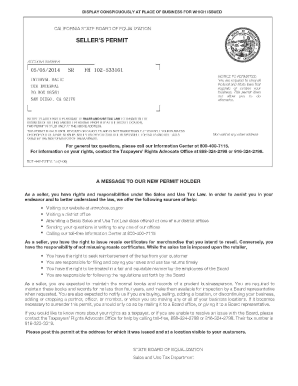

Seller's Permit 2006

What is the Seller's Permit

A seller's permit, also known as a sales tax permit, is a legal document issued by state authorities that allows businesses to collect sales tax from customers. This permit is essential for any business that sells tangible goods or certain services in the United States. It ensures compliance with state tax laws and provides the necessary authorization to operate legally within a specific jurisdiction. Obtaining a seller's permit is a critical step for entrepreneurs looking to establish a retail business or any venture that involves sales transactions.

How to Obtain the Seller's Permit

To obtain a seller's permit, businesses typically need to follow a straightforward application process. This process may vary slightly by state, but generally includes the following steps:

- Determine eligibility: Ensure your business qualifies for a seller's permit based on your state's requirements.

- Gather necessary information: Prepare details such as your business name, address, and federal Employer Identification Number (EIN).

- Complete the application: Fill out the seller's permit application form, which can often be done online through your state's revenue department website.

- Submit the application: Send your completed application along with any required fees to the appropriate state agency.

- Receive your permit: Once approved, you will receive your seller's permit, allowing you to legally collect sales tax.

Steps to Complete the Seller's Permit

Completing the seller's permit application involves several important steps to ensure accuracy and compliance. Here’s a concise guide:

- Identify your business structure: Specify whether you are a sole proprietor, partnership, LLC, or corporation.

- Provide business details: Include your business name, physical address, and contact information.

- List the types of products or services: Clearly outline what you plan to sell to help determine your tax obligations.

- Include owner information: Provide personal details about the business owner(s), such as Social Security numbers or EINs.

- Review and submit: Double-check your application for accuracy before submitting it to avoid delays.

Legal Use of the Seller's Permit

The seller's permit must be used in accordance with state laws. Businesses are required to collect sales tax on taxable sales and remit this tax to the state. It is crucial to maintain accurate records of sales transactions and tax collected. Misuse of the seller's permit, such as using it for non-taxable sales or failing to remit collected taxes, can lead to penalties and legal repercussions. Understanding the legal responsibilities associated with the seller's permit is essential for maintaining compliance and protecting your business.

Key Elements of the Seller's Permit

Several key elements define the seller's permit and its function within the business landscape:

- Permit number: A unique identifier assigned to your seller's permit, used for tax reporting.

- Expiration date: The validity period of the permit, which may require renewal.

- Tax collection requirements: Guidelines on how much sales tax to collect based on state regulations.

- Record-keeping obligations: Requirements for maintaining sales records and tax remittance documentation.

State-Specific Rules for the Seller's Permit

Each state in the U.S. has its own rules and regulations regarding seller's permits. These can include varying application processes, fees, and tax rates. It is important for businesses to familiarize themselves with their specific state requirements to ensure compliance. Some states may also have additional permits or licenses required for certain types of sales, such as food or alcohol. Understanding these state-specific rules helps businesses operate legally and avoid potential fines.

Quick guide on how to complete sellers permit

Complete Seller's Permit effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Handle Seller's Permit on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Seller's Permit seamlessly

- Locate Seller's Permit and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which requires only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, through email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Seller's Permit and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sellers permit

Create this form in 5 minutes!

How to create an eSignature for the sellers permit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a seller's permit?

A seller's permit is a license that allows a business to sell goods or services while collecting sales tax on behalf of the government. It's essential for businesses that need to operate legally in their state. Obtaining a seller's permit ensures compliance with tax regulations and helps avoid potential penalties.

-

How can I apply for a seller's permit?

You can apply for a seller's permit through your state's Department of Revenue or taxation office online or in person. The process usually involves filling out an application form and providing necessary documentation about your business. After submitting your application, you will receive your seller's permit once it is approved.

-

What are the benefits of having a seller's permit?

Having a seller's permit allows your business to legally collect sales tax, which can enhance your credibility with customers. It also opens up opportunities to purchase inventory tax-free from wholesalers. Additionally, it protects your business from legal liabilities associated with tax collection.

-

How much does a seller's permit cost?

The cost of a seller's permit varies by state, but many states offer it for free or charge a nominal fee. Some states might require you to pay a deposit or bond, while others may have renewal fees. Always check with your state's taxation office for specific pricing and requirements associated with obtaining a seller's permit.

-

Do I need a seller's permit to sell online?

Yes, if you're selling taxable goods or services online, you typically need a seller's permit. This requirement ensures that you collect sales tax from customers based on their location. Each state has different regulations, so it's crucial to check the rules in the states where you plan to sell.

-

How does airSlate SignNow help with seller's permit documentation?

airSlate SignNow streamlines the process of preparing and signing documents related to your seller's permit. With its user-friendly interface, you can easily create, edit, and share important forms, ensuring compliance and efficient record-keeping. Utilizing airSlate SignNow can help reduce paperwork hassles and improve your overall workflow.

-

Can I manage multiple seller's permits with airSlate SignNow?

Yes, airSlate SignNow allows you to manage multiple seller's permits with ease. You can organize, track, and store all your permit-related documents in one secure platform. This feature is especially beneficial for businesses operating in several states with different seller's permit requirements.

Get more for Seller's Permit

- Fillable online contact us nm human services department form

- Mc mcd ins signature form ncas nevada county ambulance

- Patient information form 388330372

- Authorization for release of information form roi chase brexton

- Confidential patient information allexi chiropractic and acupuncture

- Return to work form bellin hospital

- Informed consent and release of liability utah dcfs utah

- Dhs code of conduct form

Find out other Seller's Permit

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple