Distribution Trust Form

What is the Distribution Trust

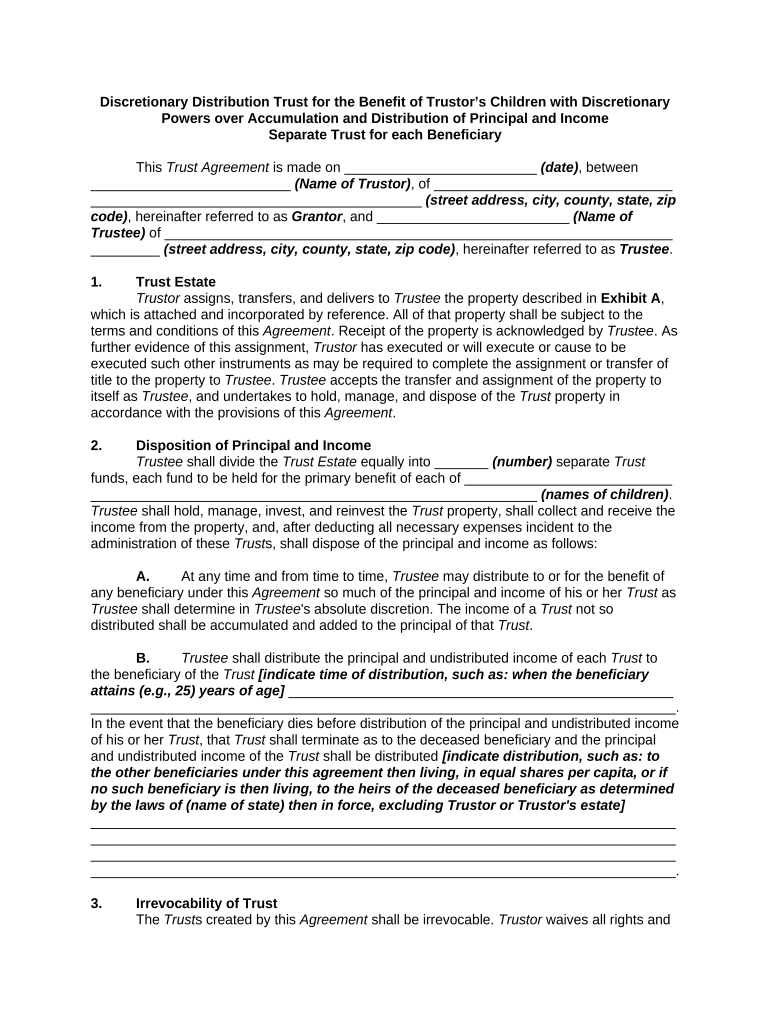

A distribution trust is a legal arrangement that allows a trustee to manage and distribute assets on behalf of beneficiaries, typically children or other dependents. The discretionary powers of the trustee enable them to decide how and when distributions are made, based on the needs of the beneficiaries. This flexibility is designed to protect the interests of the beneficiaries while ensuring that the trust assets are used in a manner that aligns with the grantor's intentions.

Steps to Complete the Distribution Trust

Completing a distribution trust involves several important steps to ensure that it is legally binding and effective. Here are the key steps:

- Identify the grantor: The individual creating the trust must be clearly defined.

- Select the trustee: Choose a reliable person or institution to manage the trust.

- Define the beneficiaries: Clearly list who will benefit from the trust, such as children or other dependents.

- Outline the discretionary powers: Specify the extent of the trustee's authority in making distributions.

- Draft the trust document: Create a formal document that outlines all terms and conditions.

- Sign and notarize: Ensure the document is signed by the grantor and possibly notarized to enhance its legal standing.

Legal Use of the Distribution Trust

The legal framework governing distribution trusts is rooted in state laws, which can vary significantly. It is essential to ensure that the trust complies with relevant laws and regulations to be recognized as valid. This includes adhering to the requirements for creating a trust, such as proper documentation and the designation of a trustee with discretionary powers. Additionally, the trust must be executed in a manner that meets the legal standards for enforceability, which may include specific language and provisions regarding the distribution of assets.

Key Elements of the Distribution Trust

Several critical elements define a distribution trust and its operation:

- Trustee's discretionary powers: The authority granted to the trustee to make decisions regarding distributions.

- Beneficiary designations: Clear identification of who will receive benefits from the trust.

- Trust assets: The property or funds held in trust for the beneficiaries.

- Distribution terms: Guidelines on how and when distributions can be made.

- Revocation clause: Provisions allowing the grantor to modify or revoke the trust under certain conditions.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how distribution trusts are taxed and the reporting requirements for both trustees and beneficiaries. Understanding these guidelines is crucial for compliance and ensuring that the trust operates within the legal framework. Trusts may be subject to income tax on their earnings, and beneficiaries may also need to report distributions as income. It is advisable to consult with a tax professional to navigate these regulations effectively.

Required Documents

To establish a distribution trust, several documents are typically required. These may include:

- Trust agreement: The primary document outlining the terms of the trust.

- Identification documents: Proof of identity for the grantor, trustee, and beneficiaries.

- Asset documentation: Records of the assets being placed in the trust.

- Tax identification number: If applicable, for the trust to comply with IRS regulations.

Quick guide on how to complete distribution trust

Complete Distribution Trust effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a great eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow gives you all the resources you require to create, modify, and electronically sign your documents quickly without delays. Manage Distribution Trust on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Distribution Trust with ease

- Locate Distribution Trust and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form: by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Edit and eSign Distribution Trust and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are discretionary powers in the context of airSlate SignNow?

Discretionary powers refer to the authority granted to users within airSlate SignNow to make decisions and take actions regarding document management. This feature allows businesses to manage workflows efficiently while maintaining control over sensitive information. Understanding these powers is essential for maximizing the platform's capabilities.

-

How does airSlate SignNow enhance the use of discretionary powers?

airSlate SignNow enhances discretionary powers by offering customizable workflows and user permissions. This flexibility enables organizations to tailor the signing process and document management according to their specific needs. By utilizing these features, businesses can ensure that their discretionary powers are exercised effectively.

-

What pricing options does airSlate SignNow offer for businesses with discretionary powers?

airSlate SignNow provides various pricing plans designed to cater to businesses of all sizes that require the management of discretionary powers. Each plan includes features that streamline the e-signing process and document security. By selecting the right plan, organizations can optimize their use of discretionary powers while staying within budget.

-

What features of airSlate SignNow support the effective execution of discretionary powers?

Features such as advanced user roles, customizable templates, and automated workflows within airSlate SignNow support the effective execution of discretionary powers. These tools allow businesses to manage permissions and streamline document processes, ensuring there’s clarity and efficiency. With these features, teams can use their discretionary powers to make informed, timely decisions.

-

Can airSlate SignNow integrate with other tools to manage discretionary powers effectively?

Yes, airSlate SignNow integrates seamlessly with a variety of third-party applications, enhancing its capability to manage discretionary powers. This integration ensures that documents can flow between platforms, streamlining processes across your organization. By connecting your favorite tools, you can maximize the effectiveness of your discretionary powers.

-

What are the benefits of using airSlate SignNow for businesses with discretionary powers?

Using airSlate SignNow provides signNow benefits for businesses, such as improved document turnaround times and enhanced compliance management regarding discretionary powers. The platform's user-friendly interface simplifies the e-signing process, allowing teams to focus on what matters most. Additionally, the robust security measures ensure that businesses can confidently exercise their discretionary powers.

-

How does airSlate SignNow ensure compliance while exercising discretionary powers?

AirSlate SignNow ensures compliance while exercising discretionary powers through features like audit trails and secure storage. These tools provide detailed records of who signed documents and when, which is crucial in maintaining accountability. This transparency fosters confidence when businesses utilize their discretionary powers.

Get more for Distribution Trust

- Down payment bgift letterb date to bmo bank of bb the biggar team thebiggarteam form

- This application must be signed by at least one individual who is an owner andor officer of the form

- Personal debit card application personal debit card application form

- Vendor information form parkway school district

- Personal deposit account application sage capital bank form

- Veritiv credit app form

- Jmmb form

- Applying for aid at cummings school cummings school of form

Find out other Distribution Trust

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself