Revocable Trust Agreement Form

What is the Revocable Trust Agreement

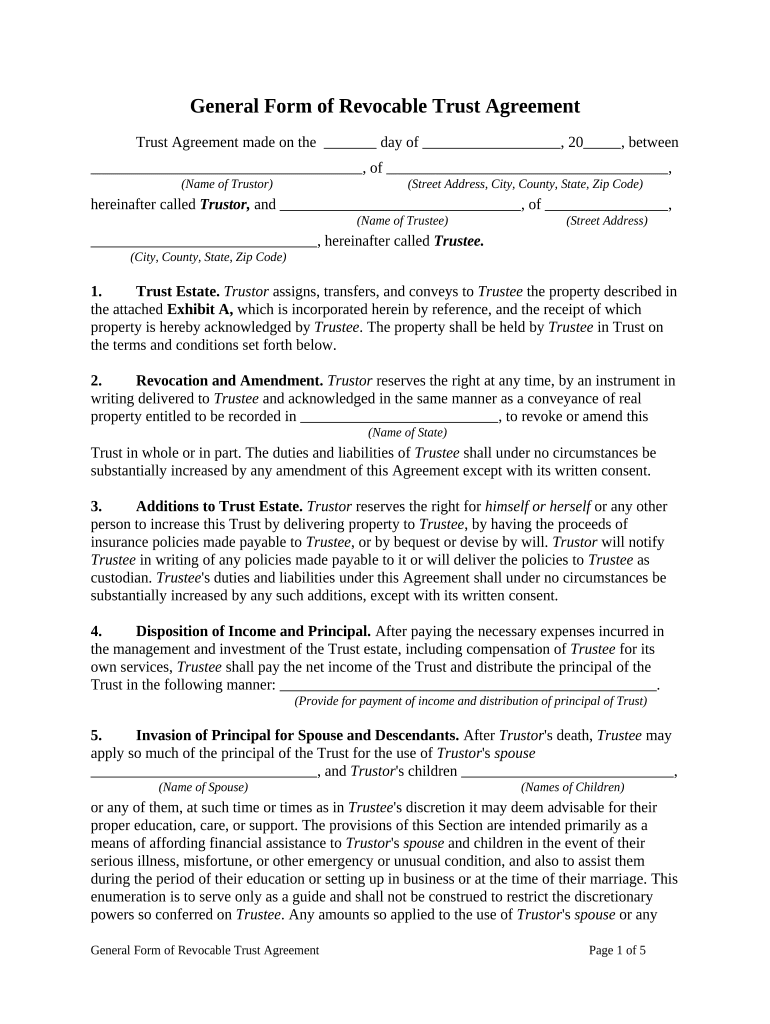

A revocable trust agreement is a legal document that allows an individual, known as the grantor, to place assets into a trust during their lifetime. This type of trust can be altered or revoked by the grantor at any time before their death. It serves to manage the grantor's assets and provides a clear plan for asset distribution after death, avoiding the probate process. The revocable trust agreement outlines the terms of the trust, including the management of assets and the responsibilities of the trustee, who is tasked with overseeing the trust's operations.

Steps to Complete the Revocable Trust Agreement

Completing a revocable trust agreement involves several key steps:

- Identify the assets: Determine which assets will be included in the trust, such as real estate, bank accounts, and investments.

- Select a trustee: Choose a trustworthy individual or institution to manage the trust. This person will be responsible for handling the assets according to the terms of the agreement.

- Draft the agreement: Create the revocable trust agreement, detailing the terms, conditions, and instructions for asset management and distribution.

- Sign the document: The grantor must sign the agreement in the presence of a notary public to ensure its legal validity.

- Fund the trust: Transfer ownership of the identified assets into the trust. This may involve changing titles or designating the trust as the beneficiary on accounts.

Legal Use of the Revocable Trust Agreement

The revocable trust agreement is legally binding once it is signed and notarized. It provides a framework for managing the grantor's assets during their lifetime and dictates how those assets will be distributed after death. This agreement is recognized under U.S. law, and its provisions must comply with state regulations. It can be used to avoid probate, maintain privacy regarding asset distribution, and provide for the grantor's care in case of incapacity.

Key Elements of the Revocable Trust Agreement

Several essential components should be included in a revocable trust agreement:

- Grantor's information: Full name and address of the individual creating the trust.

- Trustee's details: Name and contact information of the person or entity responsible for managing the trust.

- Beneficiaries: Names and details of individuals or organizations that will receive the trust assets.

- Asset description: A comprehensive list of assets included in the trust, including their value and location.

- Distribution instructions: Clear guidelines on how and when the assets should be distributed to beneficiaries.

How to Obtain the Revocable Trust Agreement

Obtaining a revocable trust agreement can be done through various means. Individuals can consult with an attorney specializing in estate planning to draft a customized agreement that meets their specific needs. Alternatively, there are online resources and templates available that can guide individuals in creating their own trust agreement. It is crucial to ensure that any template used complies with state laws and adequately addresses the individual's unique circumstances.

State-Specific Rules for the Revocable Trust Agreement

Each state in the U.S. has its own laws governing revocable trusts. It is essential to be aware of these regulations to ensure the trust is valid and enforceable. For instance, some states may require specific language in the trust document or have particular rules regarding the funding of the trust. Consulting with a legal professional familiar with local laws can help navigate these requirements and ensure compliance.

Quick guide on how to complete revocable trust agreement 497330419

Effortlessly Prepare Revocable Trust Agreement on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without any delays. Handle Revocable Trust Agreement on any platform with the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

The Easiest Way to Edit and Electronically Sign Revocable Trust Agreement

- Obtain Revocable Trust Agreement and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form—via email, SMS, invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Revocable Trust Agreement to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revocable trust agreement?

A revocable trust agreement is a legal document that allows a person, known as the grantor, to place their assets into a trust, which can be altered or revoked at any time during their lifetime. This type of trust provides flexibility and control over asset distribution, making it a popular choice for estate planning. By utilizing airSlate SignNow, you can easily create and manage your revocable trust agreement online.

-

How does airSlate SignNow simplify the creation of a revocable trust agreement?

airSlate SignNow streamlines the creation process of a revocable trust agreement through its user-friendly interface and customizable templates. You can easily input the necessary details and make adjustments as needed. This convenience ensures that you have a tailored document that meets your specific requirements without the hassle of complex paperwork.

-

What are the benefits of using a revocable trust agreement?

A revocable trust agreement offers numerous advantages, such as avoiding probate, maintaining privacy, and allowing for seamless asset management during incapacity. This flexible document ensures that your estate is managed according to your wishes while providing peace of mind for you and your beneficiaries. By incorporating airSlate SignNow, you can efficiently manage your revocable trust agreement with ease.

-

Can I edit my revocable trust agreement after it's created?

Yes, one of the key features of a revocable trust agreement is that it can be modified or revoked at any time as per your wishes. airSlate SignNow makes it simple to edit your existing document, allowing you to keep your estate plan current and aligned with your changing circumstances. This flexibility ensures that your revocable trust agreement always reflects your intentions.

-

Is there a cost associated with creating a revocable trust agreement through airSlate SignNow?

airSlate SignNow offers a cost-effective solution for creating your revocable trust agreement, with transparent pricing plans based on your business needs. By utilizing the platform, you can access various features, including document storage and eSigning, all bundled in an affordable subscription. This ensures you can manage your trust agreements without breaking the bank.

-

What integrations does airSlate SignNow offer for managing a revocable trust agreement?

airSlate SignNow integrates seamlessly with numerous applications and software to enhance your document management capabilities. Whether you want to link your trust agreements with accounting software or client management tools, these integrations can streamline your workflow. This interconnected approach allows for a smoother execution of a revocable trust agreement throughout your operations.

-

How secure is my data when using a revocable trust agreement on airSlate SignNow?

Trust is crucial when it comes to managing sensitive documents like a revocable trust agreement. airSlate SignNow prioritizes your privacy and security with robust encryption and security measures in place. This ensures your data remains protected while you create, store, and manage your trust agreements with confidence.

Get more for Revocable Trust Agreement

Find out other Revocable Trust Agreement

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template