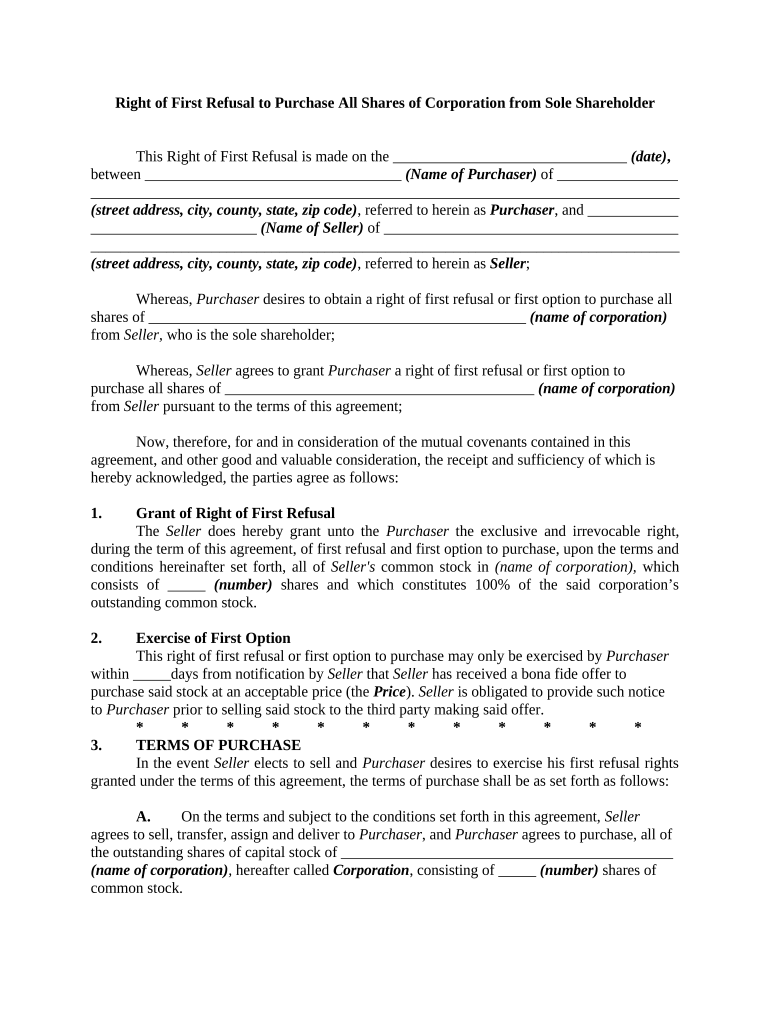

Right First Refusal Purchase Form

What is the Right First Refusal Purchase

The right first refusal purchase is a legal agreement that grants an individual or entity the opportunity to purchase a property or asset before the owner can sell it to another party. This right is often included in real estate transactions, shareholder agreements, or business partnerships. Essentially, it ensures that the holder of this right has the first chance to buy the asset under specified conditions, which can be beneficial in maintaining control over ownership or investment interests.

Steps to complete the Right First Refusal Purchase

Completing a right first refusal purchase involves several key steps to ensure the process is legally binding and properly executed. The following steps outline the general procedure:

- Review the Agreement: Examine the terms of the right first refusal to understand the conditions under which it can be exercised.

- Notify the Seller: Inform the seller of your intention to exercise the right, typically in writing, as per the agreement requirements.

- Negotiate Terms: Discuss and agree upon the purchase price and other relevant terms with the seller.

- Prepare Documentation: Draft and prepare necessary documents, including purchase agreements and any disclosures required by law.

- Complete the Transaction: Finalize the purchase by signing the documents and transferring funds, ensuring compliance with all legal requirements.

Legal use of the Right First Refusal Purchase

The legal use of the right first refusal purchase is governed by state laws and the specific terms outlined in the agreement. It is essential to ensure that the agreement complies with applicable regulations, including real estate laws and corporate governance standards. Proper legal counsel can help navigate these complexities, ensuring that the rights of all parties are protected and that the transaction is executed in accordance with the law.

Key elements of the Right First Refusal Purchase

Several key elements define the right first refusal purchase, ensuring clarity and enforceability:

- Definition of the Asset: Clearly specify the property or asset subject to the right of first refusal.

- Conditions for Exercise: Outline the conditions under which the right can be exercised, including time frames and notification procedures.

- Purchase Price Determination: Define how the purchase price will be determined, whether through appraisal, negotiation, or predetermined terms.

- Transfer of Rights: Include provisions regarding whether the right can be transferred or assigned to another party.

Examples of using the Right First Refusal Purchase

Examples of the right first refusal purchase can vary widely across different contexts. In real estate, a tenant may have the right to purchase the property they are renting before the landlord can sell it to someone else. In corporate settings, shareholders might have the first right to buy additional shares before they are offered to outside investors. These scenarios illustrate how the right can protect interests and maintain control over ownership and investment opportunities.

Eligibility Criteria

Eligibility for the right first refusal purchase typically depends on the specific terms set forth in the agreement. Generally, parties involved must have a legitimate interest in the asset, such as current ownership, tenancy, or a stake in the business. Additionally, the agreement must comply with local laws to ensure its enforceability. Understanding these criteria is crucial for parties looking to secure their rights effectively.

Quick guide on how to complete right first refusal purchase

Complete Right First Refusal Purchase effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as it allows you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without issues. Handle Right First Refusal Purchase on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Right First Refusal Purchase with ease

- Obtain Right First Refusal Purchase and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Edit and eSign Right First Refusal Purchase to ensure seamless communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a refusal purchase in the context of airSlate SignNow?

A refusal purchase refers to a transaction where a buyer chooses not to proceed with a purchase after reviewing the necessary documentation. With airSlate SignNow, businesses can streamline the eSigning process, ensuring that all documents are clear and that the refusal purchase process is transparent and efficient.

-

How does airSlate SignNow help facilitate the refusal purchase process?

airSlate SignNow simplifies the refusal purchase process by providing businesses with tools to send and manage documents electronically. This ensures that any necessary agreements and notices regarding refusal purchases are processed quickly and easily, reducing misunderstandings and potential disputes.

-

Are there any fees associated with managing refusal purchases using airSlate SignNow?

airSlate SignNow offers a cost-effective pricing structure for managing all types of document transactions, including refusal purchases. Users can choose from different pricing plans based on their operational needs, ensuring they only pay for what they use while efficiently handling refusal purchase documentation.

-

What features does airSlate SignNow provide to support refusal purchases?

Key features of airSlate SignNow that support refusal purchases include customizable templates, electronic signatures, and document tracking. These tools help businesses create clear agreements, keep records of refusal purchases, and maintain compliance with legal requirements.

-

Can I integrate airSlate SignNow with other software to manage refusal purchases?

Yes, airSlate SignNow seamlessly integrates with many popular software applications, making it easy to manage refusal purchases alongside other business processes. This integration capability allows for better document management and communication across platforms, enhancing overall workflow efficiency.

-

What benefits do businesses gain from using airSlate SignNow for refusal purchases?

Businesses using airSlate SignNow for refusal purchases experience increased efficiency and minimized errors in document handling. By automating the eSigning process, companies can save time, reduce costs, and improve customer satisfaction during potential refusal purchases.

-

Is airSlate SignNow secure for handling sensitive refusal purchase information?

Absolutely, airSlate SignNow prioritizes the security of all documents, including those related to refusal purchases. With encryption and secure cloud storage, businesses can trust that their sensitive information will be protected throughout the signing process.

Get more for Right First Refusal Purchase

Find out other Right First Refusal Purchase

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors