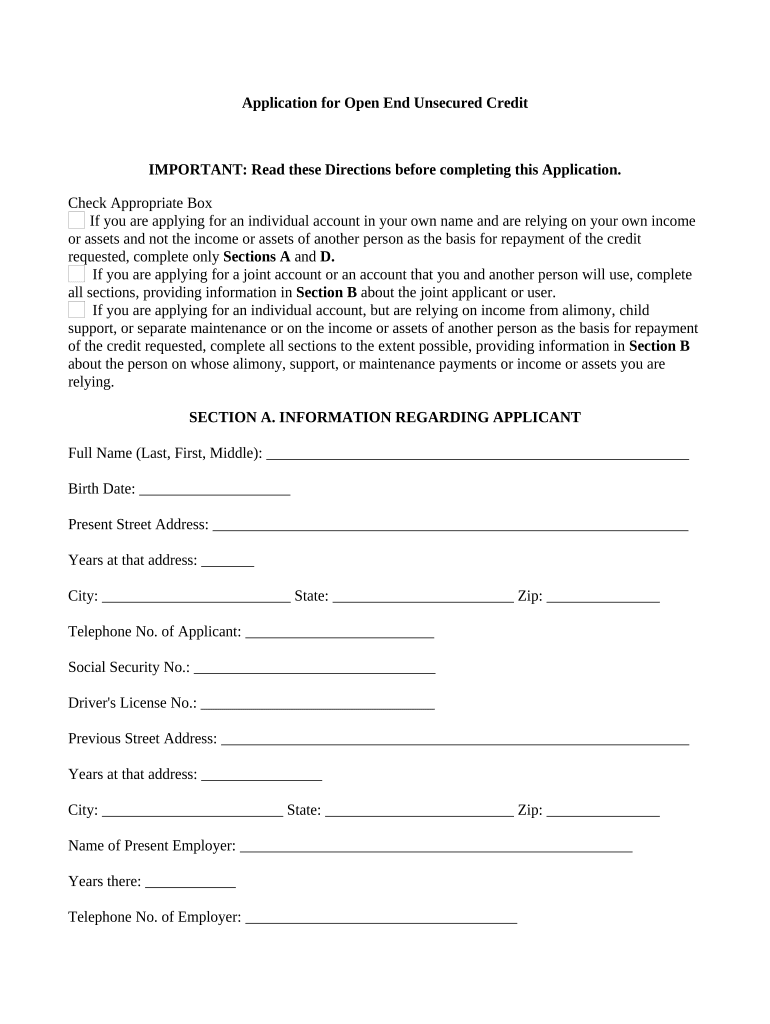

The Application For Open End Unsecured Credit Signature Loan is a financial document that individuals use to apply for a type of loan that does not require collateral. This loan allows borrowers to access funds up to a specified limit without needing to secure the loan with physical assets. It is often used for personal expenses, debt consolidation, or unexpected financial needs. This form captures essential information about the applicant's financial status, employment, and credit history, which lenders review to determine eligibility and loan terms.

Steps to Complete the Application For Open End Unsecured Credit Signature Loan

Completing the Application For Open End Unsecured Credit Signature Loan involves several key steps:

- Gather Required Information: Collect personal details, including your Social Security number, income information, and employment history.

- Fill Out the Form: Accurately enter all requested information in the application form, ensuring that there are no errors or omissions.

- Review the Application: Double-check all entries for accuracy. This helps prevent delays in processing.

- Sign the Document: Use an electronic signature to validate your application, ensuring compliance with eSignature regulations.

- Submit the Application: Send the completed form to the lender through the preferred submission method, whether online, by mail, or in person.

Legal Use of the Application For Open End Unsecured Credit Signature Loan

The Application For Open End Unsecured Credit Signature Loan is legally binding when completed and signed correctly. Under U.S. law, electronic signatures are recognized as valid, provided they meet specific criteria outlined in the ESIGN Act and UETA. This means that as long as the application is filled out accurately and signed using a compliant electronic signature solution, it holds the same legal weight as a traditional paper document. It is essential to ensure that the application complies with all applicable laws and regulations to avoid any legal issues.

Eligibility Criteria

To qualify for an open end unsecured credit signature loan, applicants typically must meet certain eligibility criteria, which may include:

- Being at least eighteen years old.

- Having a valid Social Security number or taxpayer identification number.

- Demonstrating a stable source of income.

- Maintaining a satisfactory credit history, which may include a minimum credit score requirement.

- Being a U.S. resident or citizen.

How to Use the Application For Open End Unsecured Credit Signature Loan

Using the Application For Open End Unsecured Credit Signature Loan is straightforward. Start by accessing the application form, which can typically be found on the lender's website or through a financial institution. Fill in the required fields with accurate information. After completing the form, review it carefully before signing electronically. Once signed, submit the application according to the lender's instructions. It is advisable to keep a copy of the submitted application for your records.

Key Elements of the Application For Open End Unsecured Credit Signature Loan

The Application For Open End Unsecured Credit Signature Loan includes several key elements that are crucial for processing the loan:

- Personal Information: Name, address, and contact details.

- Financial Information: Income details, employment status, and existing debts.

- Loan Amount Requested: The amount of credit the applicant wishes to access.

- Signature: An electronic signature that confirms the applicant's agreement to the terms.

Quick guide on how to complete application for open end unsecured credit signature loan

Complete Application For Open End Unsecured Credit Signature Loan effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents quickly and without delays. Handle Application For Open End Unsecured Credit Signature Loan on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Application For Open End Unsecured Credit Signature Loan without hassle

- Find Application For Open End Unsecured Credit Signature Loan and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Modify and eSign Application For Open End Unsecured Credit Signature Loan and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Application For Open End Unsecured Credit Signature Loan?

An Application For Open End Unsecured Credit Signature Loan is a loan that allows borrowers to access a line of credit without the need for collateral. This type of loan provides flexibility for personal or business expenses, ensuring you have funds available as needed. It's especially useful for managing cash flow or making signNow purchases.

-

What are the eligibility requirements for an Application For Open End Unsecured Credit Signature Loan?

Eligibility for an Application For Open End Unsecured Credit Signature Loan typically includes having a stable income, a good credit score, and a valid form of identification. Lenders may also require a debt-to-income ratio assessment to determine your ability to repay. Always check specific criteria with your lender for the most accurate information.

-

What are the advantages of using an Application For Open End Unsecured Credit Signature Loan?

The main advantages of an Application For Open End Unsecured Credit Signature Loan include quick access to funds and the flexibility to borrow as needed within your limit. Additionally, these loans usually have competitive interest rates compared to other unsecured loans. They can help you manage expenses more efficiently without risking your assets.

-

How does the application process work for an Application For Open End Unsecured Credit Signature Loan?

The application process for an Application For Open End Unsecured Credit Signature Loan typically involves filling out an online form where you provide your financial information. After submission, lenders will review your application and creditworthiness. Approval often happens quickly, allowing you to receive funds shortly after confirmation.

-

What are the fees associated with an Application For Open End Unsecured Credit Signature Loan?

Fees associated with an Application For Open End Unsecured Credit Signature Loan can vary by lender but often include origination fees, late payment fees, and interest charges. It's crucial to read the terms and conditions to understand all potential costs before applying. Transparent lenders will provide a full breakdown of fees during the application process.

-

Can I use an Application For Open End Unsecured Credit Signature Loan for business expenses?

Yes, an Application For Open End Unsecured Credit Signature Loan can be used for various business expenses, including inventory purchases, equipment upgrades, or managing operational cash flow. This flexibility makes it a valuable financial tool for entrepreneurs seeking to grow their businesses without tying up assets. Always consult with your lender for specifics regarding business usage.

-

How does airSlate SignNow integrate with Application For Open End Unsecured Credit Signature Loan services?

airSlate SignNow integrates seamlessly with Application For Open End Unsecured Credit Signature Loan services by enabling electronic signatures for loan documents. This streamlines the application and approval process, reducing time spent on paperwork. With airSlate SignNow, businesses can enhance their workflow efficiency while managing their financial services easily.

Get more for Application For Open End Unsecured Credit Signature Loan

Find out other Application For Open End Unsecured Credit Signature Loan

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed