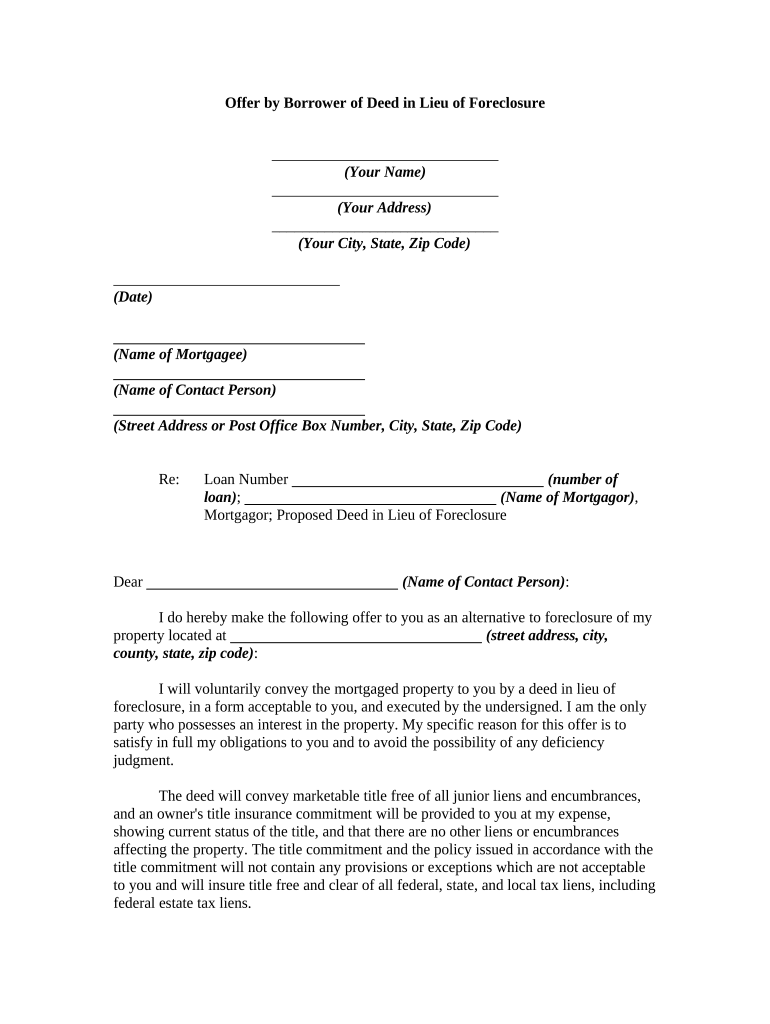

Deed Lieu Foreclosure Form

What is the deed in lieu of foreclosure?

A deed in lieu of foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid the foreclosure process. This option is typically pursued when the borrower is unable to continue making mortgage payments and wishes to prevent the negative consequences of foreclosure. By agreeing to this arrangement, the borrower can settle their mortgage obligations more amicably, often avoiding lengthy legal proceedings and potential credit damage associated with foreclosure.

Key elements of the deed in lieu of foreclosure

Understanding the key elements of a deed in lieu of foreclosure is crucial for both borrowers and lenders. These elements include:

- Mutual Agreement: Both parties must agree to the terms of the deed in lieu, ensuring that the borrower willingly transfers the property.

- Property Condition: The property should be in good condition, as lenders typically evaluate its state before accepting the deed.

- Clear Title: The borrower must provide a clear title, free of liens or other encumbrances, to facilitate a smooth transfer.

- Release of Liability: The lender may agree to release the borrower from further liability for the mortgage debt, depending on the negotiation.

Steps to complete the deed in lieu of foreclosure

Completing a deed in lieu of foreclosure involves several steps to ensure legal compliance and a smooth transition of property ownership. Here are the essential steps:

- Contact the lender to discuss the possibility of a deed in lieu of foreclosure.

- Gather necessary documentation, including the mortgage agreement and proof of income.

- Evaluate the property’s condition and make any necessary repairs.

- Negotiate the terms of the deed in lieu with the lender, including any potential release of liability.

- Prepare the deed in lieu of foreclosure document, ensuring it meets state requirements.

- Sign the document in the presence of a notary public.

- Submit the signed deed to the lender and ensure it is recorded with the appropriate local authority.

Legal use of the deed in lieu of foreclosure

The legal use of a deed in lieu of foreclosure is governed by state laws and regulations. It is essential for borrowers to understand their rights and obligations under these laws. The deed must be executed voluntarily and without any coercion. Additionally, the lender must comply with any applicable statutory requirements, such as providing the borrower with a clear explanation of the process and implications. Legal counsel is often recommended to navigate the complexities involved.

Required documents for a deed in lieu of foreclosure

When preparing for a deed in lieu of foreclosure, specific documents are necessary to facilitate the process. These typically include:

- The original mortgage agreement.

- Proof of income or financial hardship documentation.

- A property appraisal or inspection report.

- The completed deed in lieu of foreclosure form.

- Any correspondence with the lender regarding the arrangement.

State-specific rules for the deed in lieu of foreclosure

State-specific rules can significantly impact the process of executing a deed in lieu of foreclosure. Each state may have different requirements regarding documentation, timelines, and the rights of borrowers and lenders. It is crucial for individuals to research their state’s laws or consult with a legal professional to ensure compliance. Some states may also have additional protections for borrowers, which can influence the feasibility of this option.

Quick guide on how to complete deed lieu foreclosure 497330162

Complete Deed Lieu Foreclosure effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Deed Lieu Foreclosure on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Deed Lieu Foreclosure without difficulty

- Obtain Deed Lieu Foreclosure and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with specific tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your requirements in document management with just a few clicks from your preferred device. Modify and eSign Deed Lieu Foreclosure and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is deed foreclosure and how does it work?

Deed foreclosure is a legal process that allows a lender to reclaim a property when the borrower defaults on their loan. This process involves the lender obtaining a deed to the property, which grants them the right to sell it to recover the owed amount. Understanding the intricacies of deed foreclosure is essential for both lenders and borrowers to navigate potential challenges.

-

How can airSlate SignNow assist with deed foreclosure documents?

AirSlate SignNow provides an easy-to-use platform for creating, sending, and electronically signing deed foreclosure documents. Our solution ensures that all necessary documents are securely stored and organized, streamlining the process. By utilizing our service, you can save time and reduce paperwork-related hassles during a deed foreclosure.

-

What are the pricing options for using airSlate SignNow for deed foreclosure?

AirSlate SignNow offers a variety of pricing plans tailored to fit different business needs, making it cost-effective for managing deed foreclosure documents. Our plans include various features like unlimited document templates and integrations at competitive rates. You can choose the plan that best meets your requirements without overspending.

-

What features should I look for in a deed foreclosure solution?

When considering a deed foreclosure solution, look for features like secure electronic signatures, document tracking, and compliance with legal standards. AirSlate SignNow includes these essential features, ensuring that your deed foreclosure documents are handled professionally and securely. Additionally, user-friendly interfaces and fast turnaround times are crucial for efficiency.

-

Is airSlate SignNow secure for handling deed foreclosure documents?

Yes, airSlate SignNow employs high-level security measures, including encryption and secure servers, to protect your deed foreclosure documents. We prioritize the safety of your sensitive information to ensure compliance with relevant regulations. You can trust our platform to keep your data safe during the deed foreclosure process.

-

Can I integrate airSlate SignNow with other platforms for managing deed foreclosure?

Absolutely! AirSlate SignNow offers numerous integrations with popular platforms like CRM systems, document management software, and cloud storage services. This connectivity allows you to streamline your workflow and enhance the efficiency of managing deed foreclosure processes across various tools.

-

What are the benefits of using airSlate SignNow for deed foreclosure?

Using airSlate SignNow for deed foreclosure provides several advantages, including faster document turnaround times and improved accuracy through electronic signatures. Our cost-effective solution reduces the need for printing and mailing documents, leading to less environmental impact. Additionally, the ease of use empowers teams to manage deed foreclosure processes efficiently.

Get more for Deed Lieu Foreclosure

- Delaware lease termination letter form

- Delaware standard residential lease agreement form

- State of delaware delcodedelawaregov form

- Free delaware lease to own purchase option agreement form

- Chicago association condominium form

- Chicago real estate forms

- Not furnished chicago apartment lease form

- Illinois cash farm lease form

Find out other Deed Lieu Foreclosure

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement