Agreement for Credit Counseling Services Form

What is the Agreement For Credit Counseling Services

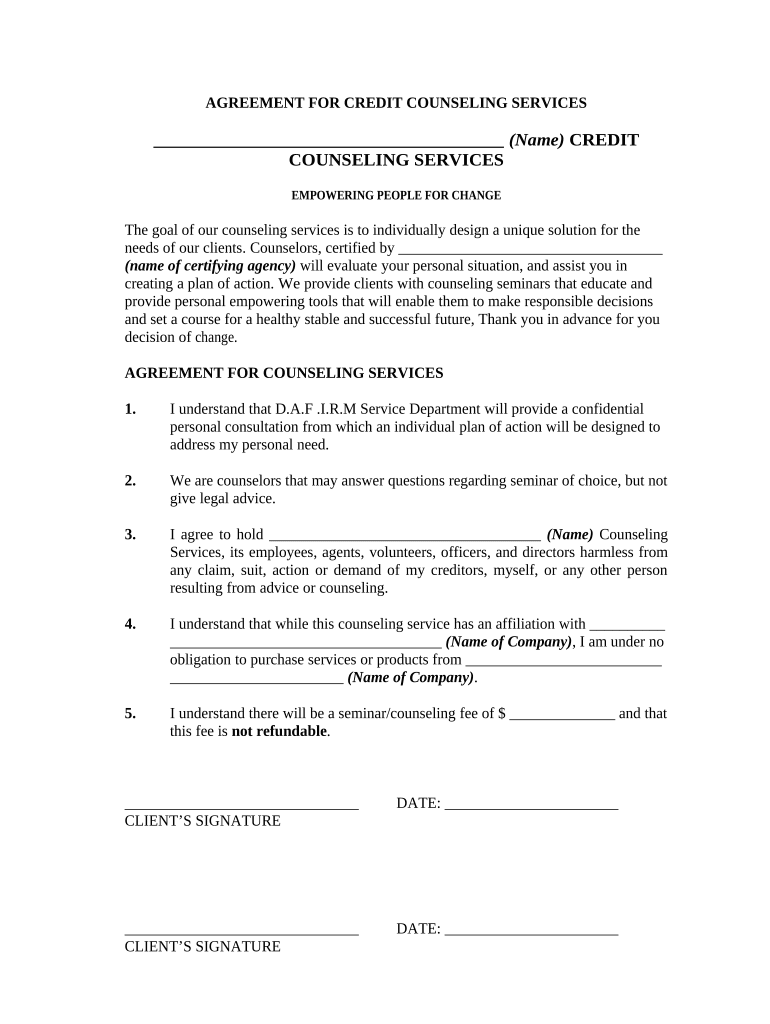

The Agreement For Credit Counseling Services is a formal document that outlines the terms and conditions under which credit counseling services are provided. This agreement typically includes details about the services offered, fees, and the responsibilities of both the client and the credit counseling agency. It serves to protect the interests of both parties and ensures that clients are fully informed about what to expect from the counseling process.

How to use the Agreement For Credit Counseling Services

Using the Agreement For Credit Counseling Services involves several steps. First, clients should carefully read the document to understand the terms. Once they are comfortable with the content, they can fill in their personal information and any other required details. After completing the form, clients should sign it to indicate their acceptance of the terms. This agreement can be used to initiate services with a credit counseling agency and is essential for establishing a formal relationship.

Steps to complete the Agreement For Credit Counseling Services

Completing the Agreement For Credit Counseling Services involves a straightforward process:

- Review the entire agreement to ensure understanding of all terms.

- Fill in required personal information, including name, address, and contact details.

- Provide any necessary financial information that may be requested.

- Sign and date the document to confirm acceptance of the terms.

- Submit the completed agreement to the credit counseling agency, either electronically or via mail.

Key elements of the Agreement For Credit Counseling Services

Several key elements are typically included in the Agreement For Credit Counseling Services. These elements may comprise:

- A detailed description of the services provided, such as budgeting assistance and debt management plans.

- Information about fees and payment structures, including any upfront costs.

- Client responsibilities, such as providing accurate financial information.

- Confidentiality clauses to protect client information.

- Termination conditions, outlining how either party can end the agreement.

Legal use of the Agreement For Credit Counseling Services

The Agreement For Credit Counseling Services is legally binding when properly executed. It must comply with applicable laws and regulations governing credit counseling services. This includes adherence to the Fair Debt Collection Practices Act and other relevant consumer protection laws. Clients should ensure that the credit counseling agency is licensed and follows legal standards to validate the agreement.

Eligibility Criteria

Eligibility for credit counseling services may vary by agency, but common criteria include:

- Demonstrating a need for credit counseling due to financial difficulties.

- Being an individual or household facing debt challenges.

- Willingness to participate in a counseling session and follow recommended plans.

Potential clients should check with their chosen agency for specific eligibility requirements before completing the agreement.

Quick guide on how to complete agreement for credit counseling services

Effortlessly Prepare Agreement For Credit Counseling Services on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Agreement For Credit Counseling Services on any device using the airSlate SignNow Android or iOS applications, and streamline any document-related tasks today.

The Easiest Way to Modify and Electronically Sign Agreement For Credit Counseling Services

- Obtain Agreement For Credit Counseling Services and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Agreement For Credit Counseling Services and guarantee effective communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Agreement For Credit Counseling Services?

An Agreement For Credit Counseling Services is a legal document that outlines the terms and conditions between the client and the credit counseling agency. This agreement ensures that both parties understand their rights and responsibilities, providing clarity and transparency in the credit counseling process.

-

How does airSlate SignNow facilitate the signing of an Agreement For Credit Counseling Services?

airSlate SignNow allows users to easily send and eSign an Agreement For Credit Counseling Services through a simple and intuitive platform. The solution is designed to streamline the signing process, making it quick and hassle-free for both the credit counselor and the client.

-

What are the benefits of using airSlate SignNow for my Agreement For Credit Counseling Services?

Using airSlate SignNow for your Agreement For Credit Counseling Services offers numerous benefits, including increased efficiency, security, and cost-effectiveness. With advanced features like templates and automated workflows, you can save time and ensure compliance with legal standards.

-

Is there a cost associated with creating an Agreement For Credit Counseling Services on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is competitively priced to provide excellent value for businesses. By investing in this platform, you gain access to powerful tools that simplify the creation and management of agreements, including the Agreement For Credit Counseling Services.

-

Can I integrate airSlate SignNow with other tools for my Agreement For Credit Counseling Services?

Absolutely! airSlate SignNow offers integration with a variety of third-party applications, allowing you to combine it with your existing workflow for an Agreement For Credit Counseling Services. This ensures that you can efficiently manage all aspects of your credit counseling services from one centralized hub.

-

What security measures does airSlate SignNow have for Agreement For Credit Counseling Services?

airSlate SignNow prioritizes security, ensuring that your Agreement For Credit Counseling Services and other documents are protected. The platform uses advanced encryption, secure access protocols, and complies with industry regulations to keep your sensitive information safe.

-

How can I customize an Agreement For Credit Counseling Services using airSlate SignNow?

Customizing an Agreement For Credit Counseling Services in airSlate SignNow is straightforward, thanks to the user-friendly template editor. You can add your branding, modify text fields, and adjust clauses easily, ensuring the agreement meets your specific needs and complies with local regulations.

Get more for Agreement For Credit Counseling Services

Find out other Agreement For Credit Counseling Services

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast