Sale Interest Llc Agreement Form

What is the Sale Interest LLC Agreement

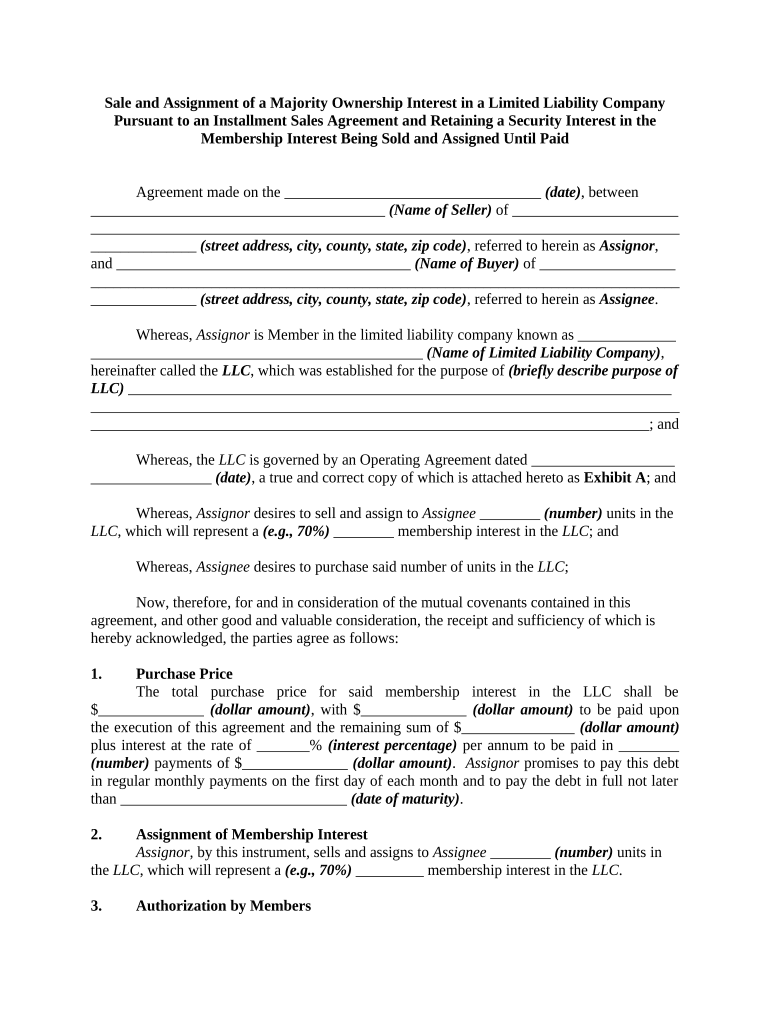

The Sale Interest LLC Agreement is a legal document that outlines the terms and conditions under which an ownership interest in a limited liability company (LLC) is transferred from one party to another. This agreement serves to protect the rights of both the seller and the buyer by clearly defining the responsibilities, obligations, and expectations associated with the sale. It typically includes details such as the purchase price, payment terms, and any representations or warranties made by the seller regarding the LLC's operations and financial status.

Key Elements of the Sale Interest LLC Agreement

Several critical components are essential for a Sale Interest LLC Agreement to be effective and enforceable. These elements include:

- Identification of Parties: Clearly state who is involved in the transaction, including the seller and buyer.

- Description of Interest: Specify the exact ownership interest being sold, including percentage ownership and any associated rights.

- Purchase Price: Outline the agreed-upon price for the sale and the payment structure, whether it is a lump sum or installment payments.

- Representations and Warranties: Include any assurances made by the seller regarding the LLC's financial health and legal standing.

- Conditions Precedent: Detail any conditions that must be met before the sale can be finalized, such as obtaining necessary approvals or consents.

Steps to Complete the Sale Interest LLC Agreement

Completing a Sale Interest LLC Agreement involves several important steps to ensure that the process is smooth and legally sound:

- Draft the Agreement: Begin by drafting the agreement, incorporating all key elements and ensuring clarity in language.

- Review the Document: Both parties should review the agreement thoroughly, ideally with legal counsel, to ensure understanding and compliance with applicable laws.

- Negotiate Terms: Engage in discussions to negotiate any terms that may require adjustment before finalizing the agreement.

- Sign the Agreement: Once both parties are satisfied, sign the document. Consider using an electronic signature for efficiency and security.

- File Necessary Documents: Depending on state requirements, file any necessary documents with the appropriate state authorities to formalize the transfer.

Legal Use of the Sale Interest LLC Agreement

The Sale Interest LLC Agreement must adhere to specific legal standards to be enforceable. In the United States, this means complying with the relevant state laws governing LLCs and contract law. The agreement should be clear, unambiguous, and executed with the proper formalities, such as signatures from all parties involved. Additionally, it is important to ensure that the agreement does not violate any existing operating agreements or state statutes that govern the LLC's structure and operations.

How to Obtain the Sale Interest LLC Agreement

Obtaining a Sale Interest LLC Agreement can be done through several avenues. Many legal document services offer templates that can be customized to fit the specific needs of the parties involved. Alternatively, consulting with a legal professional who specializes in business law can provide tailored guidance and ensure that the agreement meets all legal requirements. It is essential to use a reputable source to ensure the document is comprehensive and compliant with state laws.

Examples of Using the Sale Interest LLC Agreement

There are various scenarios in which a Sale Interest LLC Agreement may be utilized. For instance:

- A member of an LLC decides to sell their ownership stake to a new investor, requiring a formal agreement to outline the terms of the sale.

- An existing member wishes to buy out another member's interest in the LLC, necessitating a clear agreement to protect both parties' interests.

- A business owner looking to transition their LLC to a family member or partner may use this agreement to facilitate the transfer of ownership smoothly.

Quick guide on how to complete sale interest llc agreement

Complete Sale Interest Llc Agreement seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with the tools necessary to create, edit, and electronically sign your files swiftly without holdups. Manage Sale Interest Llc Agreement across any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Sale Interest Llc Agreement effortlessly

- Find Sale Interest Llc Agreement and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark essential parts of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sale Interest Llc Agreement and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are LLC sales and how can they benefit my business?

LLC sales refer to the ownership transfer of a Limited Liability Company. Engaging in LLC sales can provide tax advantages and enhance your business credibility. By utilizing airSlate SignNow, you can streamline the documentation process involved in LLC sales, ensuring a smooth transaction.

-

How does airSlate SignNow facilitate LLC sales?

airSlate SignNow simplifies LLC sales by allowing you to create, send, and eSign necessary documents securely and efficiently. Our user-friendly platform reduces the time spent on paperwork, ensuring that your LLC sales process is quick and hassle-free. Plus, you can track the status of your documents in real time.

-

What are the pricing options for airSlate SignNow related to LLC sales?

airSlate SignNow offers various pricing tiers to accommodate different business needs, especially for LLC sales. You can choose from flexible monthly or annual plans that fit your budget while providing access to essential features for effective document management. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other tools for LLC sales?

Yes, airSlate SignNow integrates seamlessly with numerous applications that can enhance your LLC sales process. Whether you're using CRM systems, project management tools, or cloud storage, our platform can connect with those tools, allowing for smoother operations during LLC sales transactions.

-

What features does airSlate SignNow offer for LLC sales?

airSlate SignNow includes features specifically designed to assist with LLC sales, such as customizable templates, bulk sending, and advanced security measures. These features ensure that your documents remain compliant and protect sensitive information, making the LLC sales process both secure and efficient.

-

How does eSigning benefit LLC sales?

eSigning is crucial for speeding up LLC sales, as it eliminates the need for physical signatures. With airSlate SignNow, you can obtain legally binding signatures in minutes, streamlining the sales process. This efficiency helps in closing deals faster while ensuring full compliance with regulations.

-

Is airSlate SignNow compliant with legal standards for LLC sales?

Absolutely, airSlate SignNow complies with all legal standards regarding eSigning and documentation for LLC sales. Our platform adheres to industry regulations such as ESIGN and UETA, ensuring that your LLC sales documents hold up in court. You can trust airSlate SignNow to keep your transactions legitimate and secure.

Get more for Sale Interest Llc Agreement

- Direct deposit authorization form 5742766

- Hovnanian scholarship 439346805 form

- Utsa registrar challenge examiniation request form challenge examiniation request form undergraduate students only

- Staff fee waiver continuing staff career development update application fee waiver changes form

- Massasoit community college transcript form

- Undergraduate minor change office of the registrar uc form

- Scholastice record verification form

- New hire documents georgia tech human resources form

Find out other Sale Interest Llc Agreement

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer