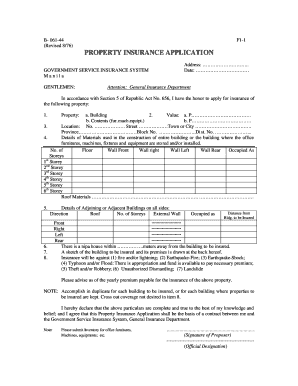

Property Insurance Application Form

What is the Property Insurance Application Form

The property insurance application form is a crucial document used by individuals and businesses to apply for property insurance coverage. This form collects essential information about the property, the applicant, and the type of coverage desired. It typically includes details such as the property address, its value, the nature of the coverage requested, and any existing insurance policies. Understanding this form is vital for ensuring adequate protection against potential risks, such as fire, theft, or natural disasters.

Steps to Complete the Property Insurance Application Form

Completing the property insurance application form involves several key steps to ensure accuracy and completeness. First, gather all necessary information about the property, including its location, size, and any special features. Next, provide personal information, such as your name, contact details, and any relevant identification numbers. After filling out the form, review it carefully to check for errors or omissions. Finally, submit the form electronically or via mail, depending on the insurer's requirements.

Key Elements of the Property Insurance Application Form

Several critical elements must be included in the property insurance application form to facilitate the underwriting process. These elements typically encompass:

- Property Information: Address, type of property, and construction details.

- Coverage Amount: The desired level of coverage to protect against potential losses.

- Personal Information: The applicant's name, contact information, and identification details.

- Previous Insurance History: Information on any prior insurance claims or existing policies.

Legal Use of the Property Insurance Application Form

The legal validity of the property insurance application form hinges on compliance with specific regulations and standards. When completed electronically, the form must adhere to eSignature laws, ensuring that signatures are legally binding. Additionally, the form should be filled out truthfully, as providing false information can lead to denial of coverage or cancellation of the policy. Understanding these legal requirements helps applicants navigate the insurance process more effectively.

Form Submission Methods

Submitting the property insurance application form can be done through various methods, depending on the insurer's preferences. Common submission methods include:

- Online Submission: Many insurers offer digital platforms for submitting applications, allowing for quick processing.

- Mail: Applicants can send a printed version of the completed form to the insurer's address.

- In-Person: Some applicants may choose to submit their forms directly at the insurer's office for immediate assistance.

Required Documents

When completing the property insurance application form, certain documents may be required to support the application. These documents typically include:

- Proof of Ownership: Deeds or titles that confirm ownership of the property.

- Property Valuation: Appraisals or assessments that determine the property's value.

- Previous Insurance Policies: Documentation of any existing or prior insurance coverage.

Quick guide on how to complete property insurance application form

Complete Property Insurance Application Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Property Insurance Application Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to alter and eSign Property Insurance Application Form without hassle

- Obtain Property Insurance Application Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Property Insurance Application Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property insurance application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a property insurance application form?

A property insurance application form is a document used to apply for property insurance coverage. It typically includes information about the property, its owner, and the type of coverage desired. Completing this form accurately ensures that the insurance provider can offer you tailored protection based on your specific needs.

-

How can airSlate SignNow help with property insurance application forms?

airSlate SignNow provides an easy-to-use platform for sending, signing, and managing property insurance application forms efficiently. With its intuitive interface, users can complete and eSign documents securely online, streamlining the submission process. This can signNowly reduce processing times and help you obtain coverage faster.

-

What are the pricing options for using airSlate SignNow for property insurance application forms?

airSlate SignNow offers several pricing plans that cater to different business needs, making it cost-effective for managing property insurance application forms. You can choose from monthly or annual subscriptions, with features that scale according to the size of your operations. Each plan provides access to advanced eSigning tools and document management capabilities.

-

Is airSlate SignNow secure for submitting property insurance application forms?

Absolutely! airSlate SignNow employs industry-standard security protocols, including encryption and secure storage, to protect your property insurance application forms and sensitive information. Additionally, all eSigned documents are legally binding, ensuring your submissions meet compliance requirements while keeping your data safe.

-

Can I integrate airSlate SignNow with my existing property insurance software?

Yes, airSlate SignNow easily integrates with numerous property insurance management systems and other software tools. This allows for seamless automation of workflows when handling property insurance application forms. By integrating our solution, you can enhance productivity and ensure that data flows smoothly between platforms.

-

What features does airSlate SignNow offer for property insurance application forms?

airSlate SignNow includes features such as customizable templates, bulk sending, real-time tracking, and automated reminders for property insurance application forms. These tools simplify the document management process and ensure that all necessary signatures are collected promptly, minimizing delays in coverage approval.

-

How can I track the status of my property insurance application form?

With airSlate SignNow, you can easily track the status of your property insurance application forms in real-time. The platform provides notifications and updates when documents are viewed, signed, or completed. This transparency helps you stay informed and ensures that your applications are handled in a timely manner.

Get more for Property Insurance Application Form

Find out other Property Insurance Application Form

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template